Gold Proves Resilient to Rising Inflation

Gold emerged as a surprising star in 2023, defying the odds of rapidly rising interest rates and resilient economies. The precious metal experienced a notable 15% surge, reaching a record high of $2,078 and securing its position as one of the best-performing assets. Gold’s resilience was attributed to various factors, including central bank support, geopolitical tensions, interest rates, and positive momentum, leading to its consolidation above the $2,000 mark.1

The World Gold Council calculated central bank purchasing boosted gold prices by 15%. The majority of which was from emerging markets. They acquired gold for security and stability as the risks of sanctions and uncertainty increased. As global conflicts in Ukraine and the Middle East heat up, vulnerable economies turn to gold for its safe haven appeal.

Even rising bond yields did not deter gold’s ascent. Bond yields and gold typically have an inverse relationship. Higher bond yields mean investors choose them over other investments, since gold doesn’t pay interest or dividends. This typically results in lower demand for gold, thereby lowering prices. Safe haven asset desire overcame this usual practice. When interest rates do drop, bond yields will decrease and make gold even more appealing and prices even higher.

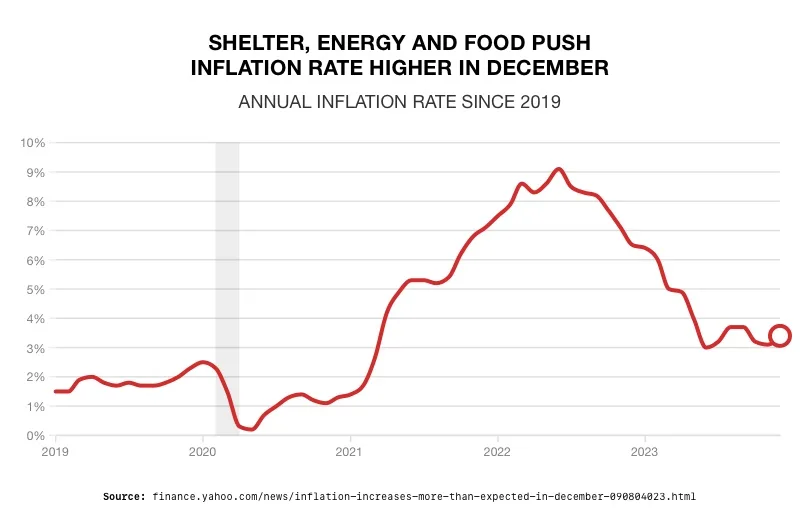

Inflation Continues to Rise

2

2

Gold maintained its strong position despite consumer prices increasing more than expected in December. Prices rose 3.4% over the prior year. There were notable increases in the shelter index, which rose 6.2%. Core inflation, prices without the volatile food and energy categories, fell. But the drop failed to meet the expectations of economists.3

The rise in inflation threw cold water on Wall Street, which had been counting on lower inflation to spur rate cuts. Markets have gotten ahead of themselves, baking future rate cuts into current stock prices. Traders are banking on a recession-free soft landing. The CME FedWatch Tool says there is a 69% chance the Fed cuts rates in March.

Bank of American is trying to keep an optimistic outlook. “I don’t think it’s enough to delay cuts,” Bank of America US economist Stephen Juneau said. “We’re looking for a March cut to kind of kick off the cutting cycle. This kind of keeps the door open, it definitely doesn’t slam the door shut.”4

But the Fed isn’t eager to cut rates. Fed Governor Michelle Bowman said that while they may eventually need to cut rates if inflation falls further, “we are not yet at that point.” Atlanta Fed president Raphael Bostic echoed a similar sentiment.

While the possibility of a significant increase in inflation is currently seen as unlikely, if it were to happen, it could have a positive impact on the price of gold.

A return of inflation can challenge the effectiveness of the Fed’s policy, increasing uncertainty. And if inflation returns to previous levels, the Fed would be forced to raise rate again, causing a more severe economic downturn or “hard landing.” Gold prices would benefit due to their perceived role as a hedge against economic uncertainties and challenges to traditional monetary policies.

Going Forward

Gold is set to maintain its upward trajectory. There are several factors that can affect the rate of that climb:

– Interest Rates are expected to eventually come down. Lower rates increase demand by making gold a more attractive store of value.

– A declining dollar provides a tailwind for gold. Gold and the dollar often have an inverse relationship. A weaker dollar means it takes more dollars to buy the same amount of gold, leading to an increase in the dollar-denominated price of gold. It also makes gold more attractive to international investors.

– Growing uncertainty increases safe haven demand for gold. Sources of instability include growing fears that the government may default on the national debt, destroying confidence in the dollar as a store of value; the rise of geopolitical conflicts that can stall the global economy, and elections around the world, particularly in the US, that can twist the world’s financial future.

Conclusion

The Federal Reserve’s long slog against inflation seems never-ending. An overeager Wall Street is factoring in rate cuts that may not happen for quite some time, setting the market up for another fall. After hitting all-time-highs, gold is continuing to prove itself as the leading safe haven asset. Demand for the precious metal is forecasted to keep growing. Now is a great time to investigate how a Gold IRA can help protect and grow your portfolio from inflation, recession, and surging volatility. Contact us today at 800-462-0071.