Rising Geopolitical Risk Threatens Global Economy

Flaring geopolitical conflicts hold potential ruin for the global economy. Four years after the outbreak of the pandemic, the international economy remains fragile and uncertain. The pandemic exposed structural weakness of the interconnected economy. These weaknesses come closer to breaking as the globe splinters further into more blocs and factions. A whole new world order is emerging that can topple the economic security millions have relied upon for decades.

In a survey from the Depository Trust & Clearing Corporation, geopolitical risk was cited by 81% of respondents as the top risk for 2024, increasing from 68% last year. This is the second year in a row that geopolitical Risk has been ranked as the top risk, as global tensions and conflicts continue to impact markets.1

Natixis Investment Managers said that after seeing how the early stages of the Russian invasion of Ukraine drove big price spikes for energy and food in 2022, institutional investors have a “good reason for concern” as the geopolitical landscape is looking “less stable going into 2024”. They found that 64% of institutional investors believe China’s political ambitions will split the global economy. Natixis thinks the growing split between the BRICS+ Alliance and the West will lead to greater economic uncertainty. Over half of institutional investors surveyed believe a recession is inevitable in 2024. 2

Crisis Points

– Russia’s war with Ukraine is approaching its 3rd year. Experts think it will continue through 2024. The conflict has already disrupted supply chains, food, and energy prices. Analysts fear unforeseen consequences can emerge as support for Ukraine comes into question.

– The Israel-Hamas conflict may escalate into a regional war. It could expand into Lebanon as Israel responds to shelling from Hezbollah. In response, Iran would get more deeply involved to support Hezbollah.

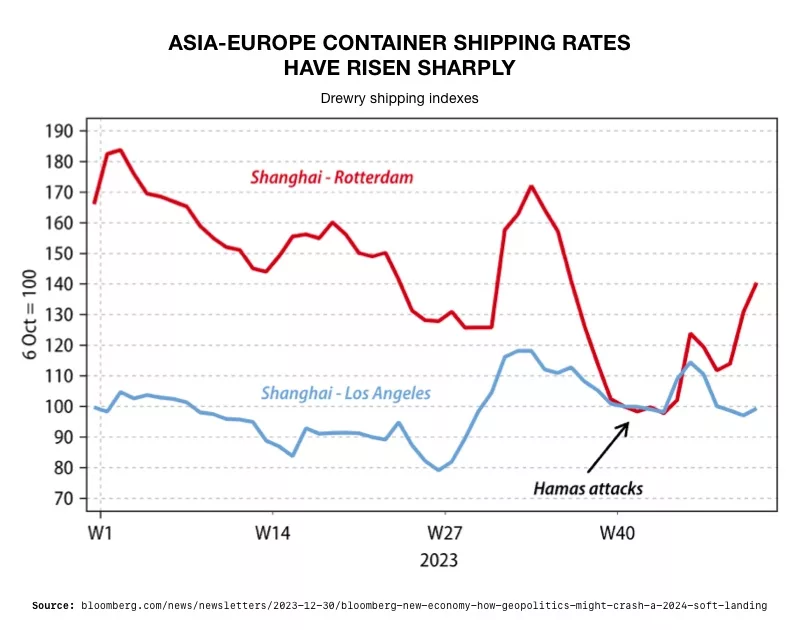

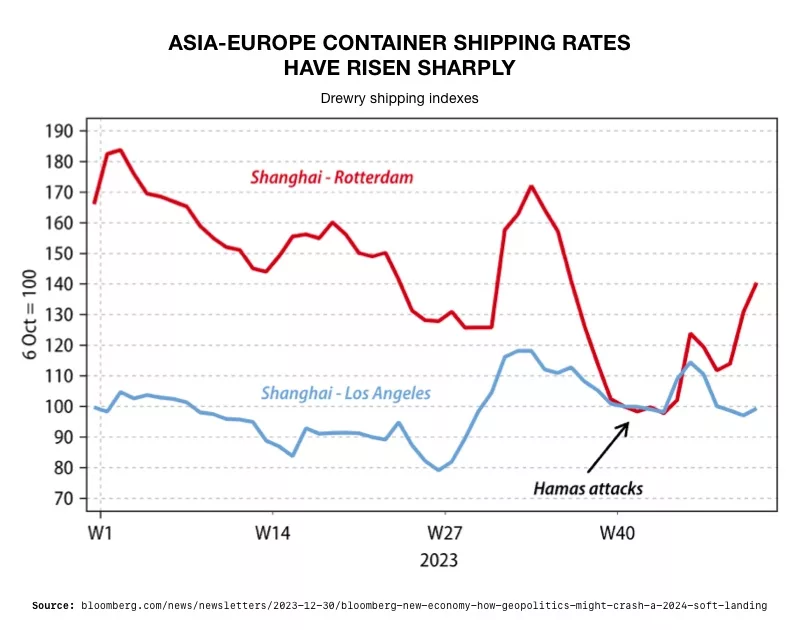

– The Yemen-based Houthi are attacking shipping in the Red Sea. The attacks have forced ships to go around Africa – driving up shipping costs, times, and insurance. The US Navy may be forced to attack the Houthis, heating up the conflict. The Pentagon is trying to reassure safety with a multinational force, but half of the container ship fleet traffic has already switched routes. Economists said, “The West will have to bear the cost of disruption to the 10% or so of world trade that passes through the Bab on its way to or from Suez.” The danger is “a large handful of sand in the wheels of global trade—which is bad news for growth and for many markets.”3

4

Global Elections

In 2024, there will be elections in 50 countries, with more than 2 billion people going to the polls. The countries include India, Indonesia, Mexico, South Africa, the United States and 27 member states of the European Parliament. In total, participants in the 2024 Electoral Olympiad account for 60 percent of global economic output. The results of these elections can radically alter the course of global events.

The rising tide of populism may result in strict controls on trade, foreign investment. Diane Coyle, a professor of public policy at the University of Cambridge, said such policies would tilt the global economy toward “a very different world from the one we’re used to.”5

Obviously, the US elections will affect the direction of the global economy. Some other elections stand out as flash points. India’s prime minister election can dictate the direction of the world’s fastest growing economy. Meanwhile, tensions between China and Taiwan are flaring as presidential elections are set to occur in Taiwan. Mainland China opposes Taiwan’s independence leaning parties. Provocative actions by either party could spiral dangerously out of control in a vital area of global trade.

Experts fear these events can feed off each other. As the success of one emboldens aggression in others. With the US bogged down, rival nations may see an opportunity for aggression.

Conclusion

As the world fragments more and more, the impact of conflicts on the global economy will become greater. Rickard McCaffrey is a geopolitical analyst at EY-Parthenon. He said, “Even if these conflicts are minor, they can still affect global supply chains in unexpected ways.” He continued, “Geopolitical power is dissipating,” and that contributes to instability.6

The World Economic Forum reached the same conclusions. “Sustained volatility in geopolitical relations between major economies remains a major concern for risk managers in the public and private sectors.” 7

The world is growing more unstable by the day. However, the stock market is surging, having priced in a soft landing. That soft landing is based on geopolitical conflict not throwing the global economy into turmoil. If unrest erupts, stocks are due for a major correction. People interested in protecting the value of their retirement funds from global instability should investigate the benefits of a Gold IRA from American Hartford Gold. Contact us today at 800-462-0071.

4

Global Elections

In 2024, there will be elections in 50 countries, with more than 2 billion people going to the polls. The countries include India, Indonesia, Mexico, South Africa, the United States and 27 member states of the European Parliament. In total, participants in the 2024 Electoral Olympiad account for 60 percent of global economic output. The results of these elections can radically alter the course of global events.

The rising tide of populism may result in strict controls on trade, foreign investment. Diane Coyle, a professor of public policy at the University of Cambridge, said such policies would tilt the global economy toward “a very different world from the one we’re used to.”5

Obviously, the US elections will affect the direction of the global economy. Some other elections stand out as flash points. India’s prime minister election can dictate the direction of the world’s fastest growing economy. Meanwhile, tensions between China and Taiwan are flaring as presidential elections are set to occur in Taiwan. Mainland China opposes Taiwan’s independence leaning parties. Provocative actions by either party could spiral dangerously out of control in a vital area of global trade.

Experts fear these events can feed off each other. As the success of one emboldens aggression in others. With the US bogged down, rival nations may see an opportunity for aggression.

Conclusion

As the world fragments more and more, the impact of conflicts on the global economy will become greater. Rickard McCaffrey is a geopolitical analyst at EY-Parthenon. He said, “Even if these conflicts are minor, they can still affect global supply chains in unexpected ways.” He continued, “Geopolitical power is dissipating,” and that contributes to instability.6

The World Economic Forum reached the same conclusions. “Sustained volatility in geopolitical relations between major economies remains a major concern for risk managers in the public and private sectors.” 7

The world is growing more unstable by the day. However, the stock market is surging, having priced in a soft landing. That soft landing is based on geopolitical conflict not throwing the global economy into turmoil. If unrest erupts, stocks are due for a major correction. People interested in protecting the value of their retirement funds from global instability should investigate the benefits of a Gold IRA from American Hartford Gold. Contact us today at 800-462-0071.

4

Global Elections

In 2024, there will be elections in 50 countries, with more than 2 billion people going to the polls. The countries include India, Indonesia, Mexico, South Africa, the United States and 27 member states of the European Parliament. In total, participants in the 2024 Electoral Olympiad account for 60 percent of global economic output. The results of these elections can radically alter the course of global events.

The rising tide of populism may result in strict controls on trade, foreign investment. Diane Coyle, a professor of public policy at the University of Cambridge, said such policies would tilt the global economy toward “a very different world from the one we’re used to.”5

Obviously, the US elections will affect the direction of the global economy. Some other elections stand out as flash points. India’s prime minister election can dictate the direction of the world’s fastest growing economy. Meanwhile, tensions between China and Taiwan are flaring as presidential elections are set to occur in Taiwan. Mainland China opposes Taiwan’s independence leaning parties. Provocative actions by either party could spiral dangerously out of control in a vital area of global trade.

Experts fear these events can feed off each other. As the success of one emboldens aggression in others. With the US bogged down, rival nations may see an opportunity for aggression.

Conclusion

As the world fragments more and more, the impact of conflicts on the global economy will become greater. Rickard McCaffrey is a geopolitical analyst at EY-Parthenon. He said, “Even if these conflicts are minor, they can still affect global supply chains in unexpected ways.” He continued, “Geopolitical power is dissipating,” and that contributes to instability.6

The World Economic Forum reached the same conclusions. “Sustained volatility in geopolitical relations between major economies remains a major concern for risk managers in the public and private sectors.” 7

The world is growing more unstable by the day. However, the stock market is surging, having priced in a soft landing. That soft landing is based on geopolitical conflict not throwing the global economy into turmoil. If unrest erupts, stocks are due for a major correction. People interested in protecting the value of their retirement funds from global instability should investigate the benefits of a Gold IRA from American Hartford Gold. Contact us today at 800-462-0071.

4

Global Elections

In 2024, there will be elections in 50 countries, with more than 2 billion people going to the polls. The countries include India, Indonesia, Mexico, South Africa, the United States and 27 member states of the European Parliament. In total, participants in the 2024 Electoral Olympiad account for 60 percent of global economic output. The results of these elections can radically alter the course of global events.

The rising tide of populism may result in strict controls on trade, foreign investment. Diane Coyle, a professor of public policy at the University of Cambridge, said such policies would tilt the global economy toward “a very different world from the one we’re used to.”5

Obviously, the US elections will affect the direction of the global economy. Some other elections stand out as flash points. India’s prime minister election can dictate the direction of the world’s fastest growing economy. Meanwhile, tensions between China and Taiwan are flaring as presidential elections are set to occur in Taiwan. Mainland China opposes Taiwan’s independence leaning parties. Provocative actions by either party could spiral dangerously out of control in a vital area of global trade.

Experts fear these events can feed off each other. As the success of one emboldens aggression in others. With the US bogged down, rival nations may see an opportunity for aggression.

Conclusion

As the world fragments more and more, the impact of conflicts on the global economy will become greater. Rickard McCaffrey is a geopolitical analyst at EY-Parthenon. He said, “Even if these conflicts are minor, they can still affect global supply chains in unexpected ways.” He continued, “Geopolitical power is dissipating,” and that contributes to instability.6

The World Economic Forum reached the same conclusions. “Sustained volatility in geopolitical relations between major economies remains a major concern for risk managers in the public and private sectors.” 7

The world is growing more unstable by the day. However, the stock market is surging, having priced in a soft landing. That soft landing is based on geopolitical conflict not throwing the global economy into turmoil. If unrest erupts, stocks are due for a major correction. People interested in protecting the value of their retirement funds from global instability should investigate the benefits of a Gold IRA from American Hartford Gold. Contact us today at 800-462-0071.