Chinese Economy in Decline

They say, “a butterfly flaps its wings in China and causes a tornado in Texas.” If that holds true, then the American economy should brace for a massive storm. The Chinese economy is falling apart. In the absence of a post-pandemic boom, China is facing an epic slowdown. The consequences of which threaten to bring down the value of stock-based retirement funds.

There is growing pessimism that a post pandemic boom will ever occur. Analysts thought that 2023 would provide us with a rally in the Chinese stock market. Morgan Stanley and Goldman Sachs said it was coming. Bank of America said China would be a “notable exception” from global recession. Expectations for China’s growth hit a 17-year high.

There was a short bounce after strict Covid restrictions were lifted. But then it dropped right back down and continued sliding. Manufacturing contracted and exports declined. Youth unemployment remains high as consumer confidence falls lower every day.

Economists are warning of a global economic drag from reduced demand from China. It is resulting in a cutback in orders and lower revenue around the world. The slowdown is hurting major American companies that are heavily vested in China. It is showing in the earning results across a range of companies like DuPont, Dow, and Caterpillar. Dupont recently cut its overall growth outlook. The ailing companies are worried about further trouble as growth grinds to a halt.

Root Cause: The Property Crisis

At the heart of China’s economic woes lies a severe property crisis. This issue is more than just a real estate problem. It’s a ticking time bomb that threatens to detonate the broader economy. The property sector was once the bedrock of China’s economic growth. It has turned into a destabilizing force.

1

1

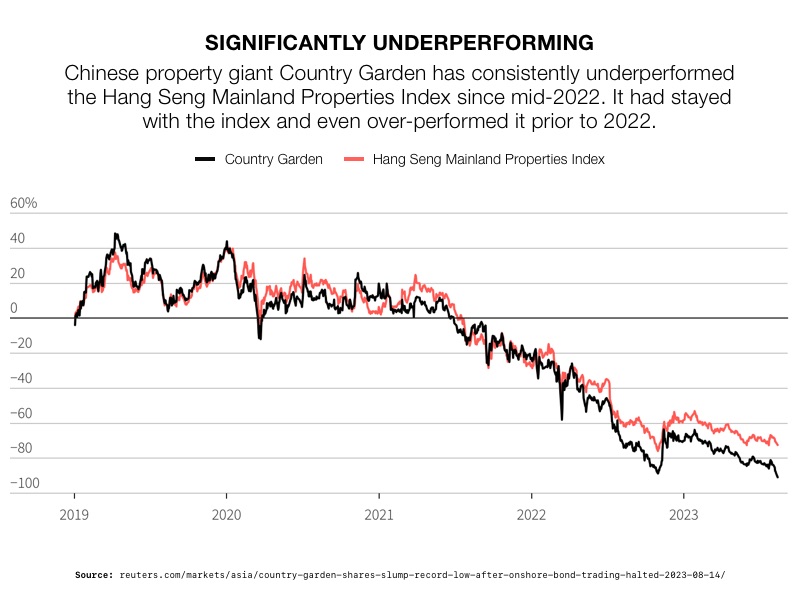

Evergrande, Sunac China, and Country Garden are the three major private developers in China. They are all battling massive debt and default. China’s ‘miraculous’ growth came from the government. They pumped money into the economy with infrastructure and property development projects. But the government has been pulling back support. As they do, developers are leaving a trail of half-finished construction projects across China. With 70% of China’s wealth tied up in real estate, the Chinese middle class is being left holding the bag.

Now, there are fears that the defaulting companies will spark a major banking crisis. Widespread instability could hit across every sector as a result if the government doesn’t intervene. Echoes of that instability will resonate throughout the global economy.

The End of an Era

Analysts are now suggesting that the era of the “Chinese miracle” is over. The property bubble has burst. And the mechanisms that propelled China to international economic prominence have broken down. This shift prompted JPMorgan to advise clients to reconsider the value of investing in the country.

Meanwhile, geopolitical tensions are preventing increasing exports that could help their economy. The US is looking to move away from China. We want to rely on friendly countries. Especially as China is leading the charge in overthrowing the US dollar with the new BRICS currency.

The Domino Effect on US Stocks

The ailing Chinese economy can decrease the value of stock-based retirement funds by dragging the market down. Stocks will be hurt for a variety of reasons:

Global Trade: Reduced demand for goods and services from China directly affects US companies that heavily rely on exports to the country.

Supply Chain Disruptions: Complex supply chains with Chinese components can lead to production disruptions, affecting US firms’ capabilities.

Commodity Prices: A slowdown in China’s economy could lead to decreased demand for commodities, affecting US energy and commodities sectors.

Investor Sentiment: Investor uncertainty can lead to increased market volatility and prompt investors to sell off stocks.

Financial Sector Exposure: Financial institutions with Chinese investments could experience stress, affecting US financial institutions.

Currency Impact: A weakening yuan can create currency market instability, impacting global trade dynamics.

The economic struggles in China are sending shockwaves through the global economy and US stocks. A faltering Chinese economy can lead to severe market downturns in the US. In the face of these uncertainties, diversification becomes crucial. One avenue worth investigating are precious metals. Gold has historically served as a safe haven in turbulent economic times. The Gold IRA from American Hartford Gold is designed to protect your portfolio from global economic instability. Call us today at 800-462-0071 to learn more.