Brief Russian Revolt: Lasting Repercussions

This past weekend gave credence to the saying that Russian history can be summed up in five words – ‘and then, it got worse.’ The rebellious Wagner mercenary group came within 125 miles of Moscow before stopping their advance. The threat was serious enough for Putin to say Russia was on the brink of a 1917-style civil war. Wagner withdrew, leaving chaos and a weakened Putin in its wake. Potential for further internal strife in the nation with the world’s largest nuclear arsenal is putting observers on edge. With a teetering global economy, the events in Russia may spark a new wave of inflation and market volatility.

The decision to invade Ukraine has hammered the Russian economy. They dropped out of the ranks of the top 10 economies in the world. Western sanctions have had the desired effect of reducing the amount of money Moscow earns from energy.

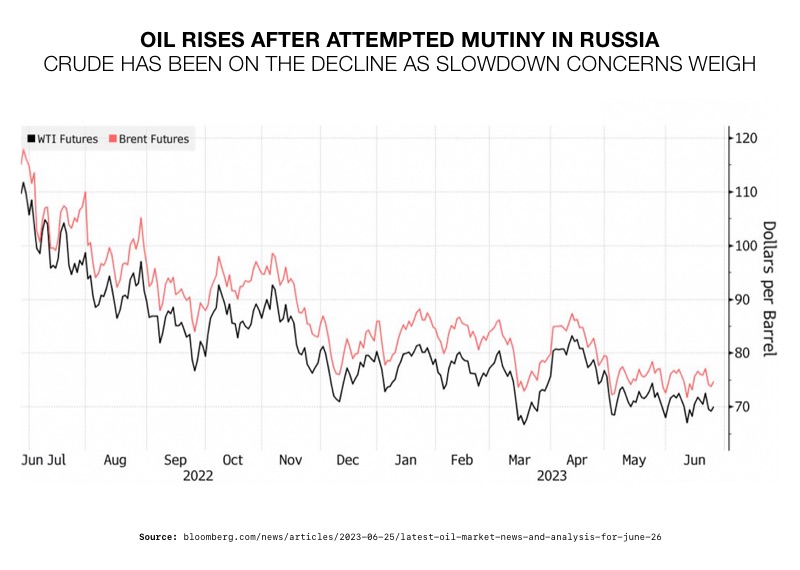

But, despite sanctions, Russia remains one of the biggest suppliers of energy to global markets. Russia’s oil exports have rebounded to levels seen before it invaded Ukraine. China and India are buying up barrels shunned by G7 nations. At just under 10 million barrels per day, Russia produces about 10% of global crude oil demand. And with total oil exports of nearly 8 million barrels per day, Russia is the second biggest power by a wide margin after Saudi Arabia in the OPEC+ alliance of leading energy producers.1

Thus, it’s easy to see why oil prices spiked on Sunday after the Wagner Group’s attempted mutiny. Analysts say oil prices could continue to rise. They fear the unrest could spill over into former Soviet countries that also produce oil, such as Kazakhstan and Azerbaijan.

Historically, geopolitical events in oil-producing nations raise the price of oil 8% within a week. Prices can shoot up even higher if the chaos stems the flow of oil from Russia. China and India would be forced to compete with Western nations for energy supplies. Higher oils prices and political disruption can also send the prices of grain and fertilizer soaring.

2

2

Inflation

Global energy and food prices shot up in the wake of last year’s invasion of Ukraine. Inflation in Europe and the United States was turbocharged. It has fallen from multi-decade highs since, but the battle to control prices is not over and is now in a decisive phase.

In addition to their direct effect on inflation, higher oil prices raise inflation indirectly because crude oil is a key ingredient in petrochemicals used to make plastic. So, more expensive oil will tend to increase the prices of many products made with plastic.

Similarly, consumer prices factor in transportation costs, including fuel prices, and the cost of oil accounts for roughly half of the retail price of gasoline. The indirect contributions of crude oil prices to inflation are reflected in the core CPI index, which does not include energy or food prices because they tend to be more volatile. Federal Reserve Chair Jerome Powell said that, as a rule of thumb, every $10 per barrel increase in the price of crude oil raises inflation by 0.2% and sets back economic growth 0.1%.3

The Fear Index

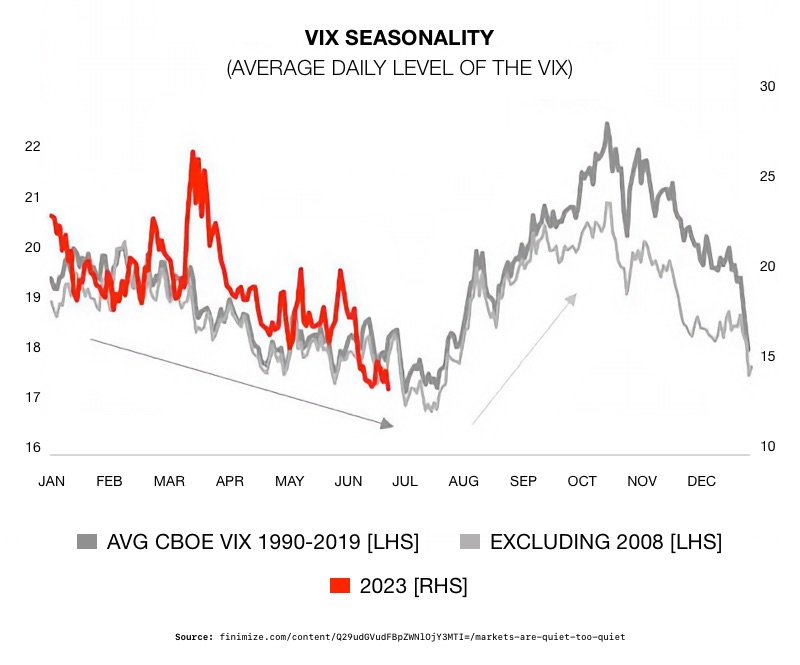

The CBOE Volatility Index, VIX, is also known as the ‘fear index.’ It has fallen to its lowest level since January 2020. The subdued performance is taken by some market watchers as a calm before the storm. The VIX follows seasonal trends. A lull in July before rising through October is expected. But now Russian events are combining with aggressive rate hikes. Analysts say any complacency is about to be shaken off. We can be facing massive volatility and harsh economic consequences.

4

4

Move to Safe Havens

The actions of a rebellious military commander could potentially result in global economic chaos. An increase in oil prices could send inflation soaring again. The heavy price being paid to bring inflation down with unprecedented interest rate hikes would be for naught. High energy costs could grind growth to a halt and speed the country into recession. And those are just predictable outcomes. US Secretary of State Antony Blinken said turmoil in Russia “raises profound questions.” Experts are almost too scared to envision what would happen if a nuclear-armed Russia fractured and fell into civil war. 5

The entire economic order is reaching new heights of turbulence. Now is the time to investigate how to protect your funds when the financial system is under severe threat. A Gold IRA is designed to secure the value of your portfolio in the face of global upheaval. Contact American Hartford Gold today at 800-462-0071 to learn more.