- The US is in a ‘rolling recession’ with some industries sinking as the overall economy treads water

- Conditions are creating a unique ‘richcession’ where white collar workers are being laid off en masse

- A Gold IRA can protect the value of assets from the effects of the impending recession

A ‘Rolling Recession’ Plagues the Economy

A surging stock market, declining inflation, and solid job market have analysts putting the idea of recession behind us. This view is strengthened by signals from the Fed of potential interest rate cuts. However, this perspective isn’t seeing the whole picture. Hopes for a ‘soft landing’ are blinding some observers to the current ‘rolling recession’ and the advent of a ‘richcession’.

Rolling Recession

‘Rolling recession’ was coined to describe the current situation where only some industries are shrinking while the overall economy manages to stay above water. The economic weakness is across various segments but primarily focused on manufacturing and housing. An overall recession has been avoided by offsetting that weakness with the relative strength in consumer services such as travel, restaurants, etc.

Excessive government spending shielded sectors like education, government work, and healthcare from surging interest rate hikes. Private industry was not so lucky. The housing sector was the first to suffer from aggressive rate hikes. Mortgage rates nearly doubled, and home sales plunged. They are 19% lower than they were a year ago.

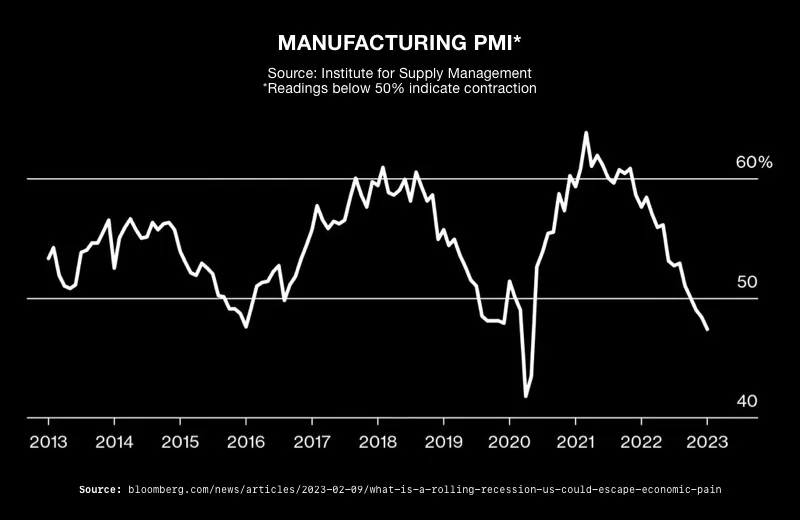

Manufacturing quickly followed. It’s been dubbed the “global cardboard box recession” because demand dropped for things that go in a cardboard box. Factory output dropped dramatically in 2023. The Global Manufacturing Purchasing Managers Index (PMI) marked the 15th straight month below 50, the level that divides growth from contraction. That is the longest stretch in history. A shrinking number of new orders indicate that production weakness will continue well into 2024, furthering the record duration. 1

2

2

The Richcession

Current economic conditions are giving rise to a phenomenon dubbed a ‘richcession’. In a typical recession, lower paying jobs are cut first and in greater numbers. Now, service industries – restaurants, hotel, bars – are hiring. Major job cuts are concentrated in higher paying industries like technology and finance.

3

3

Economists point out that higher-income individuals tend to have financial cushions to withstand layoffs. Therefore, their rising unemployment is less likely to sink the overall economy. Still, their economic pain is compounded by fewer comparable job openings and salaries. Having the overall economy stay above water is cold comfort to someone approaching retirement age. A recent Bank of America report showed that the number of 401(k) plan participants taking hardship withdrawals was up 13% from the second quarter and 27% compared with the first quarter of the year.4

Major companies initiated substantial job cuts, reminiscent of the significant layoffs observed in 2022 when over 120 large U.S. companies downsized, affecting about 125,000 employees. Tech firms bore the brunt, but startups, banks, manufacturers, and online platforms were also affected. Major US banks trimmed 20,000 jobs in 2023. Salesforce let 10% of its workforce go, about 8,000 employees. Amazon fired 18,000 people, mostly impacting corporate roles with hourly staff minimally affected. And Spotify cut 17% of its global workforce. 5

A 2023 Randstad RiseSmart report revealed that 92% of employers are gearing up for layoffs in 2024 to address COVID-19’s economic impact and potential overstaffing.

Full Recession is Coming

Analysts don’t see the consumer sector offsetting declining parts of the economy much longer. Most leading indicators suggest consumer spending is slowing. Higher costs and borrowing rates will continue to put pressure on profit margins. And spending cuts by households and businesses will result in an across-the-board recession.

Predictions of a soft landing are being challenged by a couple of factors. First is the lagging in impact of rate hikes. We have not officially past the ‘expiration’ date for those lags. This is seen in the Leading Economic Index (LEI). The LEI is a composite index designed to predict the future direction of the economy. It’s comprised of several individual indicators, including the stock market, job market, and interest rates.

The LEI has declined for 19 consecutive months. Such steep declines typically only occur during recession. This recession signal from the LEI has not expired. The average length between peaks in the LEI and recession start is 11 months. But the actual range is much larger. It’s been as little as three months to as many as 21 months.6

Another recession signal is the inverted yield curve. The yield curve has been inverted for more than a year. Now, except for an extremely brief and mild inversion in 1998, all other inversions over the past six decades have had a perfect track record of signaling recessions to come.

Conclusion

Despite hopes for a ‘soft landing,’ the burden of a ‘rolling recession’ continues to impact specific sectors like manufacturing and housing. Moreover, the emergence of a ‘richcession’ signals a unique economic downturn, characterized by job cuts in higher-paying industries. Indicators point towards an inevitable recession when the rest of the economy starts to shrink. As the economic ground shifts, people contemplating retirement should carefully examine how to protect their portfolios. A Gold IRA can protect retirement funds from the effects of recession and richcession. Contact American Hartford Gold today at 800-462-0071 to learn more.