Escalating Bank Deposit Flight

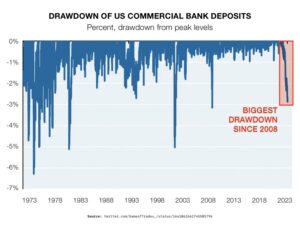

Despite surging second-quarter profits, banks are teetering on the edge of crisis. The industry is still dealing with the fallout from this year’s record-setting bank failures. Now, they are facing a massive spike in deposit flight. The exodus threatens to not only drag down the banking industry but could potentially undermine the entire financial system.

During the brief period from July 5th to 12th, $78 billion exited American bank accounts. This occurred even as major banks invested substantial amounts of cash to attract new deposits. The money is leaving banks for higher yielding money market accounts. 1

2

2

The Federal Reserve released its annual stress test. In a “severely adverse” scenario, the test predicts more than half a trillion dollars could exit the US banking system. Last year, the Fed found $742 billion in deposits had left the banking system.3

Three major US banks collapsed this year — First Republic, Silicon Valley Bank and Signature Bank of New York. They had more combined assets under management than all 25 federally insured lenders that failed in 2008 at the onset of the Great Recession. First Republic had lost more than $100 billion of deposits in the first quarter of the year.4

Risk to Banks

The severity of the situation isn’t lost on the banking industry. JPMorgan Chase CEO Jamie Dimon issued a warning to shareholders. He said there is an urgent need for banks to offer higher rates to prevent further deposit flight. Banks must find the balance between attracting new deposits with higher yields without jeopardizing their financial standing.

The risk caused by the mass withdrawal of deposits is made worse by the collapsing commercial real estate sector. The current remote/hybrid work environment is causing a tremendous drop in commercial real estate value. This loss is increasing the risk to banks that hold commercial real estate loans.

A recent report from S&P Global Market Intelligence says 576 American banks are at risk from overexposure to real estate loans. That is a fear-inducing 30% increase from last year. Roughly 70% of bank-held commercial mortgages still sit on the balance sheets of both regional and small lenders. These loans were the undoing of Silicon Valley Bank and First Republic. Experts worry about the stability of the banking system if the situation worsens. 5

Risks to the Economy

Banks rely on customer deposits to fund their lending activities and other operations. If a large portion of deposits is withdrawn, it could limit the amount of money available for loans, mortgages, and other credit facilities. Economic growth and investment in various sectors may slow to a standstill.

As banks strive to compete with money markets, they may raise interest rates on loans to attract more deposits. This could increase borrowing costs for consumers and businesses.

In addition, reduced deposits could lead to decreased net interest income for banks. The drop in net income profits may result in cost-cutting measures or changes in lending practices.

The larger issue is the systemic risk posed by dwindling deposits. A crisis of confidence in the banking system can erupt if a significant number of depositors simultaneously withdraw their funds. The resulting “bank run” would have severe economic consequences.

A bank run can quickly deplete a bank’s reserves. If the bank’s assets are not sufficient to cover the withdrawals, it may become insolvent, leading to its collapse. Bank failures can have a domino effect. The loss of confidence spreads to other banks. This contagion effect can spread rapidly and result in a cascading series of bank failures and widespread financial instability.

When a bank run occurs, banks may become reluctant to lend. A reduction in credit availability can stifle economic growth, hamper investment, and lead to job losses. A harsh recession is the likely outcome of a failing bank system.

In the face of a systemic bank run, the government may be forced to intervene to prevent a complete collapse of the financial system. They may need to provide emergency liquidity support to banks, guarantee deposits, or even bail out troubled financial institutions. These cash infusions can send inflation soaring again.

When it come to their recent profits, banks may be winning a battle but losing the war. These gains don’t reflect the dire straits they are currently in. Retirement fund holders should be aware of the danger. Moving into safe haven assets like precious metals can protect those funds from an unstable financial system. A Gold IRA can safeguard the value of your portfolio if the mass flight of depositors continues. Contact us today at 800-462-0071 to learn more.