- The UN, IMF, and World Bank predict a decade of dismal growth

- The global economy is being dragged down by war, inflation, high interest rates, and debt

- Physical precious metals can preserve portfolio value against global recession

Global Economy Facing ‘Wasted Decade’

Global financial institutions are painting a sobering picture for the years ahead. The IMF, UN, and World Bank all foresee a challenging path for the world economy, with a bleak period of economic growth that could result in a “wasted” decade.

World Bank Outlook

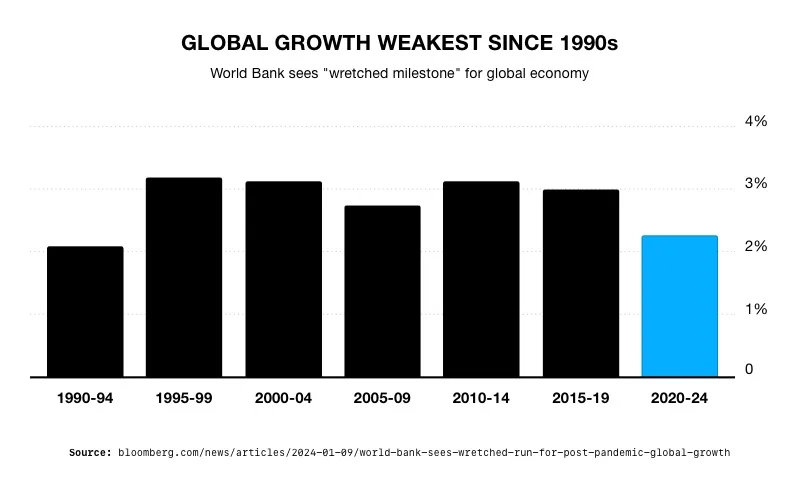

The World Bank said the global economy is on course to record its worse half decade of growth in 30 years. The global growth forecast has slowed for the third year in a row. And it is the slowest rate for a five-year period since 1990-1994. It is slowed down by high interest rates, sluggish trade, and geopolitical tensions. World Bank called it a ‘wretched milestone’.

“Without a major course correction, the 2020s will go down as a decade of wasted opportunity,” Indermit Gill, the World Bank Group’s chief economist and senior vice president, said.1

2

2

The World Bank pointed to the rise in geopolitical conflict as one of the primary drags on the global economy.

“You have a war in Eastern Europe, the Russian invasion of Ukraine. You have a serious conflict in the Middle East. Escalation of these conflicts could have significant implications for energy prices that could have impacts on inflation as well as on economic growth,” said Ayhan Kose, the World Bank’s deputy chief economist.3

While growth is set to weaken in the West, developing countries are going to face the biggest decline. They are trapped by paralyzing levels of debt that is only growing more expensive as interest rates soar. By the end of 2024, 1 out of every 4 developing countries will be poorer than they were before the pandemic began. Investment in developing countries will drop to about half the average of the previous 20 years. Inflation has declined in the past year, but in about a quarter of all developing countries, annual inflation is projected to exceed 10%.4

United Nations Forecast

The United Nations issued a pessimistic forecast for the global economy due to escalating conflicts, sluggish global trade, high interest rates and increasing climate disasters.

A UN report, the World Economic Situation and Prospects 2024, projected global economic growth would slow this year. It will be below the 3% growth rate before the COVID 19 pandemic. Their forecast is lower than those of the IMF and the Organization for Economic Cooperation and Development.

The UN report warned tighter credit conditions and higher borrowing costs could present “strong headwinds” for a world economy saddled with debt. Especially for developing countries in need of investment to recover.

They caution that global inflation could lurch upwards again. All it would take would be another supply chain shock or problem in fuel availability to boost inflation. This, in turn, could prompt another interest rate hike to bring inflation down – further slowing global growth.

Meanwhile, the UN Economic Analysis and Policy division said long term high interest rates and potential price shocks means ” we are not yet out of the woods” when it comes to a global recession.5

The UN signaled that the United States isn’t immune to a downturn. “Amid falling household savings, high interest rates, and a gradually softening labor market, consumer spending is expected to weaken in 2024 and investment is projected to remain sluggish,” the UN said. They continued, “the United States economy will face significant downside risks from deteriorating labor, housing and financial markets.” Growth in the US is expected to slow to 1.6 percent this year from 2.5 percent.6

The World Bank attributes the coming US slowdown to the highest interest rates in 22 years. They see businesses becoming wary of investing due to economic and political uncertainty, especially around the 2024 election.

Conclusion

In today’s world, no country is an economic island. The fortunes of the entire globe are bound together. So just as a rising tide raises all ships, the opposite holds true. The largest international finance organizations are all warning of a dismal decade ahead. The US economy may be able to stagger through the downturn. But it will also need to resist the downward pull of the sinking economies of developing nations. As global recession sets in, the value of markets, and retirement funds built on them, will naturally decline. Those looking to protect the value of their portfolios before the slide accelerates should investigate the benefits of a Gold IRA from American Hartford Gold. To learn how physical precious metals can safeguard your financial future, contact us today at 800-462-0071.