Central Bank Purchasing Drives Record Gold Prices

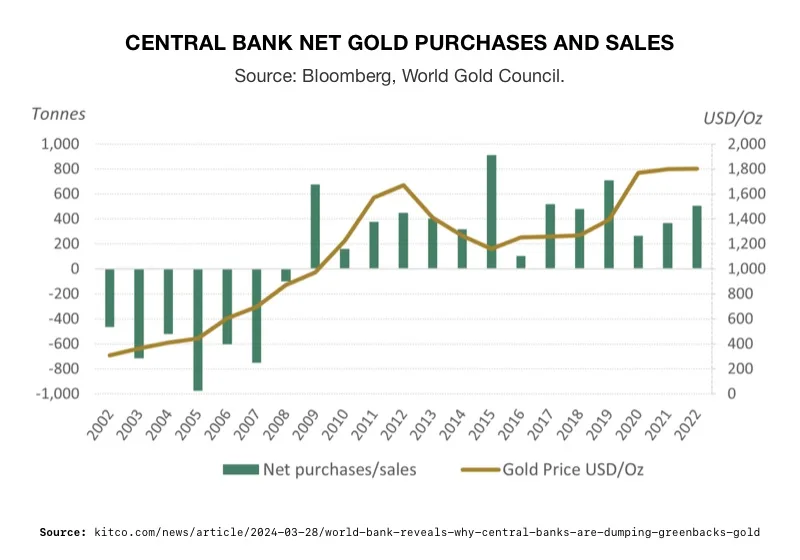

A “hedge against fear” is what the Wall Street Journal is calling gold. With gold hitting new highs, settling in above the $2200 level, there seems to be a lot to fear in this world. The desire for security extends to central banks. Their demand for gold is a primary reason for the surge in prices. A recent World Bank publication, the Gold Investing Handbook, highlighted the growing trend of central banks increasing their gold holdings and reducing their holdings of US Treasuries. Now may be the time for individuals to follow the central bank’s example.

The handbook cites the chain of events that has led to today’s record level of gold buying by central banks. It reaches back to the 2008 Global Financial Crisis and Brexit thru to the Covid pandemic and the Russian invasion of Ukraine. These events reinforced the strategic importance of gold as a buffer against financial instability.

Banks looking to diversify away from the dollar find themselves with few viable options. Moving into other currencies like the yen or Chinese debt brings a whole new set of risks. Gold becomes the only option to decrease their share of foreign government debt in reserves.

As of 2022, the world’s central banks started to rapidly increase the proportion of their gold reserves. Central bank gold purchases in 2022 and 2023 have increased by roughly 80% compared to pre-covid levels. China’s gold purchases are rising alongside its tensions with the US. To quote the handbook, “Central banks in 2022 were also more optimistic on gold as a reserve asset, with 61 percent of respondents stating that they expect global gold reserves to increase over the next 12 months…and they have been the net buyers since then, despite ever-increasing gold prices.”1

2

2

The spark of interest in gold coincided with the freezing of Russia’s assets after invading Ukraine. World Bank research has established a positive relationship between gold prices and geopolitical risk. And that reserve managers actively increase their gold holdings during times of uncertainty. Meanwhile, those in emerging markets also increase their gold purchases when the risk of financial sanctions exists.

Indeed, the central banks that most fear Western sanctions are the main drivers of sovereign gold purchases. The Handbook stated, “This is because gold is a physical asset that can be stored domestically, unlike foreign exchange reserves, which can be frozen by sanctions. In half of the ten highest annual increases in gold stockpiles since 1999, the affected country was sanctioned during the previous year or two.”3

The author of the World Bank publication suggested continued central bank gold buying could shift the world economy. As more countries buy gold, the price of gold will increase. Gold as a reserve asset would become more expensive. This may end with a new paradigm – a return to the gold standard. Sanctions could cause central banks to abandon their dollar reserves in favor of gold. The impact of which would be devastating to the value of the US dollar along with everything denominated in dollars, like stocks, bonds, and the funds that hold them.

New Gold Standard

The idea of a return to the gold standard is being explored here in the United States. A new study by the Federal Reserve Bank of Philadelphia found that a gold standard ensures long-term price stability.

Gold standard supporters point to the fact that the dollar’s value has plummeted to less than 2,000th of an ounce of gold. This decline in worth is occurring as inflation is resisting the Federal Reserve’s aggressive interest rates. According to the study, inflation and deflation are “temporary phenomena” under gold. Record breaking inflation wouldn’t have accrued under that system. Economists point to the height of the American gold standard between 1879 and 1913. During that time, inflation was held down .1 percent a year. 4

These ideas are finding support at the state level. Utah just empowered their state treasurer to protect state funds with an allocation to physical gold and silver. The Treasurer can hold up to 10% of certain reserves in physical gold to protect against inflation, stock volatility, and economic instability. Texas and Ohio have already acquired gold. Meanwhile, Missouri, Tennessee, Idaho, and West Virginia have similar legislation under consideration. And Wisconsin just became the 44th state to end sales tax on the purchase of gold and silver – paving the way for a return of gold as currency. 5

Conclusion

The price of gold is rising with the level of uncertainty in the world. To protect the value of their reserves, central banks are shifting from dollars to gold. The movement away from fiat currency to a new gold standard isn’t only occurring on the central bank level. States are creating the conditions for gold to once again be used as currency. The price of gold, already on a record-breaking rise, will gain even more support as a demand for a “hedge against fear” rises. Contact American Hartford Gold today to learn how you can safeguard your future with a Gold IRA. Call us at 800-462-0071 now.

Notes:

1. https://www.kitco.com/news/article/2024-03-28/world-bank-reveals-why-central-banks-are-dumping-greenbacks-gold

2. https://www.kitco.com/news/article/2024-03-28/world-bank-reveals-why-central-banks-are-dumping-greenbacks-gold

3. https://www.kitco.com/news/article/2024-03-28/world-bank-reveals-why-central-banks-are-dumping-greenbacks-gold

4. https://www.nysun.com/article/just-as-the-dollar-collapses-to-a-record-low-news-about-gold