Gold Prices Overcome Headwinds

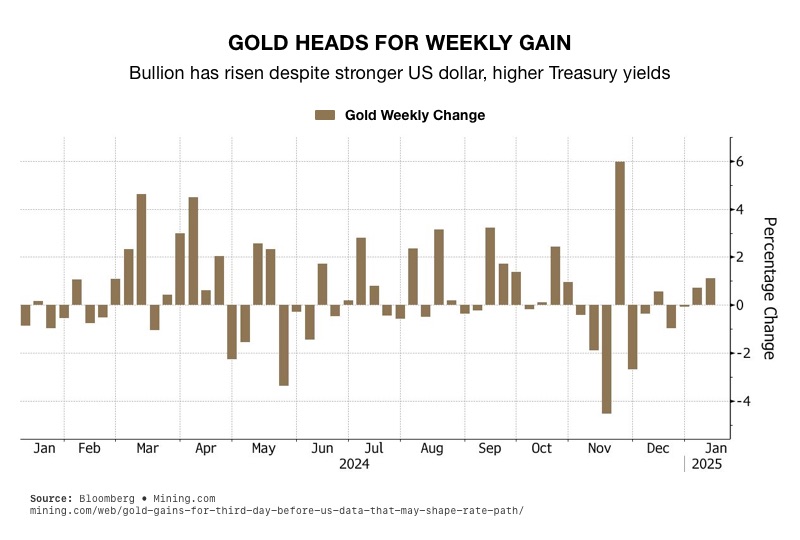

Gold is shattering expectations and challenging the rules of the financial game. Despite a strengthening dollar and rising bond yields, gold is climbing to new heights. These conditions usually weigh down gold. After two weeks of gains and a four-week high, gold is proving its status as the ultimate safe-haven asset in uncertain times.

Gold’s Relationship with the Dollar and Bond Yields

Gold prices often have an inverse relationship with the dollar. When the dollar strengthens, investors find gold less attractive because they price it in dollars. A stronger dollar makes gold more expensive for buyers using other currencies, reducing demand. Also, investors often favor dollar-denominated assets during dollar strength. These include U.S. Treasury bonds. They offer better returns than gold, which pays no interest or dividends.

Rising bond yields usually discourage investments in gold. Higher yields make bonds more appealing compared to gold, which is a non-yielding asset. When bond yields rise, investors may sell gold to capitalize on better returns elsewhere, further reducing its price. Rising bond yields also signal economic strength, encouraging investors to move away from safe-haven assets like gold.

However, gold’s recent performance challenges these norms.

1

1

Employment Data and Inflation Concerns Boost Gold

Strong labor market data pushed the 10-year bond yield to a 16-month high and the dollar to a three-year high. Despite this, gold continues to climb. Analysts point to fears over inflation and geopolitical risks as key drivers behind this anomaly. Strong employment data usually signals a healthy economy. It often pushes the Federal Reserve to halt interest rate cuts to prevent inflation from overheating. This creates a paradox for gold. Higher interest rates are bad for it. But fears of rising inflation make gold a good hedge.

The University of Michigan’s consumer survey found rising inflation fears. It also found declining optimism. These stoked fears of stagflation, a mix of stagnant growth and high inflation. In such an environment, gold’s role as a store of value becomes increasingly significant. As Kathy Lien, Managing Director of BK Asset Management, explained, “Traders are worried about the rise in U.S. yields and the implications for the economy in terms of borrowing costs and the consequences for growth.” She added, “Generally, I am bullish on gold this year and would look for opportunities to buy rather than sell.”2

Gold as a Safe Haven

Gold’s strength against old threats shows it’s one of the best safe-haven assets. Concerns over geopolitical uncertainty, trade wars, and tariffs are driving investors toward gold. As Biren Lundin, editor of Gold Newsletter, noted, “Gold has been performing impressively against the supposed headwinds of rising yields and dollar strength,” and this trend is expected to continue. “Gold, of course, is the ultimate safe haven and is therefore being bought by a growing cohort of investors from central banks down to individual investors,” Lundin added.3

The global appeal of gold is evident as it gains against every major currency, including the British pound. In the UK, rising deficit concerns and increased government spending have further boosted gold’s appeal. Debt fears are not unique to the UK; the U.S. faces even greater challenges with its debt and deficits at crisis levels. Rising bond yields reflect these global concerns, as bond buyers demand higher returns to compensate for perceived risks.

Real Interest Rates and Gold’s Appeal

The interplay between nominal and real interest rates also plays a crucial role in gold’s performance. Real interest rates—nominal rates adjusted for inflation—often determine gold’s attractiveness. When real rates are low or negative, gold is more appealing. The opportunity cost of forgoing interest-bearing assets diminishes. Analysts say that if the Fed stops rate hikes and inflation continues, resulting low real interest rates could favor gold.

Safe-haven demand continues to exceed the challenges posed by a strong dollar and higher bond yields. As FXTM analyst Lukman Otunuga observed, “Investors seem to be rushing toward the precious metal thanks to fears over Trump’s tariffs and inflation. While higher rates typically are bad news for zero-yielding gold, uncertainty over tariffs continues to accelerate the flight to safety.” He highlighted that gold is up over 2% this week, pushing its year-to-date gains to nearly 3%.4

A Changing Landscape

The current economic and political landscape underscores a transition where old rules don’t always apply. Gold’s ability to rise amid strengthening dollar and bond yields demonstrates its resilience and enduring value. As strong labor markets heighten inflation concerns, more investors are turning to gold as an inflation hedge.

Biren Lundin aptly summarized the sentiment: “Gold is proving its worth as a safeguard against economic uncertainty, and its impressive performance against traditional market headwinds is likely to continue.”5

Protect Your Savings

In uncertain times, gold remains a trusted asset for preserving wealth. By holding physical precious metals in a Gold IRA, you can protect your savings for the long run. To learn more, contact American Hartford Gold at 800-462-0071 today.