- Credit card debt and delinquencies are at record levels

- Rapidly ballooning consumer debt can have disastrous impact on individuals and the economy

- Physical precious metals can safeguard retirement funds from the effects of runaway debt

The Danger of Exploding Credit Card Debt

More and more Americans are buckling under the weight of mounting credit card debt. Inflation and strong consumer spending has sent credit card balances ballooning. Outstanding credit card balances now top an astounding $1.3 trillion. “Over the past two years, Americans’ credit card balances have skyrocketed 40%,” said Ted Rossman, senior industry analyst at Bankrate. The explosion of credit card could hold severe consequences for the economy as a whole.1

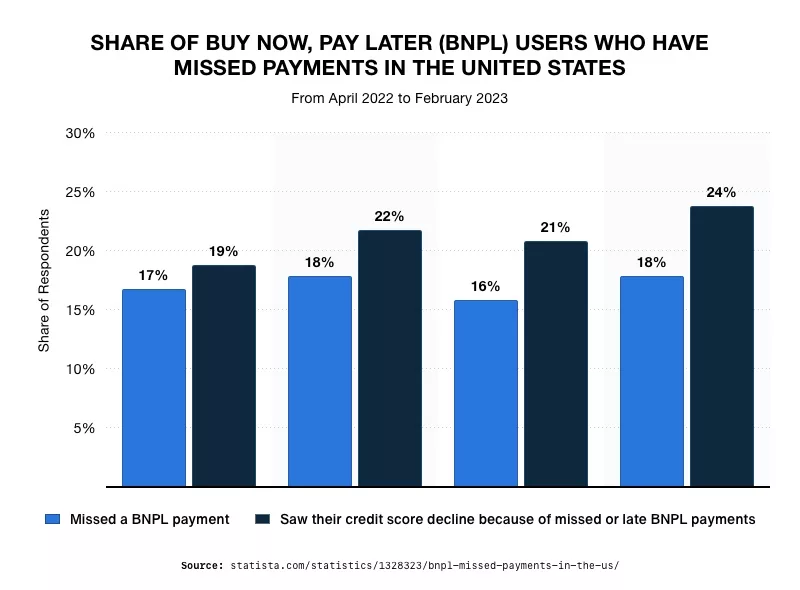

Data points to credit card debt that is snowballing out of control. Credit card balances spiked 18% this past November alone. The share of people carrying balances month to month has leapt up to 49%. Only one third of account balances are paid in full, the lowest amount in 4 years. Meanwhile, 56 million Americans have been in credit card debt for at least a year.2

3

3

In addition, all stages of credit card delinquency (30, 60, and 90 days past due) jumped higher during the third quarter of last year. They surpassed pre-pandemic levels and are close to setting a record high since data started being collected in 2012.

Delinquencies are occurring as debt is getting drastically more expensive. Carrying a balance is worsened by sky high annual percentage rates, making the debt a deeper and deeper hole to climb out of. The average credit card rate is now more than 20%. “Most cardholders’ rates have risen five-and-a-quarter percentage points during that span as a result of the Fed’s rate hikes meant to combat inflation,” Rossman said. “It’s no wonder, then, that we’re seeing more people carrying more debt for longer periods of time.”4

Paying just the minimum on a card with a 20+% rate is “brutal.” Borrowers making the minimum payment on an average credit card balance of $6,000 at the average rate of 20.74% would be in debt for more than 17 years and end up paying more than $9,000 in interest.

The overwhelming effect of debt is feeding into the negative outlook Americans have on the economy. This is despite being told how well the country is doing. People are being forced to rack up debt for practical purchases such as food, fuel, and day-to-day expenses. They are not buying indulgences that can be delayed or ignored. Bills are becoming harder to pay in the face of stubborn inflation, burned up stimulus savings, and renewed student loan payments.

Banks are making it harder to get credit in response to delinquencies. They are granting fewer credit line increases and reducing credit lines more frequently. And even if the Fed does start cutting interest rates this year, credit card APRs aren’t likely to improve much.

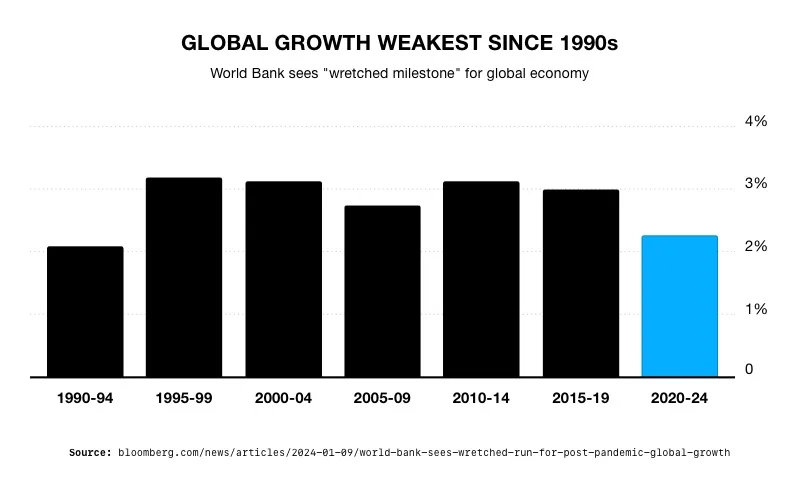

The Bigger Picture

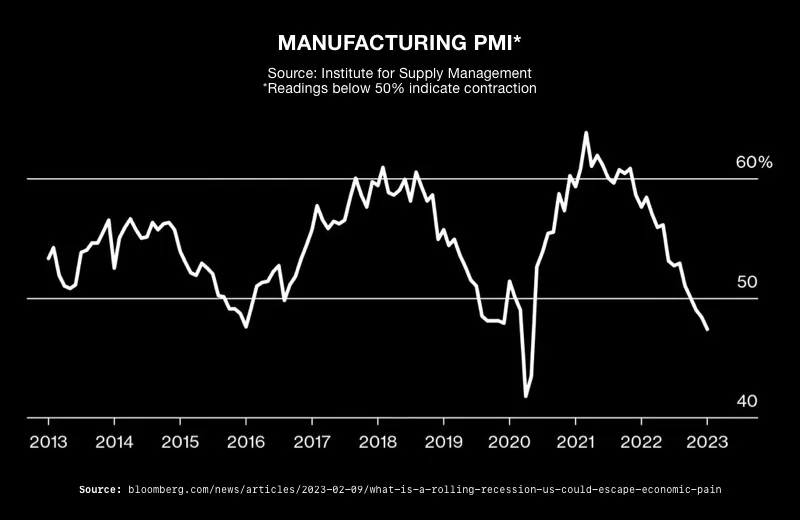

For the overall economy, more credit card debt can be ok when things are going well. Consumer spending accounts for about 70% of the US economy. But the short-term boost can become a drag in the long term. If the current pace of defaults and delinquencies continues, the consequences to individuals, financial institutions, and the broader economy would be profound.

As individuals falter in repaying their credit card debts, creditors, including banks and credit card companies, would bear the brunt. The surge in defaults would translate into significant financial losses for creditors. This could lead to a decline in their profitability, potentially threatening the stability of financial institutions. As a response, these institutions might tighten their lending practices, creating a ripple effect that restricts access to credit for consumers.

Consumer spending, a linchpin of economic growth, would contract as individuals curtail discretionary spending. Businesses, especially those reliant on consumer spending, would experience a decline in revenue. The potential consequence is layoffs and a rise in unemployment rates, compounding the economic slowdown. This negative feedback loop could lead to a prolonged recession.

Investors holding securities backed by consumer debt would not be immune to the fallout. Asset-backed securities, including those comprised of credit card debt, form a significant portion of investment portfolios. A surge in defaults would translate into losses for investors, affecting investment portfolios and retirement savings.

Conclusion

The potential for massive credit card defaults presents a clear financial danger. Ballooning consumer debt could set up the economy for a crash. With overwhelmed Americans left with nothing to spend, businesses would decline, and financial institutions could be left holding trillions in bad debt. Any government intervention can make the problem worse – stricter lending requirements could suffocate growth, cutting rates could reignite inflation, while raising them could put the final nail in indebted American’s coffin. That’s why experts suggest looking to physical precious metals to hedge against the consequences of runaway debt. With intrinsic value and no counterparty risk, physical precious metals, especially when in a Gold IRA, can protect the value of your retirement funds. Contact us today at 800-462-0071 to learn more.

2

2

2

2 3

3

2

2