- The Federal Reserve voted to keep interest rates at a 22-year high

- Fed Chair Powell said to expect more hikes in the future as rates stay higher for longer

- Stocks drop as hopes for rate cuts diminishes

Fed Hits the Pause Button on Rates

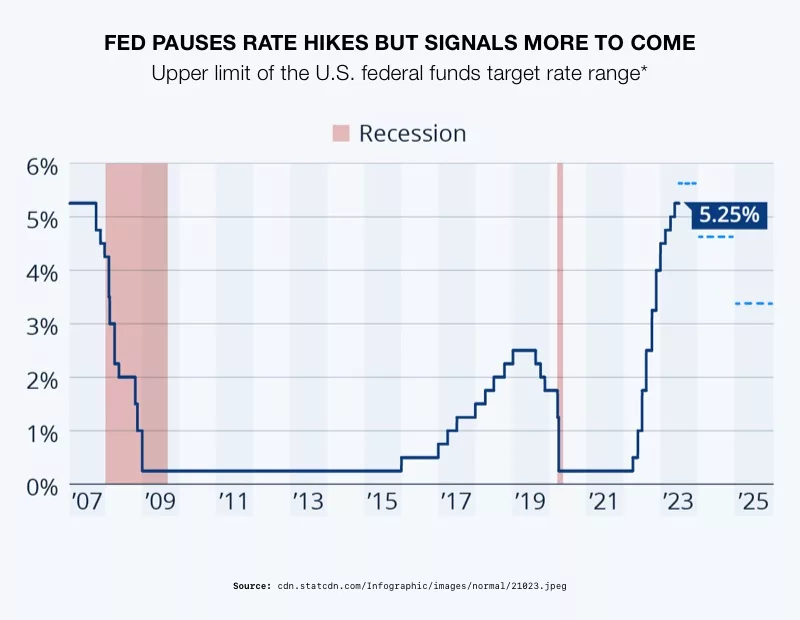

As predicted, the Federal Reserve chose not to raise interest rates again after their latest meeting. They voted to keep interest rates at their 22-year high. Since March 2022, the Fed has lifted interest rates 11 times and held them steady twice, including September’s pause.

Even with a temporary break, the rate hikes are still impacting the stock market, gold, and retirement funds.

1

1

Fed Policy Statement Changes

The Federal Reserve Policy statement is a periodic announcement by the Federal Reserve that outlines its decisions on key interest rates and provides insights into its current economic assessment and monetary policy intentions. Economists read it like tea leaves, deciphering every word to make predictions. In this latest statement, the pace of economic activity changed from “moderate” to “solid.” This is being interpreted to mean that the job market is still too strong, so more rate hikes can be expected to drive up unemployment.

Future Hikes

Officials forecasted an additional rate hike before the end of the year to bring down inflation. Powell said, “We’re prepared to raise rates further if appropriate.” He kept his comments on future hikes ambiguous. Powell told reporters that future decisions will be based on upcoming economic data. But a looming government shutdown added more uncertainty to the economy. It could limit the Federal Reserve’s ability to get key data and hinder policy making.2

“A resilient US economy and high consumer spending over the next several months will likely prompt the Fed to raise rates again heading into the new year,” said Frank Lietke, executive director and president at Ally Invest Securities.3

Rate Cuts

The Summary of Economic Projections is a consensus of Fed opinions about policy and economic conditions. It showed that most central bank officials now expect fewer rate cuts next year. That is compared to their estimates from last June. Economists anticipate rates to remain elevated for longer. A sharp economic downturn, like a severe recession, would be necessary to prompt more rapid cuts.

They may get that recession. Unemployment is predicted to jump up to 4.5% over the next two years. They did round up their growth projections for 2024. It went from 1.1% in June to 1.5% now. But that growth rate is still lagging behind inflation.

There are numerous negative consequences when growth lags inflation. The purchasing power of individuals and households diminishes. This means that the money people have becomes less valuable over time, making it harder for them to afford the same goods and services they used to. As lingering inflation erodes purchasing power, people may have to allocate more of their income to cover rising costs. This leaves less room for savings and discretionary spending. A lower standard of living, reduced savings, and worse returns on investments are all potential results. The increased uncertainty reduces business investment and hastens deeper recession.

Market Reacts

Both the S&P 500 and the Nasdaq dropped after Federal Reserve Chair Powell said that the central bank did not consider a soft landing a “baseline expectation.” A soft landing is where the US economy avoids a recession but successfully lowers inflation. Powell said avoiding a recession is possible. But he continued that price stability is the Fed’s top priority. Price stability, in the context of the Fed’s mandate, is typically defined as a low and steady rate of inflation. It aims to achieve an inflation rate of around 2 percent over the longer run. Long term high interest rates are seen as bad for business and profitability. Hence, the fall in stock prices.

Gold

The Fed’s announcement could create a good long-term position for gold. Prices for the metal have been holding steady despite recent hikes. An eventual reduction in interest rates coupled with lingering inflation create a positive environment for gold prices. Those seeking safe haven from inflation tend to turn away from lower paying Treasuries and towards gold.

Conclusion

According to the Fed, inflation is far from over. And neither are rate hikes despite a few months reprieve. Americans can expect at least one more before year’s end. Economists foresee interest rates staying higher, longer. No one can say when they will be cut. If high interest rates push us into recession, and inflation remains unresolved, we may find ourselves mired in stagflation. Much to the demise of savings, stocks, and retirement funds. For those who want to protect the value of those funds, a Gold IRA may be the right choice. To learn more contact American Hartford Gold today at 800-462-0071.