Financial Data Indicates Weak Economy

According to the Bidenomics sales pitch, inflation is declining, and the economy is on the rise. But not everyone is buying it. Despite a steady stream of optimistic headlines, the American people are increasingly worried about inflation and the economy. A Wall Street Journal poll showed 63% of Americans say the economy is “not so good” or “poor,” with 58% saying the economy has gotten worse over the past 2 years. And when it comes to inflation, 74% say it is moving in the wrong direction. Some experts are saying the American people are right to be concerned.1

The high inflation cycle is 29-months long and counting. Peter Schiff is the Chief Economist at Euro Pacific Asset Management. He said the Fed is not making any progress on inflation based on the latest inflation data and jobs report. Instead, they point to a weakening economy.

2

The Labor Department’s Personal Consumption Expenditures (PCE) index shows consumer prices rose from last month. Prices also climbed on an annual, year-over-year basis. Core prices climbed month to month and year-over-year as well. Core prices strip out the more volatile measurements of food and energy.

“It shows that the Fed is not making any progress in its inflation fight because consumers keep spending and reducing their savings in spite of the rate hikes…The rate hikes are supposed to reduce spending and increase savings. That’s how they bring down inflation. But nothing has worked, and so inflation is going to get worse,” Schiff said.3

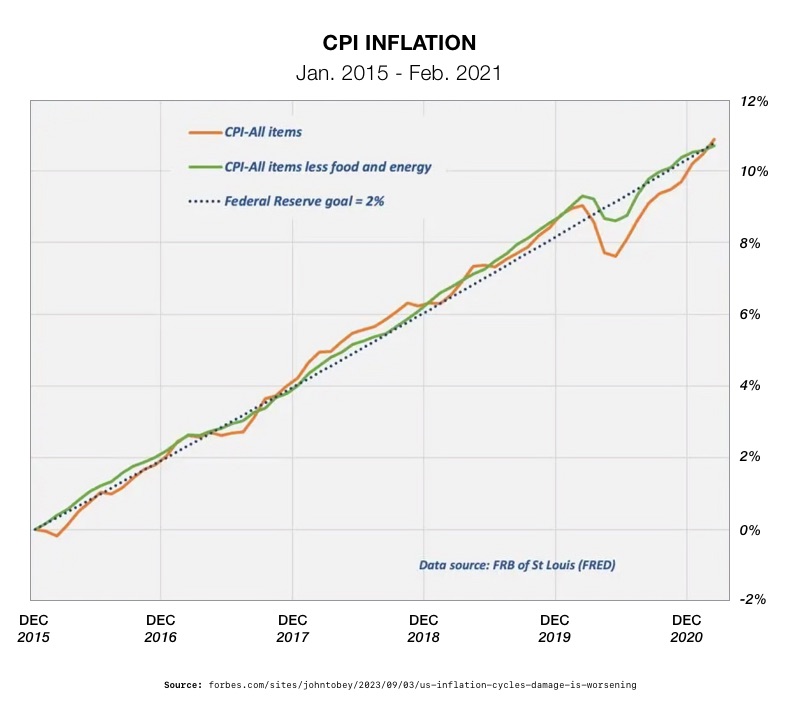

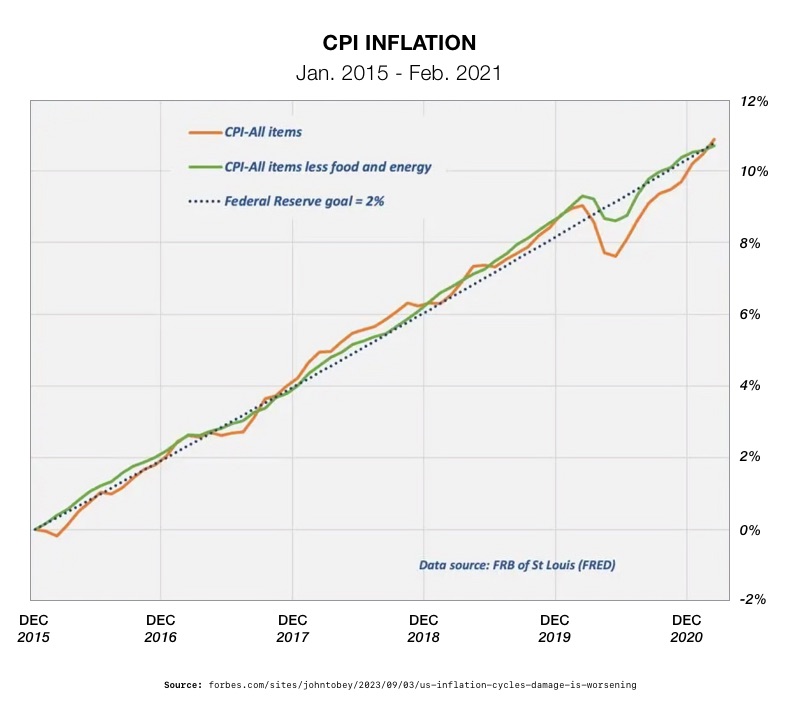

The flip side to inflation is the loss of purchasing power. From 2015 to 2021, the purchasing power of one dollar dropped to 90 cents. Therefore, to maintain the same financial position, assets needed to return 11%. A tough challenge even in good times.4

Unemployment

The recent unemployment report undermines the promise of Bidenomics. The unemployment rate climbed to its highest level since February 2022. That is the biggest increase since the early days of the COVID pandemic. Schiff considers rising unemployment as another sign of economic decline.

The data also undercuts the optimistic outlook on jobs. The latest Department of Labor report contained sharp downward revisions to job growth. Gains for June and July were revised down by a total of 110,000 jobs to a respective 105,000 and 157,000. This is the seventh consecutive downward revision to the prior month. “The Labor Department is biased in their assumptions, and they think the market is stronger than it is. And so they just assume more jobs were created,” Schiff continued.5

Consumer Spending Concerns

Consumer spending data is another source of worry. It jumped in June and July despite a small gain in incomes. At the same time, the savings rate plunged. Economists say this may be a sign of a weak economy. Consumers are raiding their savings during these difficult times. They may be facing a crisis as their savings run out and the economy still lags.

Federal Reserve Trap

The Fed may seize upon spiking unemployment and slower wage growth as reasons to pause rate hikes and invigorate the stock market. Schiff points out that to truly stop inflation, interest rates would need to go much higher. But such hikes would cripple the market and create a severe recession. The Fed’s balancing act can result in continued inflation along with a recession.

To tame inflation, beyond hiking interest rates, the Fed must undo the trillions of dollars they created with long-term bond purchases. However, the Fed can’t sell the bonds because they were bought at very low yields (much higher prices). The unrealized losses (not reported until the bonds are sold) are enormous. Our nation’s central bank is facing the same problem that has been collapsing regional banks.

Conclusion

The Fed and economists are drawing vastly different conclusions from the same data. Wall Street hopes the Fed’s data-based policy will lead to rate cuts and spur another bull market. But it can also mean the Fed is playing catchup with no long-term vision or plan. They have already revised previous data to fit their current agenda. Backward looking Fed policy could result in half-measures that end in stagflation. High interest rates, high unemployment, and high inflation could force radical solutions and decimate the value of portfolios across the board. Amidst indecision and uncertainty, it is good to have safe haven assets that retain their value no matter the chaos. Precious metals in a Gold IRA can protect the value of your retirement savings. Contact us today at 800-462-0071 to learn more.

2

The Labor Department’s Personal Consumption Expenditures (PCE) index shows consumer prices rose from last month. Prices also climbed on an annual, year-over-year basis. Core prices climbed month to month and year-over-year as well. Core prices strip out the more volatile measurements of food and energy.

“It shows that the Fed is not making any progress in its inflation fight because consumers keep spending and reducing their savings in spite of the rate hikes…The rate hikes are supposed to reduce spending and increase savings. That’s how they bring down inflation. But nothing has worked, and so inflation is going to get worse,” Schiff said.3

The flip side to inflation is the loss of purchasing power. From 2015 to 2021, the purchasing power of one dollar dropped to 90 cents. Therefore, to maintain the same financial position, assets needed to return 11%. A tough challenge even in good times.4

Unemployment

The recent unemployment report undermines the promise of Bidenomics. The unemployment rate climbed to its highest level since February 2022. That is the biggest increase since the early days of the COVID pandemic. Schiff considers rising unemployment as another sign of economic decline.

The data also undercuts the optimistic outlook on jobs. The latest Department of Labor report contained sharp downward revisions to job growth. Gains for June and July were revised down by a total of 110,000 jobs to a respective 105,000 and 157,000. This is the seventh consecutive downward revision to the prior month. “The Labor Department is biased in their assumptions, and they think the market is stronger than it is. And so they just assume more jobs were created,” Schiff continued.5

Consumer Spending Concerns

Consumer spending data is another source of worry. It jumped in June and July despite a small gain in incomes. At the same time, the savings rate plunged. Economists say this may be a sign of a weak economy. Consumers are raiding their savings during these difficult times. They may be facing a crisis as their savings run out and the economy still lags.

Federal Reserve Trap

The Fed may seize upon spiking unemployment and slower wage growth as reasons to pause rate hikes and invigorate the stock market. Schiff points out that to truly stop inflation, interest rates would need to go much higher. But such hikes would cripple the market and create a severe recession. The Fed’s balancing act can result in continued inflation along with a recession.

To tame inflation, beyond hiking interest rates, the Fed must undo the trillions of dollars they created with long-term bond purchases. However, the Fed can’t sell the bonds because they were bought at very low yields (much higher prices). The unrealized losses (not reported until the bonds are sold) are enormous. Our nation’s central bank is facing the same problem that has been collapsing regional banks.

Conclusion

The Fed and economists are drawing vastly different conclusions from the same data. Wall Street hopes the Fed’s data-based policy will lead to rate cuts and spur another bull market. But it can also mean the Fed is playing catchup with no long-term vision or plan. They have already revised previous data to fit their current agenda. Backward looking Fed policy could result in half-measures that end in stagflation. High interest rates, high unemployment, and high inflation could force radical solutions and decimate the value of portfolios across the board. Amidst indecision and uncertainty, it is good to have safe haven assets that retain their value no matter the chaos. Precious metals in a Gold IRA can protect the value of your retirement savings. Contact us today at 800-462-0071 to learn more.

2

The Labor Department’s Personal Consumption Expenditures (PCE) index shows consumer prices rose from last month. Prices also climbed on an annual, year-over-year basis. Core prices climbed month to month and year-over-year as well. Core prices strip out the more volatile measurements of food and energy.

“It shows that the Fed is not making any progress in its inflation fight because consumers keep spending and reducing their savings in spite of the rate hikes…The rate hikes are supposed to reduce spending and increase savings. That’s how they bring down inflation. But nothing has worked, and so inflation is going to get worse,” Schiff said.3

The flip side to inflation is the loss of purchasing power. From 2015 to 2021, the purchasing power of one dollar dropped to 90 cents. Therefore, to maintain the same financial position, assets needed to return 11%. A tough challenge even in good times.4

Unemployment

The recent unemployment report undermines the promise of Bidenomics. The unemployment rate climbed to its highest level since February 2022. That is the biggest increase since the early days of the COVID pandemic. Schiff considers rising unemployment as another sign of economic decline.

The data also undercuts the optimistic outlook on jobs. The latest Department of Labor report contained sharp downward revisions to job growth. Gains for June and July were revised down by a total of 110,000 jobs to a respective 105,000 and 157,000. This is the seventh consecutive downward revision to the prior month. “The Labor Department is biased in their assumptions, and they think the market is stronger than it is. And so they just assume more jobs were created,” Schiff continued.5

Consumer Spending Concerns

Consumer spending data is another source of worry. It jumped in June and July despite a small gain in incomes. At the same time, the savings rate plunged. Economists say this may be a sign of a weak economy. Consumers are raiding their savings during these difficult times. They may be facing a crisis as their savings run out and the economy still lags.

Federal Reserve Trap

The Fed may seize upon spiking unemployment and slower wage growth as reasons to pause rate hikes and invigorate the stock market. Schiff points out that to truly stop inflation, interest rates would need to go much higher. But such hikes would cripple the market and create a severe recession. The Fed’s balancing act can result in continued inflation along with a recession.

To tame inflation, beyond hiking interest rates, the Fed must undo the trillions of dollars they created with long-term bond purchases. However, the Fed can’t sell the bonds because they were bought at very low yields (much higher prices). The unrealized losses (not reported until the bonds are sold) are enormous. Our nation’s central bank is facing the same problem that has been collapsing regional banks.

Conclusion

The Fed and economists are drawing vastly different conclusions from the same data. Wall Street hopes the Fed’s data-based policy will lead to rate cuts and spur another bull market. But it can also mean the Fed is playing catchup with no long-term vision or plan. They have already revised previous data to fit their current agenda. Backward looking Fed policy could result in half-measures that end in stagflation. High interest rates, high unemployment, and high inflation could force radical solutions and decimate the value of portfolios across the board. Amidst indecision and uncertainty, it is good to have safe haven assets that retain their value no matter the chaos. Precious metals in a Gold IRA can protect the value of your retirement savings. Contact us today at 800-462-0071 to learn more.

2

The Labor Department’s Personal Consumption Expenditures (PCE) index shows consumer prices rose from last month. Prices also climbed on an annual, year-over-year basis. Core prices climbed month to month and year-over-year as well. Core prices strip out the more volatile measurements of food and energy.

“It shows that the Fed is not making any progress in its inflation fight because consumers keep spending and reducing their savings in spite of the rate hikes…The rate hikes are supposed to reduce spending and increase savings. That’s how they bring down inflation. But nothing has worked, and so inflation is going to get worse,” Schiff said.3

The flip side to inflation is the loss of purchasing power. From 2015 to 2021, the purchasing power of one dollar dropped to 90 cents. Therefore, to maintain the same financial position, assets needed to return 11%. A tough challenge even in good times.4

Unemployment

The recent unemployment report undermines the promise of Bidenomics. The unemployment rate climbed to its highest level since February 2022. That is the biggest increase since the early days of the COVID pandemic. Schiff considers rising unemployment as another sign of economic decline.

The data also undercuts the optimistic outlook on jobs. The latest Department of Labor report contained sharp downward revisions to job growth. Gains for June and July were revised down by a total of 110,000 jobs to a respective 105,000 and 157,000. This is the seventh consecutive downward revision to the prior month. “The Labor Department is biased in their assumptions, and they think the market is stronger than it is. And so they just assume more jobs were created,” Schiff continued.5

Consumer Spending Concerns

Consumer spending data is another source of worry. It jumped in June and July despite a small gain in incomes. At the same time, the savings rate plunged. Economists say this may be a sign of a weak economy. Consumers are raiding their savings during these difficult times. They may be facing a crisis as their savings run out and the economy still lags.

Federal Reserve Trap

The Fed may seize upon spiking unemployment and slower wage growth as reasons to pause rate hikes and invigorate the stock market. Schiff points out that to truly stop inflation, interest rates would need to go much higher. But such hikes would cripple the market and create a severe recession. The Fed’s balancing act can result in continued inflation along with a recession.

To tame inflation, beyond hiking interest rates, the Fed must undo the trillions of dollars they created with long-term bond purchases. However, the Fed can’t sell the bonds because they were bought at very low yields (much higher prices). The unrealized losses (not reported until the bonds are sold) are enormous. Our nation’s central bank is facing the same problem that has been collapsing regional banks.

Conclusion

The Fed and economists are drawing vastly different conclusions from the same data. Wall Street hopes the Fed’s data-based policy will lead to rate cuts and spur another bull market. But it can also mean the Fed is playing catchup with no long-term vision or plan. They have already revised previous data to fit their current agenda. Backward looking Fed policy could result in half-measures that end in stagflation. High interest rates, high unemployment, and high inflation could force radical solutions and decimate the value of portfolios across the board. Amidst indecision and uncertainty, it is good to have safe haven assets that retain their value no matter the chaos. Precious metals in a Gold IRA can protect the value of your retirement savings. Contact us today at 800-462-0071 to learn more.