Spin Can’t Deny Economic Reality

Hidden behind the Biden administration’s portrayal of economic success there lies a stark disparity between official narratives and the lived realities of countless Americans. While these cherry-picked figures paint a rosy picture, a closer examination reveals a grimmer economic landscape for many households. Rising inflation, mounting household debts, and uncertain market conditions challenge the upbeat portrayal.

The Biden administration points to the unemployment rate and GDP as proof the economy is doing well. Casey Mulligan is an Economics Professor at University of Chicago and a former economist in the Trump White House. He says Biden’s team is manipulating information to upsell “Bidenomics” and that the data doesn’t match the promise. He said, “When you’re coming out of a recession, you ought to be breaking some records, or getting near it. It should be very rapid growth coming out of a downturn.”1

Mulligan says to look at the drop in real wages to get a better picture of the economy. Real wages in economics refer to wages adjusted for inflation or changes in purchasing power. They represent the actual purchasing power of income earned by an individual or a group after accounting for changes in the general price level of goods and services.

Inflation is the main culprit in American’s economic misery. Inflation that was primarily caused by Biden’s massive infusion of cash into the country’s economy. The administrations’ boasting of decreasing inflation doesn’t change reality.

Their positive spin on inflation comes from looking at the rate of increase in prices from one year to the next. The Consumer Price Index indicates prices grew 3.2 percent from October 2022 to October 2023. That figure is notably beneath the rates of 7.7 percent recorded in October 2022, 9.1 percent in June 2022, and 6.2 percent in October 2021.2

It may look like prices are coming down and inflation is improving. But the way people perceive inflation hinges on the actual prices of goods and services rather than just the year-to-year increase. Right now, prices are still remarkably high because the effects of inflation are cumulative. That 3.2 percent increase is on top of the previous year’s 8 percent increase and the 6 percent leap from the year prior. It’s crucial to remember that for quite some time, the CPI stayed between zero and 2 to 2.5 percent annually.

Bloomberg published a comprehensive review showing how Americans are paying considerably more for groceries, gas, housing, electricity, auto loans, credit-card interest rates, and insurance than they did before the pandemic. Despite many Americans making more than they were in 2019, they don’t feel like they’re keeping up with daily living expenses.

It now requires $119.27 to buy the same goods and services a family could afford with $100 before the pandemic. Since early 2020, prices have risen about as much as they had in the full 10 years preceding the health emergency. Groceries are up 25 percent since January 2020. Same with electricity. Used-car prices have climbed 35 percent, auto insurance 33 percent and rents roughly 20 percent.3

Americans are sinking deeper into debt to cover the gap between living expenses and stagnant salaries, with credit card debt reaching record heights.

Household Losses

The effect of persistent inflation is compounded by other financial losses. US household wealth plummeted in the third quarter by the most in a year because of deep stock losses, according to a Federal Reserve report. Household net worth fell about $1.3 trillion, or 0.9%, in the three-month period from July to September to $151 trillion. The decline was largely due to a $1.7 trillion drop in the value of equity holdings. All three indexes tumbled in mid-2023 amid fears that the Federal Reserve would raise interest rates higher than previously expected – and hold them at peak levels for longer.4

2024 Outlook

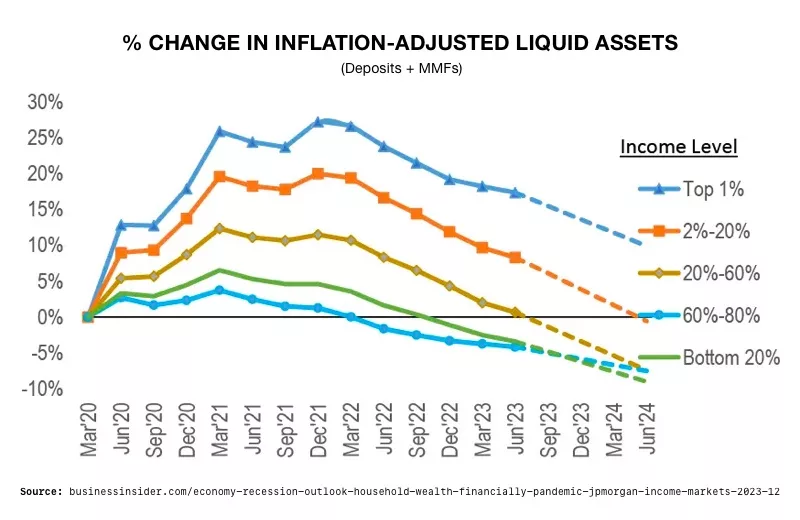

By mid-2024, nearly 99% of Americans are expected to be worse off financially compared to pre-pandemic levels, according to JP Morgan. Their analysis shows 80% of consumers, a group that accounts for nearly two-thirds of consumption, has already depleted any savings cushion they may have built during lockdowns.

“It is likely that only the top 1% of consumers by income will be better off than before the pandemic,” JP Morgan’s top stock strategist said. He pointed to the growing signs of credit card and auto loan delinquencies, as well as Chapter 11 filings, for evidence. 5

6

6

Conclusion

As the Biden administration cherry picks data to paint a bright economic picture, the underlying fiscal reality for most Americans remains dark. Current conditions, if unchecked, threaten to perpetuate widespread hardship. All of which can potentially trigger market downturns, economic recessions, and significant setbacks for retirement funds. Amidst this uncertainty, safeguarding the value of your portfolio becomes paramount. Consider securing your assets with a Gold IRA from American Hartford Gold and provide a potential hedge against the turbulence. Contact us today at 800-462-0071 to learn more.