- Almost $1 trillion in corporate debt defaults are predicted by Bank of America

- The bankruptcies are driven by record interest rates and a shrinking economy

- The surge in defaults can bring down stock prices and devalue retirement portfolios

Surging Debt Defaults

The growing threat of corporate debt defaults poses a significant risk to retirement funds. Experts are bracing for a tsunami of defaults as credit conditions tighten and companies struggle to manage heavy debt loads. The impact of rising interest rates and credit downgrades is already being felt. The number of troubled companies facing bankruptcy is swelling. The economic consequences could surpass those of previous financial crises. Fortunately, there are actions that can defend the value of retirement funds.

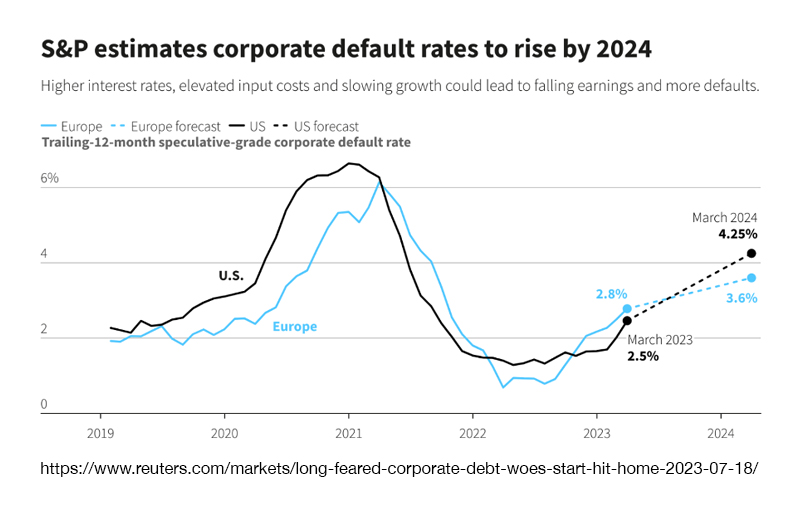

The credit crunch and impending recession could result in $1 trillion of corporate debt defaults according to Bank of America. They say a 15% corporate default rate is a distinct risk. B of A calculates that even an 8% default rate could translate into $920 billion of losses.1

US corporate debt defaults in 2023 have already surpassed last year’s totals. Fifty-five American firms have defaulted on their debt so far. That’s a 53% increase from all of 2022. Moody’s Investors Service says global debt defaults could keep surging as financial conditions continue to tighten. The global default rate could reach 13.7%, surpassing the 2008 financial crisis. And Deutsche Bank see defaults hitting 11.3%. That is only slightly lower than the all-time-high seen during the Great Recession.2

3

3

“It’s safe to bet there will be more defaults,” says Mark Hootnick. He is the co-head of capital transformation and debt advisory at Solomon Partners. Until now, “we’ve been in an environment of incredibly lax credit, where, frankly, companies that shouldn’t be tapping the debt markets have been able to do so without limitations.”4

At the moment, troubled companies are being affected. Regional financial institution Silicon Valley Bank, retail chain Bed Bath & Beyond and regional sports network owner Diamond Sports are among the largest bankruptcy filings so far this year, according to S&P Global Market Intelligence. But experts expect even stable companies to run into trouble when it comes time to refinance due to high interest rates.

Causes of Corporate Debt Default

The debt defaults are caused by several factors. Companies are facing uncertain economic conditions and heavy debt loads. Refinancing that debt is becoming more challenging. High interest rates are making new debt very expensive. In addition, banks are tightening credit conditions since the collapse of Silicon Valley Bank. Companies are also facing downgrades to junk credit ratings, resulting in higher borrowing costs.

“Capital is much more expensive now,” said Mohsin Meghji, founding partner of restructuring and advisory firm M3 Partners. “Look at the cost of debt. You could reasonably get debt financing for 4% to 6% at any point on average over the last 15 years. Now that cost of debt has gone up to 9% to 13%.”5

Corporations shouldn’t expect debt relief anytime soon. The Federal Reserve indicated at least two more rate hikes this year. They aim to keep raising rates until their 2% inflation target is hit.

NY Fed US Recession Probability Index predicting 68% of recession by April 2024.6 Recession risk is fueled by continued rate hikes. The recent banking crisis also increased recession risks. Banks are taking losses on their dropping bond portfolios and steep deposit flight. Bank of America analysts say when the recession arrives doesn’t matter. Even if it doesn’t start until 2024, the default cycle will only be delayed, not canceled.

3

3

Dangers of Default

Rising corporate debt defaults present a significant risk to the global economy. The impact of rising interest rates is yet to be fully felt. While some companies may be able to navigate through the challenges with debt restructuring, not all will survive.

Corporate debt defaults most often lead to an increased desire to sell shares and a consequential drop in stock prices. The desire to sell is fueled by several reasons. Shareholders lose confidence in the stock as they perceive financial distress or mismanagement. And the indication of higher risk has investors demanding higher returns for holding the stock. This can lead to a decrease in the stock’s price to adjust for the increased risk. Additionally, credit rating downgrades and liquidity concerns add more selling pressure. These negative effects extend beyond the defaulting company. Overall market sentiment may also be impacted, causing broader declines in other companies’ stock prices.

Thus, it can be seen, corporate debt defaults can drive down stock prices. Retirement funds that are composed of securities are vulnerable to significant losses. To protect the value of such funds, their owners can diversify their holdings with safe haven assets. Precious metals such as gold can hold their value as bankruptcies pull down the stock market. A Gold IRA from American Hartford Gold is structured to protect portfolio value in the face of a growing debt crisis. Contact us today at 800-462-0071 to learn more about how to safeguard your future.