- The Fed approves 11th rate hike since 2022

- Economy faces rate-driven recession risks

- Gold prices surge amid rate hike uncertainties

Fed Issues Another Interest Rate Increase

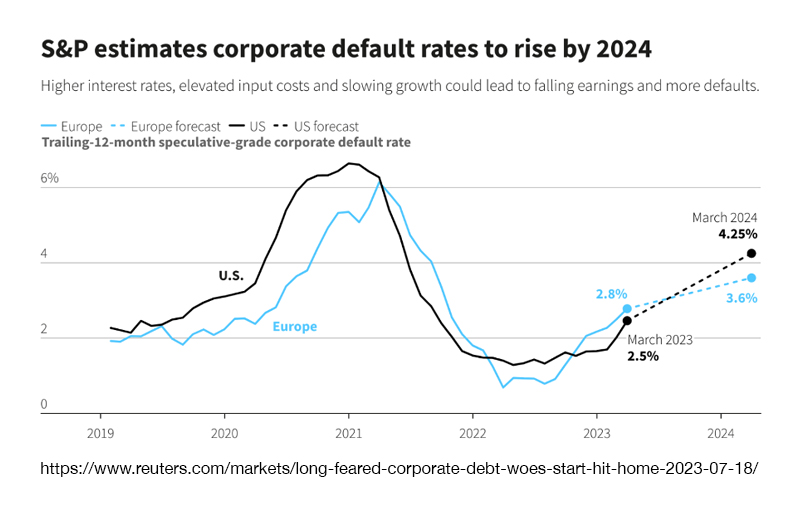

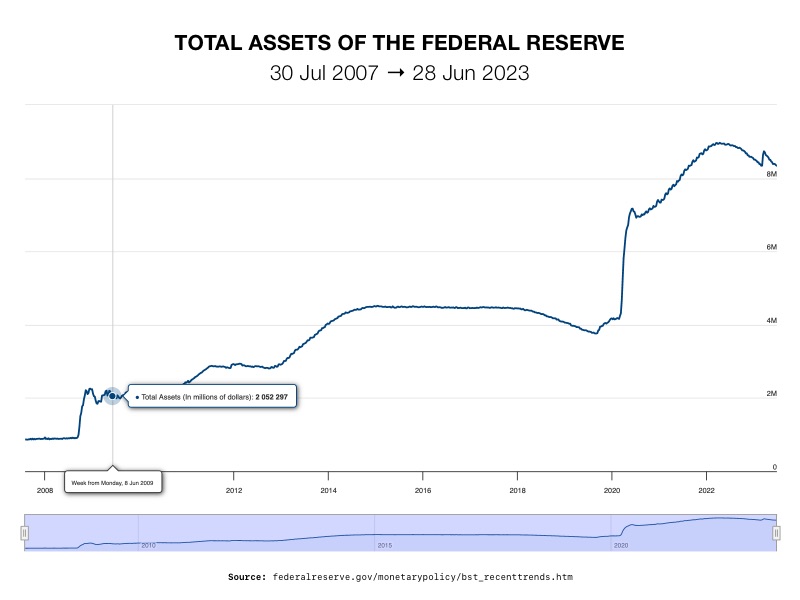

The Federal Reserve approved the 11th interest rate hike since March 2022. The benchmark borrowing rate is now at its highest level in twenty years. While investors are hoping it will be the last one for a long time, the Fed is making no such promises. Instead, the economy could soon be facing a rate-driven recession.

Last month, the Fed held interest rates steady in a range between 5% and 5.25%. That was the first pause after 10 increases raised them from near zero. The market has already priced in this latest hike. Wall Street is riding a wave of optimism despite warnings of more hikes from the central bank. The Dow Jones Industrial Average jumped more than 5% over the past month alone.1

There is a growing consensus among investors that the Fed has gone far enough and could unnecessarily push the economy into recession. The annual inflation rate declined to 3% in June, down from 9.1% a year ago. Kathy Jones is the Chief Fixed Income Strategist at Charles Schwab. She said, “The Fed should be done already. They’re walking a difficult line here. To me, the decision would be, hey, we’ve done enough for now, and we can wait and see. But apparently the folks at the Fed think they need one more at least.”2

Federal Reserve officials obviously have a different opinion. Core inflation, which excludes volatile food and energy prices, posted its smallest monthly increase in more than two years in June. It rose less than .2% from the prior month. Fed officials have been counting on a slowdown in core inflation because goods and shelter prices are slowing sharply.

But overall hiring and economic activity has been too strong for central bank officials to support this being the last hike. The Fed is going to take a data-driven approach whether to continue raising interest rates. Officials want to see evidence that economic activity is slowing, even if inflation subsides somewhat faster than projected.

Fed Chair Powell said that the central bank is not yet fully confident that inflation is defeated. Even if rates don’t rise again, they will most likely stay elevated for a long while. Powell said, “We intend to keep policy restrictive until we’re confident inflation is coming down sustainably to our 2% target, and we’re prepared to further tighten if that’s appropriate.” Powell pointed out that core inflation is still running above 3%.3

Future Rate Hikes

Powell indicated that the central bank is willing to wait things out as it follows the latest data. “We have to be ready to follow the data, and given how far we’ve come, we can afford to be a little patient, as well as resolute,” he said.4

The Fed will determine future rate increases meeting by meeting. Chair Powell said the FOMC gave no guidance on the potential for further rate increases at future meetings.

“We’re going to be going meeting by meeting and as we go into each meeting, we’re going to be asking ourselves the same questions. So, we haven’t made any decisions about any future meetings, including the pace at which we consider hiking, but we’re going to be assessing the need for further tightening that may be appropriate … to return inflation to 2% over time.”5

Fed Guided by History

Inflation is at its most severe levels since the 1980s. Back then, the Fed backed off the inflation fight too soon. As a result, the economy suffered through a stagflation of high prices and weak growth.

“The worst outcome for everyone, of course, would be not to deal with inflation now [and] not get it done. Whatever the short-term social costs of getting inflation under control, the longer-term social costs of failing to do so are greater and the historical record is very, very clear on that,” said Powell.6

Gold & Rates

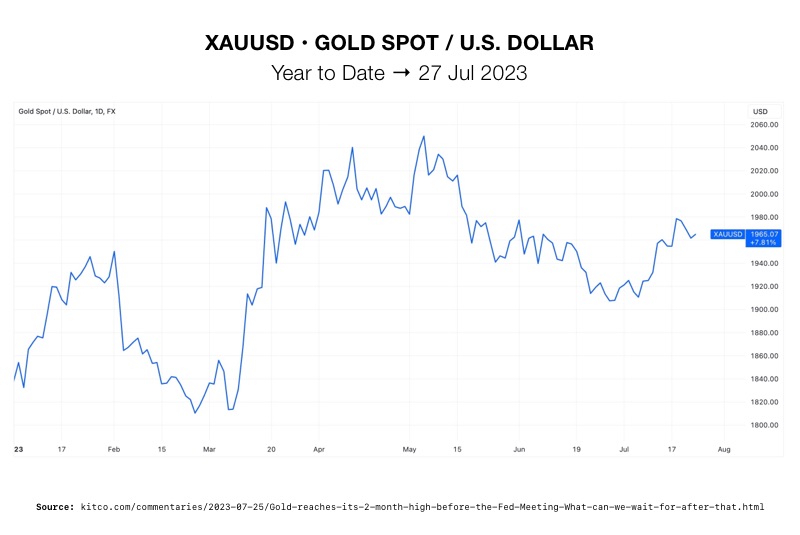

In the middle of July, gold hit its highest price since May.

7

7

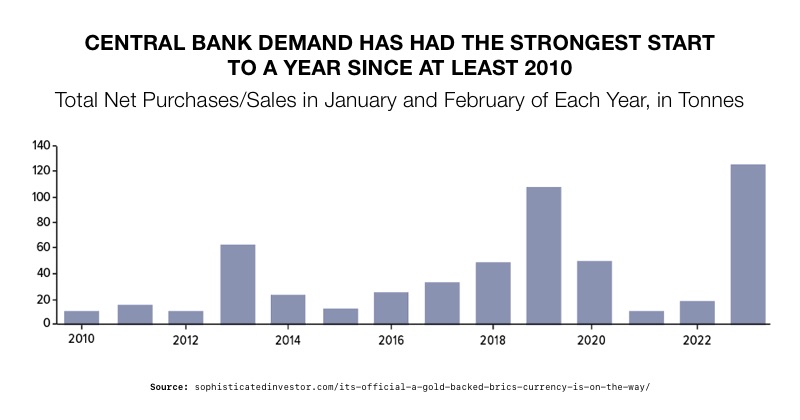

Traditionally, gold has an inverse correlation with the US dollar. As inflation recedes, investors expect a halt in rate hikes. As result, the dollar becomes less attractive for market participants. When this happens, people turn to assets like gold. Plus, news about a potential new gold-back currency created by the BRICS alliance, has also supported the demand for gold.

Gold growth may stall if there are more hikes. However, this only a near future consideration. It’s expected that towards the end of 2023 and in 2024, as the Fed’s rate cycle comes to an end and the US economy slows down, the dollar will weaken against other major currencies. This could potentially result in a growth of gold prices. Gold increases during times of recession according to historical data. With the future of rate hikes, and in turn, the economy, up in the air, those with retirement funds can investigate a Gold IRA from American Hartford Gold. It can protect your portfolio from the damage caused by interest rate increases. Contact us today at 800-462-0071 to learn more.

3

3 3

3

3

3

3

3

1

1