New Risks to Retirement Planning

For years, retirement planning was simple: set up a 401(k), contribute regularly, and trust the market to grow your wealth over time. But that strategy is coming undone. Market swings and new economic policies are pushing investors to safer assets like gold. President Trump’s tariffs and budget cuts are creating uncertainty. Many people are now rethinking the usual “set it and forget it” approach.

Market Volatility and Rising Fear

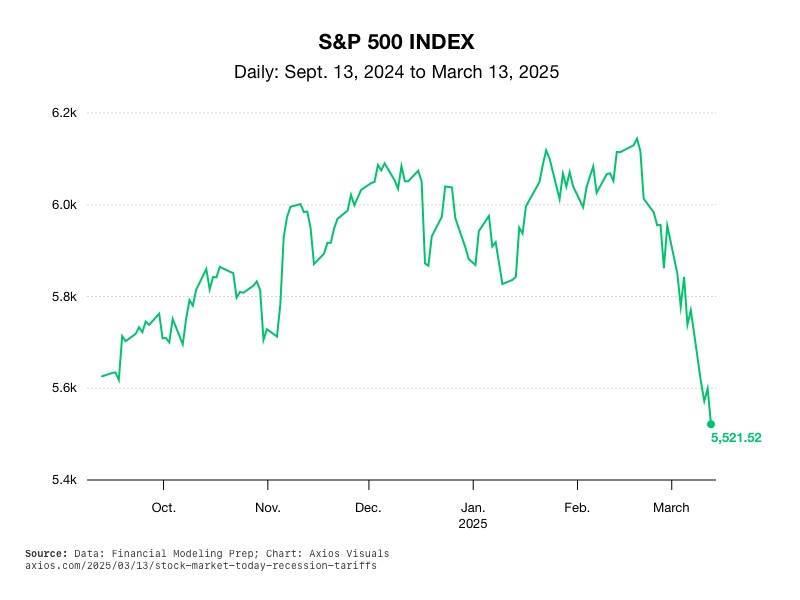

The S&P 500 had been on a historic run, rising 72% from October 2022 to a record high in February 2025. But that momentum has stalled. The S&P 500 has now dropped more than 8% from its peak, including a 2.3% decline this past week, sending it into correction territory. Wall Street’s growing fear of recession has intensified investor anxiety.1

2

2

The share of investors who are bullish on the stock market has dropped to its lowest level since September 2022, signaling a shift in sentiment. Some investors are sticking to the old advice of waiting out tough markets. But many retirees, or those close to it, are starting to doubt that the market will bounce back in time.

Since the first half of March, individual investors have been trading their 401(k)s at more than four times the normal level. The most trading activity in nearly five years. They are on a search for stability. TIAA reported a 10% increase in client calls over the past week. Many investors are seeking advice on how to adjust their retirement plans to account for market turbulence.3

Investors added a net $30 billion to money-market funds in the week ending March 5, says Alight Solutions. This is the highest total in over a year. Gold has been a particular bright spot. U.S. gold ETFs saw inflows exceeding $5 billion in February and another $1 billion so far in March. Gold also hit a record high, crossing $3,000 per ounce for the first time.4

Turning to Gold

Gold’s rising value reflects more than just short-term market fear. It’s part of a broader shift in retirement strategy. Investors are seeking the stability and security that physical assets like gold provide. Unlike stocks, gold isn’t subject to corporate earnings reports or government policy changes.

A key benefit of gold is its role as a hedge against inflation and economic uncertainty. With Trump’s tariffs raising prices and increasing the risk of inflation, gold’s ability to retain value makes it an attractive option. Advisers warn clients to avoid withdrawing from retirement funds during market turbulence. Such withdrawals can lead to taxes and penalties. For those who want the wealth protection benefits of physical gold, a self-directed Gold IRA can be opened without taxes or penalties.

Trump’s Economic Transformation and Retirement Planning

President Trump’s policy changes are reshaping the retirement landscape. His plan to extend the 2017 Tax Cuts and Jobs Act (TCJA) would give Americans extra money to spend and invest. Financial experts say this money can be used to diversify portfolios.

Trump has also proposed eliminating federal taxes on Social Security benefits. As a result, benefits could be greater in the short term. But it raises long-term concerns about the solvency of the Social Security trust fund. Benefits are likely to be cut by 20% in ten years due to shortfalls. The Committee for a Responsible Federal Budget says that cutting these taxes while adding tariffs could speed up the trust fund’s insolvency by three years.5

The Shift Toward Active Retirement Planning

With mounting economic uncertainty, the days of passive retirement planning may be ending. Investors are looking away from traditional stock-heavy portfolios. They are embracing more active strategies that include:

• Increasing contributions to safe-haven assets like gold.

• Rebalancing portfolios to reduce stock market exposure.

• Diversifying into physical gold and other inflation-resistant assets.

Gold’s rise past $3,000 an ounce reflects growing demand for financial security. A Gold IRA lets you own physical gold and still get the tax perks of a traditional retirement account. Gold has intrinsic value that protects it from market volatility.

Conclusion

“Set it and forget it” investing worked when markets were stable, and growth was steady. But Trump’s economic policies and the resulting market volatility have changed the game. Americans are recognizing that they need to take a more active role in protecting their retirement savings. For many, the answer could lie in gold. Opening a Gold IRA offers stability and security for your future. It helps protect your retirement savings, keeping their value when you need it the most. To learn more, call American Hartford Gold today at 800-462-0071.