Commercial Real Estate Crisis

Economists are warning that we are on the brink of a commercial real estate apocalypse. Office values have already tumbled 31% from a peak in March 2022 with no signs of stopping. Analysts fear the crash could spark an inescapable “urban doom loop.” The effects of which could spiral out and drag down the rest of the economy.1

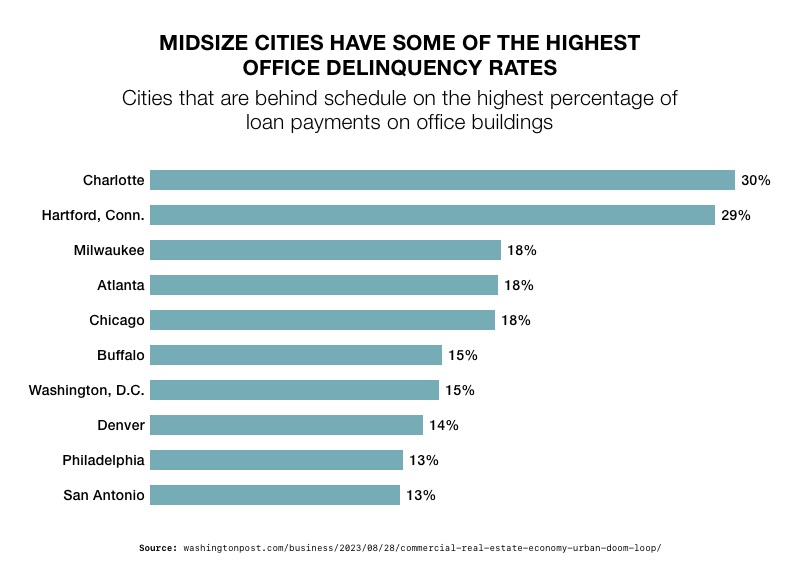

What brought us to this brink? The pandemic caused a boom in remote work. Office towers were left empty. Now downtowns are becoming ghost towns. Midsize cities are getting hit hardest since they have fewer ways to offset the lost revenue. Stijn Van Nieuwerburgh is a professor of real estate and finance at Columbia University’s Graduate School of Business. He said, “Once those offices are empty, there are few alternatives and not a lot of life after hours. It is a train wreck in slow motion.” 2

3

3

Nieuwerburgh helped coin the phrase “urban doom loop.” The doom loop goes as follows. No longer needing the space, companies pull out of leases. Vacancy rates go up. Landlords can’t rent or sell buildings without a major loss. Property owners then default on mortgages and regional banks eat the loss. Business districts empty, driving out retail. Cities lose tax revenue and conditions worsen. The cycle feeds on itself until the area become a shell of city.

The Federal Reserve highlighted commercial real estate as one of the key risks to the country’s financial stability. The average loan delinquency is about 5 percent. But that average factors in large cities like New York and San Francisco. For midsize cities like Charlotte, it is almost 30 percent.

Little time remains to find a solution, if there is one to be had. The doom loop is being delayed by cities still having stimulus from the 2021 American Rescue Plan. However, that time is shrinking. There is more than $5 trillion in commercial real estate debt in the economy. With $2.75 trillion in commercial mortgages slated to mature by 2027.

Office buildings are the biggest near-term problem. They owe more than half of the $626 billions of at-risk debt set to mature by the end of 2025. Apartment buildings are also a concern. They have $192 billion in debt that will need to be refinanced by 2025.4

The problem will become worse as properties come up for refinancing. Regional banks are in the most danger. They hold about 2/3 of total commercial real estate debt in the country. This debt was at the core of this year’s banking crisis. Economists grew terrified as the demise of two midsize firms suddenly jeopardized the economy.

Role of the Fed

Despite the danger to the economy, the Federal Reserve intends to keep raising rates. Since March last year, the Fed has lifted interest rates 11 times. They’ve moved its official rate from close to zero to a range of between 5.25 percent and 5.5 percent.

Fed Chairman Powell recently spoke in Jackson Hole. He said, “Although inflation has moved down from its peak – a welcome development – it remains too high…We are prepared to raise rates if appropriate and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective.”5

High interest rates are hammering the commercial property market. Borrowers have seen their cost of capital double or triple in just over a year. Owners are more motivated to stop payments than hold onto properties with diminishing returns. Blackstone Inc., Brookfield Corp. and Goldman Sachs Group Inc. are among investors that have defaulted or relinquished offices to lenders this year. The Newmark Group stated that landlords who try to hang on and weather the storm are likely to take a bigger hit than those who cut their losses more quickly.

WeWork Threat

The case of WeWork is a sign of the deep troubles ahead. WeWork is the largest office space tenant in several big US cities and was once valued at $47 billion. But it is struggling in the face of low occupancy and high rental costs. Its current market value has crashed to $415 million.6

Bankers fear a WeWork bankruptcy will make the commercial real estate crisis radically worse. Regional banks will be left holding the bag. Moody’s Investor Services has already downgraded 10 regional banks and put 6 more on notice. They said the banks are vulnerable to nervous investors, risks from high interest rates, and a weakening commercial real estate market. There is growing consensus that more bank failures are inevitable.

Commercial real estate is posing a clear financial danger. Economists fear its demise could endanger the rest of the economy. With massive debt coming due in only a couple of years, and no solutions in sight, now is the time to safeguard your portfolio. Moving into safe haven assets like precious metals can protect your retirement funds. Learn how the Gold IRA from American Hartford Gold can protect your financial future. Contact us today at 800-462-0071.