- The Federal Reserve raised interest rates by another 0.75 percentage points to fight inflation

- The Fed has not ruled out higher rate hikes at future meetings, increasing uncertainty in the market

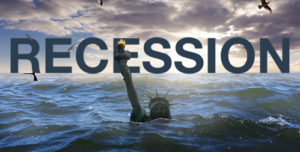

- The record pace of rate hikes is taking the US closer to recession and exploding national debt

The Fed Raises Rates – Again

When it comes to interest rates, it seems like the sky is the limit. The Federal Reserve raised interest rates by another 0.75 percentage points on July 27th. This is the fourth increase of the year, making it the fastest pace of tightening since 1981. The Fed had kept the rate pinned close to zero to ease the shock of the pandemic. The levels now match the peak of 2016-2018 tightening cycle.1

The Fed is quickly raising rates to get inflation under control. Households are feeling the strain of costlier rent, groceries, and gas. The Fed has seen few reassurances that its souped-up rate hikes are working. Inflation in June notched a new peak, climbing to 9.1 percent compared with the year before.2

But wait, there’s more. A New York Federal Reserve survey suggests that price hikes aren’t over yet. The group predicts that prices will have risen approximately 6.8% from their current levels by June 2023.3

The Fed Plays Catch Up

The Federal Reserve waited too long to respond to early signs of inflation. Former Fed Chair Ben Bernanke said, “The forward guidance, overall, slowed the response to the Fed to the inflation problem.” Treasury Secretary Janet Yellen also acknowledged the misdiagnosis coming from her own department, and that of current Fed Chair Jerome Powell. “Both of us could have probably used a better word than ‘transitory,’” she said.4

Future of Interest Rates

The Fed is committing to bring inflation down to its target of 2%. It said that failing to get inflation under control and allowing it to become “entrenched” is worse than moving too aggressively.

The central bank is prepared to raise interest rates well into the second half of 2022. Economists are split on whether the Fed will raise rates by another 0.75 percentage points in September or downshift to a half-point increase. Economists think the benchmark rate must go from the current 2.5% to 5% to hit the Fed’s inflation goals.

“While another unusually large increase could be appropriate at our next meeting,” that will depend on the data between now and then, Powell said. Powell will likely avoid sending strong signals. He wants to keep the Fed’s options open for a half- or three-quarters point move in six weeks. Powell said they will make decisions on a “meeting by meeting” basis. This is leaving the markets guessing.5

Those guesses are taking different sides. Barclays predicted annual inflation will fall to 5.7% by December. Down from its current highs but still well above the Fed’s 2% target. Goldman Sachs and Barclays both expect the central bank to approve a half-point rate increase in September. They then believe the Fed will move back to more traditional quarter-point moves in November and December. Bloomberg Economics disagrees. They think there’s little chance that the Fed will slow down its rate hikes later this year.6

Effects of Interest Rate Hikes

Markets have switched to seeming to fear recession more than persistent inflation. Evidence of a slowing economy is already emerging. Initial jobless claims recently hit an eight-month high. Housing sales have slumped amid higher mortgage rates. Retail sales did increase last month. But they declined after adjusting for inflation.

Fed officials still maintain that a recession can be avoided. Powell said that he did not believe the economy was in recession. He cited a “very strong labor market” as evidence. He acknowledges that the path to avoiding a recession has narrowed. A Bloomberg survey of economists put the probability of a downturn over the next 12 months at 47.5%.7

Personal debt increases as interest rates rise. But so does government debt. Higher interest rates will drive US debt payments to record levels according to the Congressional Budget Office. The CBO found that the cost to the federal government to make just the interest payments on money already borrowed will rise to a record 3.3 percent of the nation’s gross domestic product by 2032. Under the CBO’s projections, paying off the nation’s debt will become the most expensive federal program. More costly than even Social Security or Medicare.8

The Federal Reserve is dead set on bringing runaway inflation under control. They are prepared to raise rates as high and as fast as they must. The Fed experiences the dangers of recession, depleted retirement funds and unpayable debt as numbers on a chart. But it will be individual Americans who live with the real consequences of their policy. Fortunately, there is a way to protect your retirement funds from the hazards of skyrocketing interest rates. A Gold IRA from American Hartford Gold is a safe haven for your assets. Contact us today to learn more.