Economic Indicators Point to Recession

America’s long predicted recession may finally be arriving. Citi chief US economist, Andrew Hollenhorst, predicts the US economy is heading for a hard landing. He expects the country to be in recession by the middle of the year. The recession, and resulting interest rate cuts, will be beneficial to gold.

Hollenhorst feels the Fed won’t wait for inflation and labor market to both weaken before cutting rates. Instead, the recession will motivate the Fed to break its higher-for-longer policy and lower interest rates. Hollenhorst predicts a surprising 4 rate cuts this year.

“The reason I think the Fed’s going to see enough to cut is because we’re more toward the hard landing end of the spectrum,” he said. “We’re in the higher-for-longer stage of the policy cycle,” he explained, noting that stubborn inflation has prevented rates from coming down. “The next stage of the policy cycle is a weakening of the labor market. Once it starts gradually weakening, it then weakens more sharply. I think that’s exactly what’s playing out now.”1

State of the Economy

The economy is exhibiting signs of a slowdown. GDP is predicted to drop to 2% in the second half of the year as the economy continues to cool. The Labor Department showed 175,000 jobs were added in May. That is lower than the 233,000 predicted. It is down from 315,000 in March. Surveys show jobs are harder to find, there is less hiring, and that employees feel less secure about their jobs. 2

3

3

Based on recent sales reports, consumers are starting to cut back on spending. Consumer sentiment is dropping as inflation stays high. Prices have stayed high even as the forces pushing them up have receded. Inflation peaked at 9% and is now holding firm around 3.5%. Spending had been staying on pace despite soaring prices. To make up the difference, credit card debt is hitting dangerous levels. However, that debt is coming due, which may bring consumer spending to a sharp halt and further stall the economy. 4

The Institute for Supply Management (ISM) showed service sector activity dipped for the first time in 15 months. “The composition of the report was weak, as the employment, new orders, and business activity components all declined,” Goldman Sachs economists said in a note. The ISM business activity component also plunged in April. 5

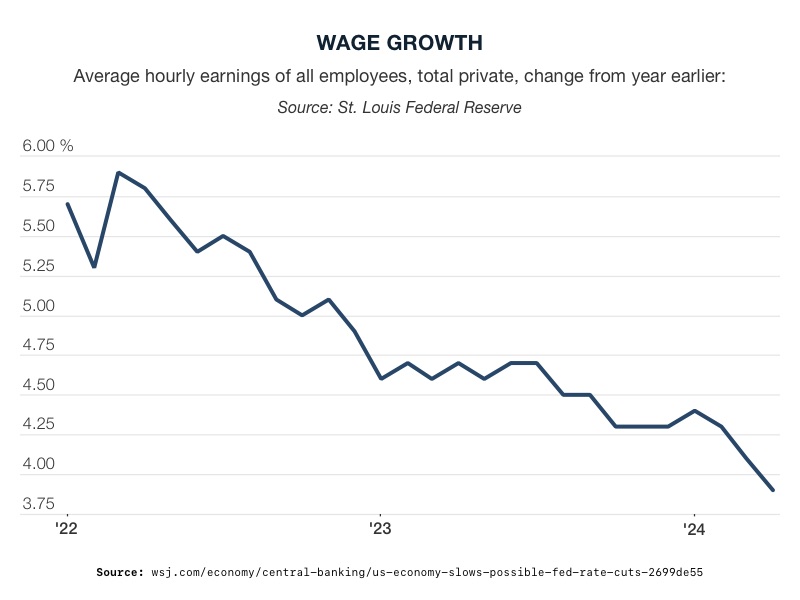

The unemployment rate ticked up to 3.9% from 3.8%. Wage growth is also slowing down. Average hourly earnings aren’t rising as quickly as they did last year. Economists think this may reduce price pressure and help budge stubborn inflation.

But inflation is proving to be sticky even as the economy contracts and the Treasury shrinks the money supply. This may largely be due to housing prices continuing to increase. Shelter represents one-third of the entire CPI index.

Good Conditions for Gold

Investors are gaining optimism for rate cuts again. As a result, stocks and bonds rose. The estimated chances of a rate cut in September increased. There is even a case being made for a cut in July, though the chances of that are slim.

The prospect of a hard landing and the resulting interest rate cuts bode well for gold. Already on a record-breaking streak, the price of gold would likely increase in these conditions.

During recessions, gold serves as a safe haven asset. Recessions are marked by economic uncertainty and market volatility. Gold’s stability and inherent value provide a safer store of value compared to stocks or cash. Additionally, gold acts as a hedge against the inflationary pressures that often accompany recessions.

Gold also increases in value when interest rates are cut. It becomes more valuable because it costs less to hold onto as safe haven demand increases. Lower interest rates also make money worth less. Owning gold is a method to protect savings from losing value. Because of the traditional inverse relationship between gold and interest rates, gold demand increases as some investors count on the price going up.

Conclusion

Economists are pointing to several major indicators that the economy is about to experience a hard landing. Rising unemployment and contracting growth are signaling that the US is entering a recession. To stem the impact of recession, the Fed may be forced to cut interest rates. That would bring an end to the ‘higher for longer’ policy brought on by stubborn inflation. Recession and interest rate cuts would pour more fuel into gold’s explosive price increase. Now is an opportune time to learn how a Gold IRA can protect and potentially grow the value of your retirement funds. Call American Hartford Gold at 800-462-0071 to learn more.

Notes:

1. https://finance.yahoo.com/news/u-economy-headed-hard-landing-222148023.html

2. https://finance.yahoo.com/news/u-economy-headed-hard-landing-222148023.html

3. https://www.wsj.com/economy/central-banking/us-economy-slows-possible-fed-rate-cuts-2699de55

4. https://charlestonbusiness.com/reports-show-early-signs-of-an-economic-slowdown/

5. https://charlestonbusiness.com/reports-show-early-signs-of-an-economic-slowdown/