Dedollarization Momentum Builds

The global financial landscape is undergoing a seismic shift. The long-standing belief in the stability of the US dollar is being challenged. Stubborn inflation, bank failures, and the looming debt ceiling crisis are causing people to question a currency backed only by the “full faith and credit” of the US government. As these challenges persist, the concept of dedollarization has gained traction. Countries and investors are exploring alternatives to reduce their dependence on the dollar. This shift carries significant implications for the global economy.

The dedollarization movement isn’t new. But it is quickly becoming more popular worldwide after the United States used the dollar for imposing sanctions. Foreign Policy Magazine held a forum called Currency in the Crossfire. There, Circle CEO Jeremy Allaire stated, “There’s been this theme of dedollarization for a long time, and people talk about it every 10 years. And people say it’s not going to really happen. And I think we’re now at a really different place…this is part of the multi-polar world that’s emerging. There’s a desire to have autonomy outside of the dollar.”1

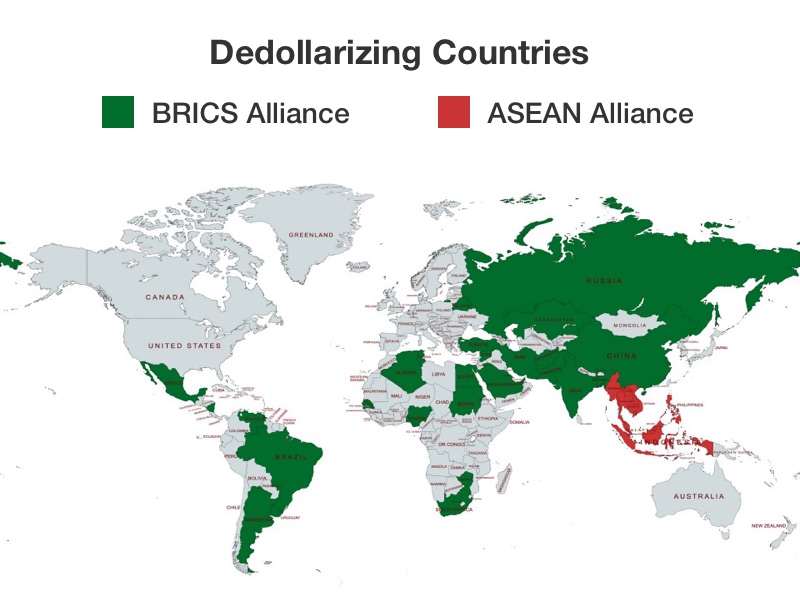

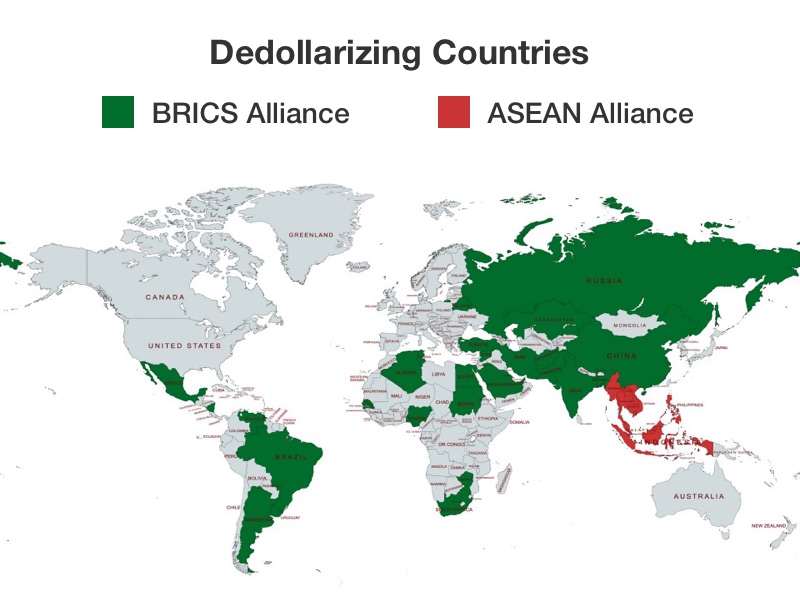

The BRICS alliance is at the forefront of dedollarization. The BRICS are composed of Brazil, Russia, India, China, and South Africa. Now, more than a dozen countries have expressed a formal interest in the joining the alliance. They want to use the new BRICS currency for international trade. The Gross Domestic Products of the alliance countries could surpass those of the US and other Western powers.

Their growing acceptance of a BRICS currency could weaken the dollar. A new global financial order may arise around the competing currencies. Analysts are most concerned about the number of oil-producing countries open to a BRICS currency. The alliance could influence countries to pay for oil with the new currency rather than the dollar. Eliminating the “petrodollar” could completely undercut the value of US currency. A grossly devalued dollar would most likely wreak havoc on the stock market. The US may find itself in an even worse debt crisis as it finds no means to fund its record deficit.

ASEAN Challenge

The BRICs alliance isn’t the only group challenging the dollar. Ten ASEAN countries made a joint decision to stop using the dollar for international trade. The nations aim to promote local currencies for cross-border transactions. Their goal is to strengthen the power of their own currencies. They also want to reduce reliance on (and the influence of) the US dollar.

This map shows the countries that are moving away from the US Dollar.

4

Role of Gold

Gold is taking on a large role in the reduction of dollar reliance. BRIC members are discussing backing their currency with gold. Countries are also working to remove dollars from their foreign reserves. They are turning to ‘sanction-proof’ gold instead.

Ruchir Sharma is the Chairman of Rockefeller International. He said, “Most Central Banks tend to hold foreign exchange reserves in other currencies, predominantly the US dollar. But over the last year or so, what they have done is that they have been diversifying and buying gold in a very big way. The Central Bank holdings of gold are increasing at the sharpest pace that we have seen in history.”2

The World Gold Council published a report saying that China purchased 102 tons of gold this year. Russia purchased 31.1 tons. And India added 2.8 tons to its gold reserves in 2023 alone.3

Rick Rule is former CEO of Sprott Holdings and the founder of Rule Investment Media. His analysis shows a massive impending upsurge in the price of gold. He highlights that precious metals-related investments make up less than one half of one percent of all savings in the United States. Meanwhile the four-decade mean market share is two percent. This highlights the immense room for growth. It suggests that gold prices have the potential to skyrocket.4

A combination of factors will drive the rise in gold according to Rule other than the international demand. The banking crisis is causing people to lose faith in traditional savings instruments. Instead, they are turning to gold to protect their purchasing power. Especially as inflation continues to devalue cash savings. According to Rule, continued high interest rates can slow the rise of gold prices. But he expects them to maintain an upward trend.

Current events are creating a new financial world order. Countries and investors are seeking alternatives to the US dollar. As we navigate an uncertain economic landscape, gold continues to shine as a reliable store of value and a safeguard against inflation. With gold prices set to rise, now is an opportune time to learn what a Gold IRA can do for you. Contact us today at 800-462-0071 to learn more.

4

Role of Gold

Gold is taking on a large role in the reduction of dollar reliance. BRIC members are discussing backing their currency with gold. Countries are also working to remove dollars from their foreign reserves. They are turning to ‘sanction-proof’ gold instead.

Ruchir Sharma is the Chairman of Rockefeller International. He said, “Most Central Banks tend to hold foreign exchange reserves in other currencies, predominantly the US dollar. But over the last year or so, what they have done is that they have been diversifying and buying gold in a very big way. The Central Bank holdings of gold are increasing at the sharpest pace that we have seen in history.”2

The World Gold Council published a report saying that China purchased 102 tons of gold this year. Russia purchased 31.1 tons. And India added 2.8 tons to its gold reserves in 2023 alone.3

Rick Rule is former CEO of Sprott Holdings and the founder of Rule Investment Media. His analysis shows a massive impending upsurge in the price of gold. He highlights that precious metals-related investments make up less than one half of one percent of all savings in the United States. Meanwhile the four-decade mean market share is two percent. This highlights the immense room for growth. It suggests that gold prices have the potential to skyrocket.4

A combination of factors will drive the rise in gold according to Rule other than the international demand. The banking crisis is causing people to lose faith in traditional savings instruments. Instead, they are turning to gold to protect their purchasing power. Especially as inflation continues to devalue cash savings. According to Rule, continued high interest rates can slow the rise of gold prices. But he expects them to maintain an upward trend.

Current events are creating a new financial world order. Countries and investors are seeking alternatives to the US dollar. As we navigate an uncertain economic landscape, gold continues to shine as a reliable store of value and a safeguard against inflation. With gold prices set to rise, now is an opportune time to learn what a Gold IRA can do for you. Contact us today at 800-462-0071 to learn more.

4

Role of Gold

Gold is taking on a large role in the reduction of dollar reliance. BRIC members are discussing backing their currency with gold. Countries are also working to remove dollars from their foreign reserves. They are turning to ‘sanction-proof’ gold instead.

Ruchir Sharma is the Chairman of Rockefeller International. He said, “Most Central Banks tend to hold foreign exchange reserves in other currencies, predominantly the US dollar. But over the last year or so, what they have done is that they have been diversifying and buying gold in a very big way. The Central Bank holdings of gold are increasing at the sharpest pace that we have seen in history.”2

The World Gold Council published a report saying that China purchased 102 tons of gold this year. Russia purchased 31.1 tons. And India added 2.8 tons to its gold reserves in 2023 alone.3

Rick Rule is former CEO of Sprott Holdings and the founder of Rule Investment Media. His analysis shows a massive impending upsurge in the price of gold. He highlights that precious metals-related investments make up less than one half of one percent of all savings in the United States. Meanwhile the four-decade mean market share is two percent. This highlights the immense room for growth. It suggests that gold prices have the potential to skyrocket.4

A combination of factors will drive the rise in gold according to Rule other than the international demand. The banking crisis is causing people to lose faith in traditional savings instruments. Instead, they are turning to gold to protect their purchasing power. Especially as inflation continues to devalue cash savings. According to Rule, continued high interest rates can slow the rise of gold prices. But he expects them to maintain an upward trend.

Current events are creating a new financial world order. Countries and investors are seeking alternatives to the US dollar. As we navigate an uncertain economic landscape, gold continues to shine as a reliable store of value and a safeguard against inflation. With gold prices set to rise, now is an opportune time to learn what a Gold IRA can do for you. Contact us today at 800-462-0071 to learn more.

4

Role of Gold

Gold is taking on a large role in the reduction of dollar reliance. BRIC members are discussing backing their currency with gold. Countries are also working to remove dollars from their foreign reserves. They are turning to ‘sanction-proof’ gold instead.

Ruchir Sharma is the Chairman of Rockefeller International. He said, “Most Central Banks tend to hold foreign exchange reserves in other currencies, predominantly the US dollar. But over the last year or so, what they have done is that they have been diversifying and buying gold in a very big way. The Central Bank holdings of gold are increasing at the sharpest pace that we have seen in history.”2

The World Gold Council published a report saying that China purchased 102 tons of gold this year. Russia purchased 31.1 tons. And India added 2.8 tons to its gold reserves in 2023 alone.3

Rick Rule is former CEO of Sprott Holdings and the founder of Rule Investment Media. His analysis shows a massive impending upsurge in the price of gold. He highlights that precious metals-related investments make up less than one half of one percent of all savings in the United States. Meanwhile the four-decade mean market share is two percent. This highlights the immense room for growth. It suggests that gold prices have the potential to skyrocket.4

A combination of factors will drive the rise in gold according to Rule other than the international demand. The banking crisis is causing people to lose faith in traditional savings instruments. Instead, they are turning to gold to protect their purchasing power. Especially as inflation continues to devalue cash savings. According to Rule, continued high interest rates can slow the rise of gold prices. But he expects them to maintain an upward trend.

Current events are creating a new financial world order. Countries and investors are seeking alternatives to the US dollar. As we navigate an uncertain economic landscape, gold continues to shine as a reliable store of value and a safeguard against inflation. With gold prices set to rise, now is an opportune time to learn what a Gold IRA can do for you. Contact us today at 800-462-0071 to learn more.