- Development of Central Bank Digital Currencies, aka, a Digital Dollar, is accelerating around the globe

- The U.S. is motivated to develop a digital dollar to avoid losing economic dominance to China in the cyber age

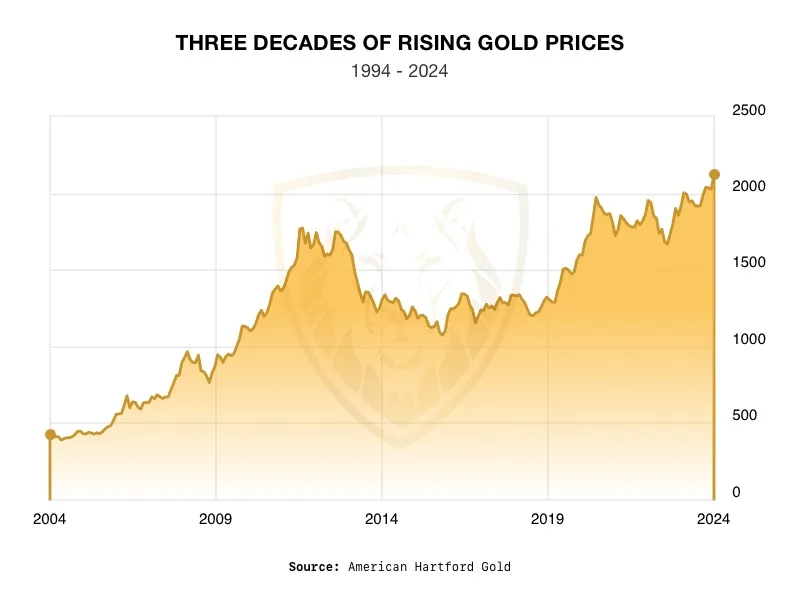

- Deemed inevitable, a digital dollar can be defended against by moving assets into physical precious metals

China Claims World’s Largest Gold Vein

Rise of the Digital Dollar

The push toward Central Bank Digital Currencies (CBDCs), aka, a Digital Dollar, is reshaping the global financial landscape at lightning speed. With 134 countries exploring CBDCs—including major powers like China piloting massive programs—this shift is more than a trend; it’s a race. But as the U.S. navigates its role in this new digital economy, critical questions arise: What does a “digital dollar” mean for your financial freedom? And more importantly, how can you protect yourself against the risks?

Where the Digital Dollar is Now

– 134 countries, representing 98% of global GDP are exploring a CBDC. That number was only 35 in 2020.

– 19 G20 countries are in the advanced stages of launching a CBDC

– All original members of the BRICS Alliance (Brazil, Russia, India, China, South Africa) are in pilot phase

– Since Russia invaded Ukraine, the number of cross-border wholesale CBDC projects has doubled

– Project mBridge connects banks in China, Thailand, Saudi Arabia, and others using CBDC

– The Digital yuan(e-CNY) is the largest CBDC pilot in the world. In June 2024, the e-CNY did over $986 billion in transactions, four times the amount done in June 2023

– The digital euro is in pilot for domestic use in Europe and internationally1

2

2

How About the U.S.

The U.S. Federal Reserve is participating in a cross-border CBDC project. It’s called Project Agora. It connects the Fed with 6 other major central banks. Along with a large group of private financial firms. Fed Chair Powell told the Bank for International Settlements (BIS) Innovation Summit 2021 that ‘way more than half’ of the Fed’s 12 regional banks had ‘active work’ on CBDC.3

What Exactly is a Digital Dollar

A digital dollar is issued by a central bank and controlled by a government. They are different than cryptocurrencies like bitcoin. Cryptocurrencies are decentralized. Their transactions aren’t monitored by one authority. Instead, blockchain technology is used as an independent ledger.

Why Governments Want a Digital Dollar

There are several reasons for countries to adopt a digital dollar. They are promoted as making money more accessible to those outside of the banking system. CBDC are supposed to increase efficiency in domestic and international trade transactions. Making them cheaper and faster. CBDC could allow governments to implement monetary policy faster and more effectively.

Why the U.S. Wants a Digital Dollar

The U.S. wants a CBDC for all the above reasons. But they have another motivation. The U.S. needs to retain its role as the world’s dominant currency. They want to keep all the financial advantages that gives. Policy makers fear that if the U.S. doesn’t take the lead, it will itself locked out of a new electronic financial system. Its leading role would be replaced by China, who is leading the development of CBDCs. China’s first-mover advantages would allow it to determine the shape of this new economic world order. With itself at top and its CBDC as the new primary means of exchange.

Problems of the Digital Dollar

The digital dollar brings problems along with its solutions. The U.S. could lose the ability to track criminal money flows or enforce sanctions.

A federally issued and controlled dollar could make the private banking system obsolete. Major economic disruptions could result.

The digital dollar also creates greater fears about loss of freedom. Both economic and personal. The Federal Reserve could manipulate their digital dollar to control financial behavior. For example, say they want to stimulate consumer spending to avoid recession. They can put an expiration date on dollars. If they aren’t spent by a certain time, they disappear from your account. Or the Fed can implement negative interest rates to force retirement savers to spend their funds. Cyber money also becomes vulnerable to cyber criminals. Billions could be stolen from the safety behind their screens.

Freedom advocates also fear the control a digital dollar would give. Every transaction would be recorded. There would be no more privacy. And there could be consequences for buying something or supporting a cause the government doesn’t approve of. It would be in their power to block the transaction, fine you, or simply erase your funds from the digital ledger without recourse.

Resistance to the Digital Dollar

President-elect Trump is taking the lead to stopping an American digital dollar. He stated, “As your president, I will never allow the creation of a central bank digital currency.” He continued, ” Such a currency would give the federal government – our federal government – the absolute control over your money. They could take your money, you wouldn’t even know it was gone. This would be a dangerous threat to freedom – and I will stop it from coming to America.”4

Legal analysts have stated that the Federal Reserve does not appear to have legal authority to issue a CBDC without congressional authorization. And Fed Chair Powell said he would not issue a digital dollar without Congressional approval.

The House of Representatives already voted to stop the Fed from issuing a digital dollar. House Democrats fought hard to stop the bill. But the bill has not yet been addressed in the Senate. Right now, the Republicans hold a slim majority. A majority that may disappear in two years. Afterwards, Congress would have a free hand to push their digital dollar agenda.

Fearful of the federal government, states are fighting back against a digital dollar. Florida, Missouri, and Tennessee have introduced bills to ban or limit the use of CBDCs.

Conclusion

The global financial system is going digital. The U.S. may ultimately be forced to join the Digital Dollar movement to avoid being shut out of the new economy. Currently, President-elect Trump, Republicans and some states are resisting being dragged into the digital dollar world. But the change may be inevitable. That’s why it is important to do something now to protect your assets. Owning physical precious metals gives you a safe haven asset that is immune from the hazards of the digital dollar. A Gold IRA gives you the means to protect your funds for the long term. To learn more, call us today at 800-462-0071.

2

2

2

2

2

2