Unemployment to Spike Amid Fears of a New Rise in Inflation

Economists see 2024 being dominated by a sharp rise in unemployment, and, if the Fed isn’t careful, a return to spiking inflation rates. While the stock market may cheer rapid rate cuts, a Federal Reserve pivot could bring about a return of 70s-style stagflation. Physical precious metals are presenting themselves as safe haven assets as the economy settles into a new equilibrium.

Unemployment to Surge

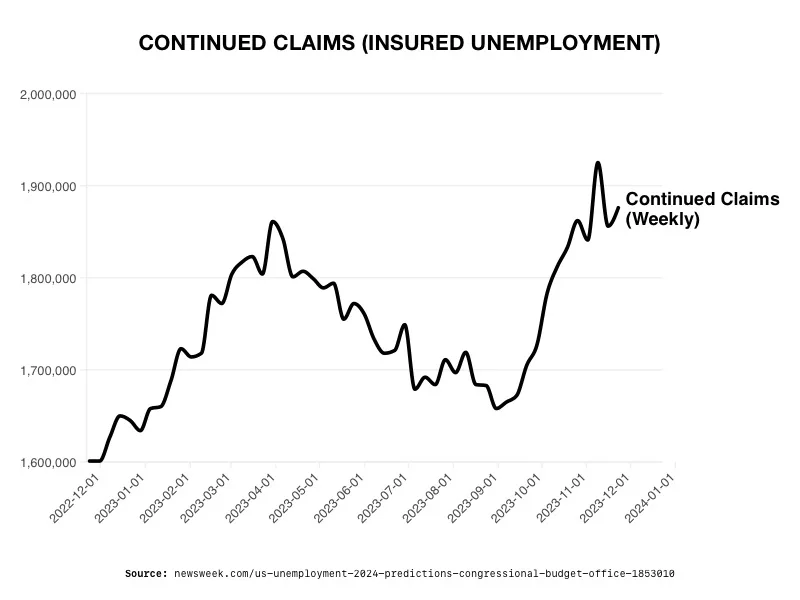

The Congressional Budget Office (CBO) forecasted a rise in unemployment from the current 3.9% to 4.4 % by the end of 2024. This would signal job losses for millions as the gross domestic product shrinks. They partially base their prediction on the rising level of continued unemployment claims. 1

2

2

They estimate 7.4 million people will lose their jobs. In addition, the CBO expects weaker consumer spending, a reduction in investment, and exports well into the next year. All of which will cause the economy to decelerate. Real GDP growth is predicted to slow down from 2.5% this year to 1.5% in 2024 – potentially pushing the country over the brink into recession.3

Rate Cuts

The CBO sees the Fed cutting interest rates after March next year. It took 11 interest rate hikes by the Fed since March 2022 to dampen spending and control price rises. The central bank has held rates steady since July. The Fed signaled three interest rate cuts for 2024 even though inflation is above its 2% target. Financial markets celebrated the announcement. The Dow Jones closed at a fresh record high for two straight days. Some feel the celebration is premature.

LPL financial chief equity strategist Jeffrey Buchbinder said the central bank has already gone too far and a recession is either coming, or already started.

“The Fed will cut rates because it worries monetary policy is too restrictive for a weakening economy,” he said.4

Other economists think the Fed’s rate-cut signal could prompt a fresh new round of inflation.

Inflation is still over the 2% target at 3.1%.

“I don’t see how the Fed is going to get inflation down to 2% if they’re going to start cutting interest rates,” said Robert Brusca, president of FAO Economics. He added that robust wage growth was also driving inflation.5

Commodities have risen sharply in anticipation of inflation spiking again over the next few months. Commodity prices can rise when people expect prices to go up in the future. They tend to buy more goods and commodities now. This increased demand for commodities can push their prices higher. Additionally, producers and sellers might also raise their prices in advance, expecting that it will cost more to make or acquire those commodities later due to anticipated inflation.

If the US economy doesn’t slow to recession levels in the next quarter, “inflation will be higher down the road, and sooner,” wrote Steven Blitz, the Chief US Economist of GlobalData.TSLombard.6

Historical Precedent

The Fed has made the mistake of cutting interest rates too quickly in the past. In the 1970s, the US faced rising inflation due to various factors, including increased government spending on social programs and the Vietnam War. To counteract this inflation, the Federal Reserve under Chairman Paul Volcker raised interest rates. Ultimately, reaching levels above 15%.

These high-interest rates were effective in curbing inflation, but their impact was not immediate. The economy suffered from a severe recession because of the tight monetary policy. As soon as inflation started to drop, the Federal Reserve, under different leadership, changed its course. They began cutting rates before achieving their target. Instead of stimulating economic growth after the severe recession, they led to a renewed increase in inflation and a new economic malaise – stagflation.

The early 1980s saw an environment where despite attempts to stimulate the economy through interest rate cuts, inflation persisted, and economic growth remained sluggish.

The Federal Reserve may recreate the scenario that they fear most. Poorly executed monetary policy over the next year may trap the economy with high unemployment, anemic growth, and recurring inflation. The combination of these effects is likely to depress the stock market, and in turn, drag down stock-based retirement funds. For those looking to protect the value of their portfolios in 2024, they should investigate the benefits of a Gold IRA. Physical precious metals in a tax-advantaged account can safeguard your funds against the impact of a stagnating economy. Contact us today at 800-462-0071 to learn more.