Inflation Expectations Run High

A survey from the Federal Reserve Bank of New York said Americans are bracing for high inflation to remain for the next few years. That viewpoint should come as no surprise. Consumer prices grew 3.5% year-per-year in March. That was the third straight month of hotter-than expected inflation. High inflation expectations can have a serious impact on the economy as a whole and retirement savings in particular. 1

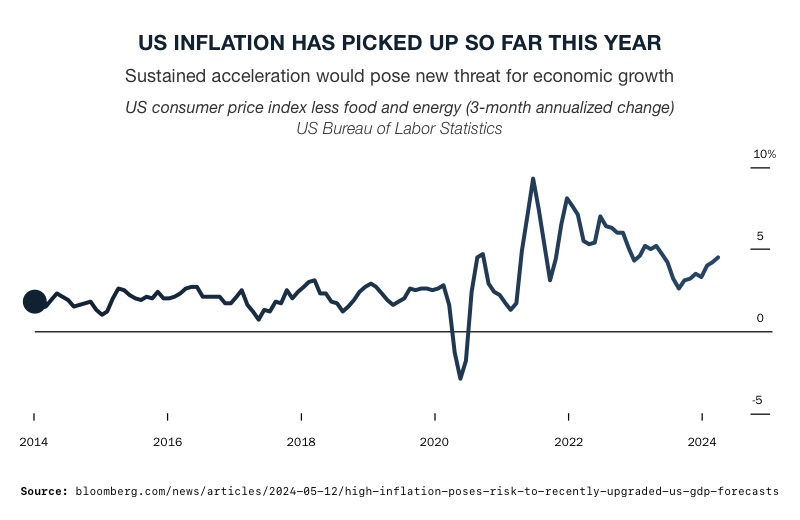

The Inflation Picture

2

2

The Fed’s inflation target is 2%. The Personal Consumption Expenditures (PCE) Index is a measure of the prices of goods and services purchased by households in the United States. One notable feature of the PCE Index is that it incorporates changes in consumer behavior over time. It is the Fed’s preferred inflation gauge. It increased in March from February.

The New York Fed survey showed people expect high prices a year from now on rent, food, gasoline, and medical costs. As future spending is expected to rise, respondents also expect smaller future earnings. It makes sense that the survey also showed that more and more households are worried about their personal financial situation.

The results also revealed that people are unsure about the job market. It found that the fewest number of people feel confident about finding a new job if they lost their current one since April 2021.

Consumers aren’t alone with their inflation outlook. The Cleveland Fed said inflation expectations among business leaders rose as well.

Future Expectations Affect Inflation Today

When people expect prices to go up in the future, they tend to buy more things now to avoid paying higher prices later. This increased demand for goods and services can lead to higher prices today. So, when people believe inflation will happen in the future, it can actually cause inflation to happen sooner.

Inflation is taking its toll on Americans. Household spending has lost momentum. At the same time, payroll and wage growth slowed. Another widely followed indicator of wages, the ‘quits rate,’ points to a worsening jobs market ahead. But with all this, there was no corresponding cooldown in prices. As a result, the strain on families increased.

Savings accumulated during the pandemic are thought to have largely driven consumer spending in the past few years. Those savings may finally be exhausted as of March. Worryingly, as personal consumption increased, there was a decline in the saving rate. It fell to a 17-month low in March.

Prolonged Inflation and the Stock Market

The stock market could fall around 500 points according to the Stifel investment firm. They think there will be a market correction because falling inflation is a “pipe dream.” Fed rate cuts will be delayed as a result of prolonged inflation. As of now, the CME Fed Watch tool sees just one of two rate cuts by the end of this year. Yet, there is now talk of no rate cuts until 2025. There was already a market sell off in April when hopes for Fed rate cuts were first dialed back. 3

Stifel maintains that inflation will remain high. According to them, the economy is coming out of a “pseudo-recession.” That slowdown accounted for what appeared to be inflation coming down around the beginning of the year. Now that economic activity is picking up again, inflation will return and rise.

Interest Rates & Inflation

At the May Fed meeting, interest rates were kept at their highest level in more than two decades. They’ve been there since July.

Federal Reserve Governor Michell Bowman said the central bank should proceed “carefully and deliberately” toward the Fed’s 2% inflation goal. Bowman thinks inflation will stay elevated for a while. Therefore, the bank should move slowly when deciding on policy to avoid making mistakes. Bowman also mentioned that there aren’t enough buyers and sellers in the Treasury market. She added, “Ultimately, liquidity in the US Treasury market has the potential to amplify or dampen shocks to the financial system.”4

Bowman’s inflation sentiment is echoed by Boston Fed President Susan Collins. She said it will take “more time than previously thought” to bring inflation sustainably down to the central bank’s 2% target, and Minneapolis President Neel Kashkari said rates will likely stay high “for an extended period of time.”5

Their boss, Fed Chair Powell, said inflation data hasn’t given them the confidence that price increases are slowing to 2%. He did not share when rate cuts should be expected.

Conclusion

There is a saying that expectation is the root of all heartache. When it comes to inflation, it proves to be true. Expecting prolonged high inflation can be a self-fulfilling prophecy. The Fed has run out of tools to try and bring it to their 2% target. All they can do now is keep interest rates high and hope that the economy slows down. This is leaving Americans trapped between high prices and lower incomes. And businesses facing higher costs, tougher financing, and slower sales. All of which spell trouble for stock prices and the retirement plans whose value rely on them. That why people looking to preserve the value of their portfolio are investigating physical precious metals like gold. A Gold IRA is designed to shelter your funds from the impact of stubborn high inflation. Contact American Hartford Gold today at 800-462-0071 to learn more.

Notes:

1. https://markets.businessinsider.com/news/stocks/stock-market-outlook-sp500-correction-inflation-economy-fed-rate-cuts-2024-5

2. https://www.bloomberg.com/news/articles/2024-05-12/high-inflation-poses-risk-to-recently-upgraded-us-gdp-forecasts?embedded-checkout=true

3. https://markets.businessinsider.com/news/stocks/stock-market-outlook-sp500-correction-inflation-economy-fed-rate-cuts-2024-5

4. https://www.bloomberg.com/news/articles/2024-05-10/bowman-says-fed-should-move-carefully-to-reach-inflation-goal

5. https://www.bloomberg.com/news/articles/2024-05-10/bowman-says-fed-should-move-carefully-to-reach-inflation-goal