Understanding the Inflation Downtrend

For the past five quarters, the Federal Reserve has been focused on cooling historically high inflation. They’ve raised benchmark interest rates by 500 basis points from near-zero levels to upward of 5% – the fastest pace in four decades. As the Federal Reserve hints at even more rate hikes, voices are expressing doubts if they are necessary. Not only that, but the effectiveness of rate hikes altogether is also being called into question.

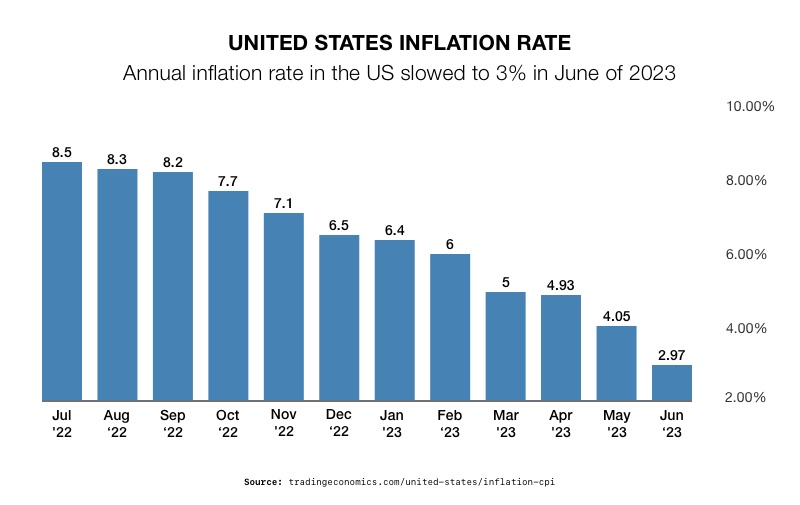

Consumer prices rose 3% annually in June. That is down from a four-decade high of 9.1% a year ago. And core inflation, which excludes volatile food and energy prices, fell to 4.8%. Yet, inflation is still higher than the Fed’s 2% target.1

2

2

Because of this, the Federal Reserve has signaled two more interest rate hikes this year. Fed Governor Christopher Waller says they are necessary. According to him, if the effects of hikes have already happened, then you will need more to reach the 2% goal. He said, “If one believes the bulk of the effects from last year’s tightening have passed through the economy already, then we can’t expect much more slowing of demand and inflation from that tightening.” Waller continued, “Pausing rate hikes now, because you are waiting for long and variable lags to arrive, may leave you standing on the platform waiting for a train that has already left the station.”3

Due to the unprecedented rapid nature of the increases, hike supporters say they can’t rely on textbook models. Instead, they think the Fed must keep going until the target is hit. If one more hike doesn’t work, then Americans should brace for another one right after it.

Questioning the Effectiveness of Rate Hikes

Are the rate hikes responsible for the drop in inflation? Some economists are saying no. For sure, the hikes have done damage. High mortgage rates are slowing the housing market. Car loans and credit cards are more expensive. Stock prices are being dragged down. Banks are failing and the country is lurching towards recession.

Joseph LaVorgna is the Chief US Economist of the SMBC group and a former top economic adviser to President Trump. He does not think the reduction in inflation is due to Fed policy. He thinks inflation dropped for other reasons. He credits the drop to resolved supply chains. This is indicated by the Oxford Economics supply chain stress index which has fallen to about half its peak early last year.

Also, pent up pandemic demand has been exhausted. Reduced demand led to lower prices. Costs actually started to drop within months of the first rate hike. Too soon for hikes to be the cause. Fed Governor Christopher Waller stated it takes at least 9 to 12 months.

LaVorgna also credits falling inflation to a sharp drop in commodity prices. The Ukraine war sent them skyrocketing. But they came down after shippers found ways to bypass the war-torn region and recession fears shrank global demand. Overall, LaVorgna maintains that the Fed tries to slow inflation by slowing the economy with rate hikes. But the economy hasn’t weakened by and large.

LaVorgna isn’t alone in his assessment. Jonathan Miller is a former Fed economist and now senior economist at Barclays. He thinks the hikes themselves didn’t bring inflation down. But the Fed had a supportive role. They managed public expectations on inflation. Absent the Fed hikes, “Maybe we would have spiraling inflation,” he says, “though there’s no way to tell.4

Mark Zandi is the chief economist of Moody’s Analytics. He said the Fed’s rate hikes deserve an “honorable mention” at best. They may have helped soften consumer demand by making loans and credit card more expensive. As pandemic cash reserves run dry and credit becomes expensive, spending may drop.

This leads to the question – if the drops aren’t directly tied to the rate hikes, why not wait before raising rates more?

The Fed’s 2% goal may be unreasonable according to BlackRock’s CIO. Rick Rieder is chief investment officer for fixed income at the world’s largest asset manager. “This whole idea of there’s a magic to 2% doesn’t make any sense to me. You just had immense stimulus – let it play out. It’s not worth it. Why would you take millions of people out of work because you need to go from 2.7% to 2%?”5

The benefits of interest rate hikes on inflation are in question. The harm they do is not. Retirement funds are losing value as stocks and bonds react to the high interest rate environment. Impending rate hikes could make things worse. That is why now it the time to investigate a Gold IRA from American Hartford Gold. It is structured to protect the value of your portfolio in a high interest rate environment. Contact us today at 800-462-0071 to learn more.