Gold Prices Soar

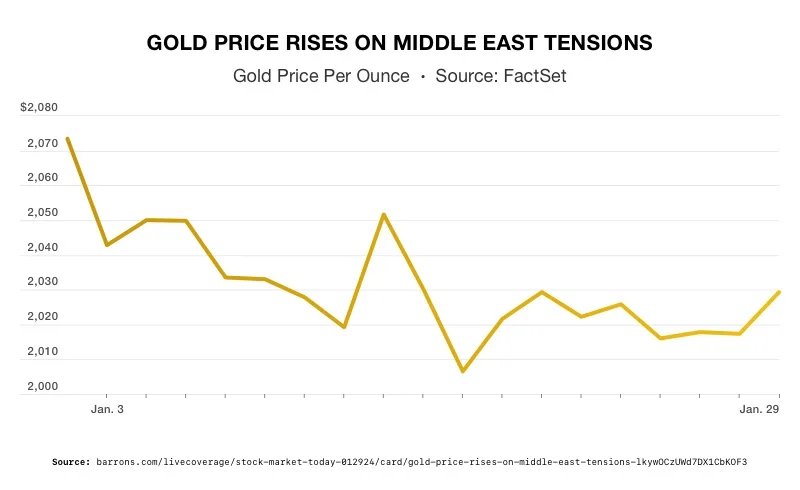

Gold may soon approach all-time highs. Gold prices jumped nearly ten points as conflict in the Middle East sent traders flocking to safe havens assets. In addition, a slew of upcoming economic data could push the price of gold even higher.

Safe haven demand due to geopolitical conflicts is sending gold prices soaring. Already boosted by the ongoing war in Ukraine and heightened tensions between China and Taiwan, the price of gold is rising higher as the conflict in Gaza engulfs the region. Attacks on Red Sea energy shipments by Iran-backed-Houthis are disrupting the global supply chain. And President Biden pledged retaliation for a drone attack that killed US service members in Jordan. Traders are turning to gold as global volatility and uncertainty spike.

1

1

Upcoming Data Could Push Gold Higher

Several soon-to-be-released economic reports could push gold prices even higher. These reports include the ISM Manufacturing Report, the Nonfarm Payrolls Report, and the US JOLTS Job Openings data. They will reveal the strength of the manufacturing sector and how strong labor demand is despite interest rates remaining elevated. This data will influence the Fed’s interest rate policy.

If those reports point to continued strong growth, the Fed is likely to delay any easing of interest rates. “With the U.S. growth outlook improving, the FOMC is in no hurry. With that in mind, the current number of projected rate cuts cannot go any higher until the cat is out of the bag (cuts begin) or economic data suddenly takes a turn for the worse,” said Ole Hansen, head of commodity strategy at Saxo Bank.2

The current data shows a very uncertain economy. Prices in some sectors are continuing to rise, but so is consumer spending. This is leaving the Fed in a precarious position on interest rates. As of now, the Federal Reserve is expected to keep interest rates unchanged at 5.25-5.50%. Traders see a good chance that interest rates will begin to be cut in May. However, the Fed is prepared to keep rates higher for longer until data shows that inflation is on track to come down to their 2% goal.

If interest rates remain unchanged, gold’s appeal may persist. Especially if other economic factors, like inflation concerns or geopolitical uncertainties, support demand for safe haven assets.

Interest rate cuts would also benefit gold. Lower interest rates typically reduce the opportunity cost of holding gold, as the appeal of non-interest-bearing assets increases.

“The anticipation of potential central bank rate cuts later this year, alongside recent US dollar weakening, is fueling optimism that gold markets will advance further and sustain gains much higher than its current price just above US$2,000 per troy ounce. If [Federal Reserve Chair] Jerome Powell indicates that rate cuts could take place sooner rather than later this year, gold markets could breakout higher on this signal.,” said Stuart O’Reilly, Market Insight Analyst at The Royal Mint.3

The ‘No Landing’ Scenario

The Fed is trying to navigate a ‘soft landing’. They want to bring down inflation without sparking a ‘hard landing’ recession. Their policy is opening the door to another possibility – the ‘no landing’.

A ‘no landing’ scenario means higher-than-expected growth coupled with higher-than-expected inflation. This is the situation we are currently in. The gross domestic product grew more than projected in the fourth quarter. The growth came from a strong job market and solid consumer spending. Meanwhile, inflation is still considered to be too high.

‘No landing’ means that interest rates will stay high alongside high inflation. This situation will further strain individuals and businesses already struggling with high prices and expensive debt.

Conclusion

Conflicts and policy are creating the case for gold’s continued climb.

“Bigger picture, geopolitical volatility and recent economic uncertainty are creating elevated demand for precious metals as more investors move into ‘safe-haven’ assets. Gold and other precious metals are increasingly becoming a mainstream choice for investors who are looking to diversify their portfolio and hedge against inflation,” O’Reilly added.4

Technical analysis sees gold maintaining critical support above $2,000 an ounce and potentially jumping up to $2,050.5 As increased volatility threatens the value of tradition funds, now is the time to investigate how a Gold IRA can protect, and potentially increase, the value of your portfolio. Contact us today at 800-462-0071 to learn more.