- Gold prices are reaching record heights with no slow down in sight

- Numerous forces are aligning to push gold prices higher

- Americans are moving into Gold IRAs to gain both tax-advantages and the wealth protection of physical precious metals

Gold Prices Continue to Rise

“There is a perfect storm brewing in the gold market,” says Phillip Streible, the Blue Line Future Chief Market Strategist. And a recent price surge is proving him correct. Gold rose 1.3% to hit a new record of $2,141.60 per ounce, $150 above its February lows. Prices rose on the hopes of a Fed pivot on interest rates, geopolitical risks, and a potential stock market crash.1

Market watchers were surprised by the scale of gold’s rise. Experts are saying momentum is helping the precious metal to continue its upward trajectory.

2

2

Saxo Bank said increased demand came from the rising risk of a falling stock market. Ole Hansen, senior strategist at the bank, pointed to weak US manufacturing data as a signal for an impending market correction. There is also growing concern that the ‘Magnificent 7’ tech bubble is about to burst.

Gold’s ascent is boosted by the belief in upcoming interest rate cuts by the Federal Reserve. The exact date of when the cuts will happen is unknown. Swap markets show an almost 60% chance of a rate cut in June.

Central banks are also providing critical support to gold prices even as interest rates spiked last year. Typically, gold goes down when interest rates increase because interest paying securities become more attractive than non-interest paying metals. “Speculation over a Fed rates pivot and continued geopolitical tensions keep gold shining,” said Ewa Manthey, commodities strategist at ING Group.3

Geopolitical risks are also supporting gold’s safe haven demand.

“We expect gold prices to trade higher this year as safe-haven demand continues to be supportive amid geopolitical uncertainty with ongoing wars and the upcoming US election,” said the ING Group.4

Attacks on shipping in the Red Sea increase the risks to energy and supply chains. In addition, the conflict in the Middle East threatens to broaden into a wider regional war that could have global economic implications. Volatility is further amped up as a contentious US presidential election goes into full swing, bringing a new level of uncertainty with it.

Bullion was also supported over the Lunar New Year. Chinese consumers are seeking safe haven assets against the turmoil in the country’s stock market and collapsing real estate sector.

The prospect of another regional bank crisis is also fueling interest in gold. New York Community Bank is down 80% since January while other regional banks are down 40%. A collapsing banking system will have two effects on gold. Investors will flock to the precious metal as a safe haven asset to protect the value of their portfolios from the impact of a banking crisis. It may also cause the Fed to cut rates sooner to provide relief for banks being crushed by high interest rates.

Gold – Room to Go Higher

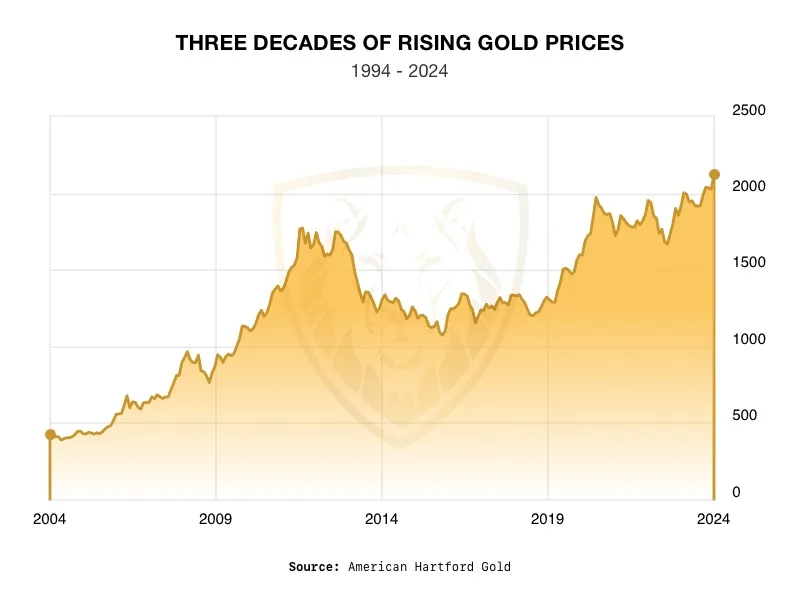

Gold has risen more than 600% since the turn of the millennium.

Analysts think that there is significant underinvestment in the gold market right now. There is already critical support to keep gold above $2100. Streible continued, “I think we could be easily back at $2,500. If you go since 1990, within the first 30 days of the first interest rate cut, gold futures on average have had a rally of about 6%. So if you go 6% from here, that’s going to be about another $150 higher. So I think $2,500 is a realistic target.”5

Conclusion

All the contributing factors that elevate gold prices are coming into alignment. Interest rates are set to be lowered, reducing the holding cost of gold and competition from interest bearing assets. A rise in global risk if fostering demand for safe haven assets. A tech bubble ready to burst and a banking crisis about to erupt hold the potential to irreversibly damage retirement funds, increasing the need for the security provided by precious metals. A Gold IRA from American Hartford Gold can combine the benefits of wealth protecting precious metals with the tax advantages of an IRA. Contact us today at 800-462-0071 to learn more.