Rise of the BRICS+

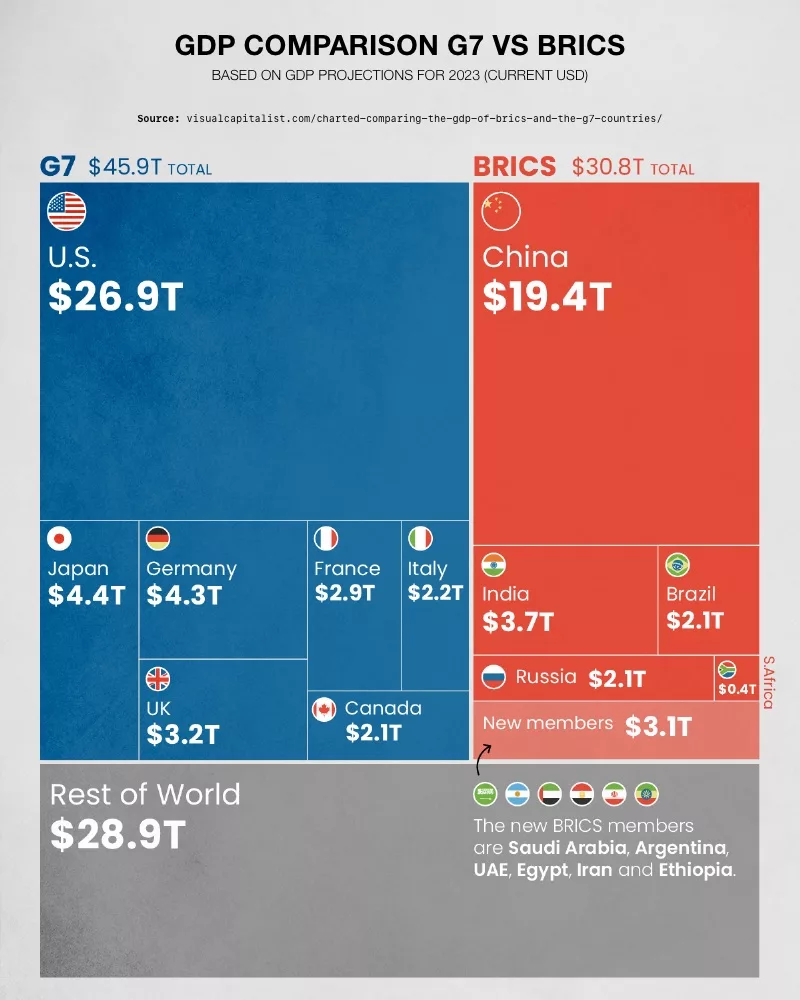

The concept of the BRICS began humbly in 2001. Economists at Goldman Sachs coined the term to draw attention to the strong economic growth rates in Brazil, Russia, India and China. They wanted to create an optimistic scenario for investors amid market pessimism following the September 11th terrorist attacks. Since then, those four nations have transformed the concept into a force that threatens to upend the global economic order.

After the BRICS summit in August, six new countries joined the group. Argentina, Saudi Arabia, the UAE, Egypt, Iran, and Ethiopia will enter the alliance in January 2024. Despite their differences, they have one thing in common: an end to dollar dominance.

Understanding the BRICS

The BRICS have been on an upward trajectory since their formation. They developed the New Development Bank as a counter to the World Bank, which they considered an oppressive financial tool. The bank has so far approved almost $33 billion of loans for development projects. Trade between the bloc’s five existing members surged 56% to $422 billion between 2017 and 2022. Economically, the natural resources and farm products of Brazil and Russia make them natural partners for Chinese demand.1

2

2

New Members, More Power

The power of BRICS+ comes not only from the number of new countries – but where they are located and what they export. The addition of Egypt, Ethiopia, and Saudi Arabia could give BRICS influence over 12% of all global trade. That’s because those three countries surround the Suez Canal, a key passage for goods to flow into international markets. Together, they can weaponize the Suez to control global trade.3

The new membership of BRICS+ also represents a range of commodities that enhance their power. With the addition of Saudi Arabia, the UAE, and Iran, BRICS more than doubles its members’ share of global oil production to 43%. Along with petroleum, Argentina’s addition to BRICS significantly expands the total lithium reserves of the group, which will be key as global battery production and EV adoption continue to grow. Meanwhile, countries such as Brazil, China, and Russia are significant producers of precious and rare earth metals.4

The decision of Saudi Arabia to join the BRICS alliance holds particular concern. Financially, Saudi Arabia owns over $100 billion in US Treasury bonds. The BRICS total holdings in US Treasuries are over $1 trillion. But the real challenge come from the oil trade. 5

Saudi’s admission plays into the BRICS’ dedollarization plan by controlling the oil sector. Saudi Arabia is the world’s largest oil exporter and plays a crucial role in the global oil market. Red flags went up when Saudi Arabia’s Finance minister said the kingdom is considering dropping the US dollar for international oil trade.

Dollar dominance relies on the petrodollar system. That system requires oil-producing countries to price and sell their oil in US dollars. When countries need to purchase oil, they must hold significant dollar reserves, increasing global demand for the US currency. If oil were paid for in another currency, such as the euro or yuan, it would reduce the global demand for dollars. This shift could weaken the dollar’s status as the world’s primary reserve currency. That could lead to a decrease in its value. It would make it more expensive for the US to borrow money from other nations. It would also reduce America’s ability to finance its trade deficits and government spending. Hyperinflation and defaulting on the national debt become real possibilities.

Dollar Danger

Former White House economist Joe Sullivan said the dollar is facing a growing challenge from the BRICS countries. He pointed to mounting fears that a new BRICS currency could lead to the dollar’s downfall. The dollar could find itself going the way of the British pound last century.

“The BRICS+ nations do not need to wait until a shared trade currency meets the technical conditions typical of global reserve currency before they swing their newly enlarged economic wrecking ball at the dollar,” he added.6

If the BRICS decide to use local currencies for trade instead of the dollar, the dollar’s role in the world economy would go down. A variety of currencies could rise to fill that gap. And when a country’s currency loses its influence, the country’s economic and political power also declines.

New Currency

BRICS are working on launching their own currency to replace the US Dollar. Sergy Glazyev is a former Russian minister. He said the BRICS currency is almost ready to launch. They just need the support from China and India.

Glazyev said, “It is based not only on a basket of national currencies of the member countries, but also on a basket of exchange commodities. The model shows that this currency will be very stable and much more attractive than the dollar, pound and euro.” Gold is purportedly one of the primary commodities on which the new currency will be based.7

Conclusion

The process of dedollarization is picking up speed as BRICS+ membership expands. The BRICS+ group is strategically positioning itself in the global economy, potentially giving them more influence than their size might suggest. Their shift away from the dollar could lead to severe negative consequences for the US economy. At the same time, gold may gain prominence as it backs the emerging rival currency and serves as a safe-haven asset during the turbulent times of global economic restructuring. Discover how a Gold IRA can safeguard your savings in this changing landscape. Reach out to us today at 800-462-0071 for more information.