Stocks Turn Lower

Fear is stalking Wall Street. Hopes for a new bull market after the S&P 500 experienced a 14% increase are fading. Losses are growing as turbulence increases. The Nasdaq took a substantial 7.7% drop in August while the S&P 500 had a 5% decline. Meanwhile, the Dow recently closed lower than its 50-day moving average – a possible bear market signal. No wonder why the CNN Business Fear & Greed Index is shifting into the “Fear” territory for the first time since March. Market fears are being fueled economic slowdowns, war, and the lingering bank crisis. 1

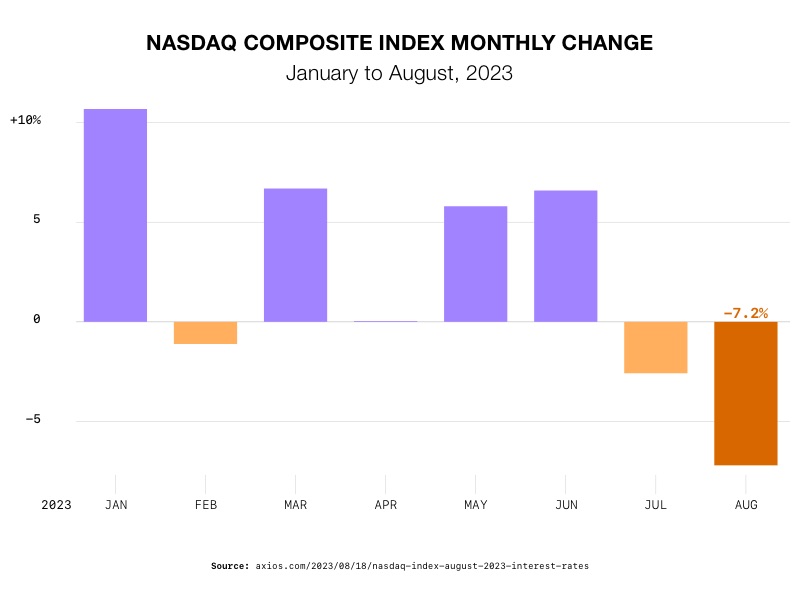

Tech Stocks Under Pressure

The Nasdaq is on track for its worst month of 2023. Earlier this year, inflation started to ease and hopes for a Fed pivot rose. The Nasdaq surged more than 37% year-to-date through mid-July. AI-related tech companies like Nvidia and Microsoft experienced a massive rise in share price. But potential new rate hikes could send growth stocks spiraling. And with tech stocks driving this year’s rally, the whole market could come crashing down. What looked like the beginning of a bull market may have just been a mirage.2

3

3

China Woes Amplify Fear

The economic slowdown in China has emerged as a significant worry, impacting global markets and portfolios. Chinese consumer spending, factory production, and long-term investments have all experienced declines. And a real estate crisis threatens to undermine the country’s economy. Escalating tensions between China and the United States are adding to the uncertainty.

China has played a substantial role in driving global economic growth over the past years. Any slowdown in its economy could have negative implications for US equities. Companies like Apple, Intel, Ford, Tesla, Starbucks, and Nike have significant business ties to China. They stand to lose if China’s downward trajectory continues.

Interest Rates and Federal Reserve Actions

When inflation seemed to hit a plateau, Wall Street seemed certain rate hikes were over. The possibility of cuts was even being discussed. Markets rallied despite warnings from the Fed. Then inflation rose again last month. The economy isn’t contracting as the Fed wants. There was a whopping estimated 5.8% annualized third-quarter GDP growth rate. Unemployment remains low. Consumer spending is strong. Fearing inflation will continue to rise, the Fed said more interest rate hikes may be necessary soon.

Geopolitical Turmoil

The ongoing war in Ukraine is adding another layer of uncertainty into the financial markets. The conflict has the potential to raise food and oil prices, contributing to global economic instability. Jamie Dimon is CEO of JPMorgan Chase. He has cited the ongoing war as his greatest concern. He highlights the increased risk of nuclear proliferation. Saying “the world’s not that safe,” he believes the overall stability of the world economy is in jeopardy.4

Festering Bank Crisis

The big fires of the regional bank crisis may be out but the issues that caused them are still smoldering. Major banks are now facing growing insecurity after being downgraded by Fitch Ratings. They were downgraded because of growing financial risks and strains that could erode their profitability. Coming on the heels a US credit rating downgrade, the banking downgrade is a further sign of an unstable economy.

Betting on a Downturn

Michael Burry may be best known as the “Big Short” investor who predicted the 2008 housing market collapse. He may soon make another claim to fame. Burry just bet more than $1.6 billion on a Wall Street crash. Using more than 90% of his portfolio, Burry bought $866 million in put options against the S&P 500 and $739 million against the Nasdaq 100. He is also acting on the issues mentioned above. He is selling off his shares in endangered regional banks and Chinese stocks like JD.com and Alibaba.5

Surviving a Crash

If a crash does occur, you obviously want to be positioned to walk away unscathed. One way to do that is to have assets that are independent of market volatility, such as precious metals. With their own intrinsic value, precious metals like gold and silver can secure the worth of your portfolio. A Gold IRA, in particular, is a sound choice to safeguard retirement funds from the looming threats. To learn more about what precious metals can do for you, contact us at 800-462-0071 today.