“Temporary Hardship” Predicted

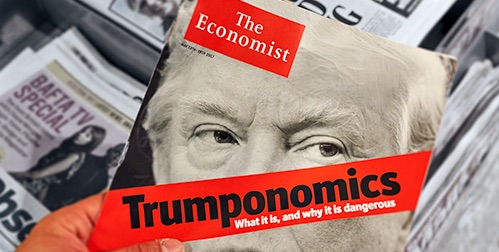

As President-elect Donald Trump prepares for his second term, Americans are wondering how his economic policies might impact their retirement savings. Trump has promised relief through tax cuts and aims to revitalize economic growth. But his policies could have unintended adverse effects on retirement security.

Here’s how Trump’s policies could influence retirement security.

1. Tariffs and Inflation: Higher Costs for Consumers and Investors

1

1

Trump’s trade policy emphasizes tariffs on imports. A proposed 10% tariff on all imports and steeper tariffs on Chinese good could significantly affect consumers. While tariffs are designed to protect American businesses, they essentially act as a tax on consumers. The increased cost of imported goods gets passed on to buyers. According to CBS MoneyWatch, tariffs could add about $1,700 per year in additional expenses to middle-class households. 2

These tariffs could drive inflation up to a potential 3.4%. Purchasing power would worsen, especially after the record-high inflation during Biden’s term. Rising inflation could lead to the Fed to change course on lowering interest rates. For the past two years, we’ve seen the damage the Fed can do with higher rates. The resulting slower growth and increased volatility can negatively impact retirement savings.

2. Rising Federal Debt: The Burden of Tax Cuts

Trump’s economic agenda includes extending and expanding tax cuts from the Tax Cuts and Jobs Act (TCJA). These cuts potentially reduce federal revenue and contribute to a growing deficit. The $35+ trillion-dollar debt is an unfolding crisis. It can fuel inflation, spike interest rates and force massive spending cuts. All of which can depress the value of retirement funds.

3. Social Security: The Potential for Benefit Cuts

Social Security is a vital safety net for millions of retirees. However, the Social Security Trust Fund is projected to run out of full funding by the mid-2030s. Analysts predict benefit cuts of up to 25% if no changes are made. Trump has proposed eliminating the personal income tax on Social Security benefits. While immediately gratifying, the reduced revenue could further strain Social Security’s solvency.

“President-elect Trump’s suggestion to eliminate the taxation of Social Security benefits is likely to be popular with many older voters, but it could have the unintended consequence of causing Social Security to go insolvent two years sooner than currently forecast” Mary Johnson, an independent Social Security and Medicare policy analyst.3

4. Impact on Housing and Labor Markets: Higher Costs, Less Affordability

Trump’s policies on immigration and tariffs are likely to affect the housing market. Deporting millions of undocumented immigrants could worsen labor shortages in the building industries. In addition, construction costs could rise due to tariffs on building materials. Housing prices may increase as a result.

High prices might seem promising. But without buyers, retirees’ equity is now trapped in their homes. Leaving them with fewer options to downsize or sell. The rise in housing costs could also limit disposable income, leaving less available for retirement savings.

5. Elon Musk’s Austerity and its Impact on Retirement Savings

Donald Trump suggested giving Elon Musk the role of “Secretary of Cost Cutting” in his potential administration. Tax cuts and deregulation could potentially boost stock prices in the short term. But Musk’s austerity agenda raises the risk of longer-term economic instability. Musk himself predicts his cuts would trigger a temporary economic downturn, including a significant stock market crash.

Two-thirds of the federal budget is already dedicated to Social Security, Medicare, debt interest, defense, and veterans. The remaining budget, including Medicaid, totals $2.35 trillion. Musk’s promise to cut “at least $2 trillion” would mean either eliminating nearly all other programs—like Medicaid, Transportation, Justice, Homeland Security, and Agriculture—or cutting Social Security and Medicare. As Musk put it, there will be “no special cases… no exceptions.”4

6. 401(k) Challenges

Another concern under Trump’s proposed tax changes is the potential impact on retirement accounts like 401(k)s. Experts have warned that the deferred-income-tax treatment of 401(k) contributions might be at risk. Investors could face higher taxes on retirement withdrawals.

Conclusion

Retirement security could face significant challenges in the coming years. The specter of rising inflation looms over the incoming administration. While the hope is that Trump’s tax cuts will stimulate growth and swell fund value, the long-term effects could prove problematic. To prepare for trouble, individuals should consider diversifying with safe haven assets like physical precious metals. To learn how a Gold IRA can help safeguard your retirement future, call us today at 800-462-0071.