- Global gold prices surged in the past month

- Continuing geopolitical risks, peaking bond yields, and a bear market can sustain gold’s momentum

- A Gold IRA can help grow personal wealth while protecting it

Gold Prices Surge

October proved to be a pivotal month for gold in the global precious metals market. It witnessed a dramatic 6.8% surge, culminating in a historic monthly close of US $1,997/oz. This marked the highest-ever finish for the London Bullion Market Association Precious Metals (LBMA PM) price. The LBMA PM is a benchmark price set for gold. The increase reversed an initial downturn in the month. The resurgence was primarily attributed to safe-haven demand fueled by escalating geopolitical tension.1

October started with gold prices trailing below US$1,850/oz at the end of September. However, the geopolitical events in Israel on October 7 sparked a rally that catapulted gold prices above US$2,000/oz by October 27. Notably, this record-high closure resonated across major currencies, reflecting a global shift in prices.2

Global Gold Demand Rises

Globally, gold bars and coins had a strong first half of the year. Investment slowed down in the 3rd quarter, but quarter-over-quarter demand was still over the five-year average. While European demand dipped and US demand plateaued, other global regions compensated to lift overall demand.

China’s appetite for gold was the strongest since 2021. A depreciating currency and lack of alternative safe haven assets sent people to gold. The People’s Bank of China continued brisk buying as well. The country’s economic and political uncertainty boosted demand 16% year-over-year and a walloping 66% quarter-over-quarter. The outlook for future buying looks strong.3

India and Turkey also posted remarkably higher demand. India’s gold demand came from a growing economy and increased purchasing power. Paradoxically, demand in Turkey skyrocketed in response to collapsing economic conditions and political instability.

Central bank buying was also back in force. They are positioned to beat even last year’s record-breaking level of purchasing. Their gold acquisitions helped prices defy the headwinds of surging bond prices and a strong US dollar.

What’s Needed to Sustain This Rally

To sustain this bullish momentum, analysts believe one or more of the following need to occur. Geopolitical risks must continue or get worse. There must be a peak in bond yields and the US dollar. And there needs to be a bearish trend in equities coupled with a resurgence of recessionary fears.

Geopolitical Risks

As seen after the invasion of Ukraine, worsening political risk bolsters demand for physical gold. Economists think the current situation is worse than Ukraine because it adds to existing tensions instead of replacing them. Conflict dampens economic optimism, disrupts supply chains, and threatens to hike energy prices. All of which can slow growth and increase inflation, moving the global economy closer to stagflation. Under these conditions, investors turn to gold as a safe haven asset to preserve value.

Peak in Bond Yields

The recent spike in bond yields is wreaking havoc on the economy. But when bond yields have peaked, and inflation is decreasing, bonds become more attractive due to better returns. As a result, there’s a potential impact on how bonds and stocks relate to each other. During such times, investors might seek assets like gold as a hedge against market uncertainty. Thereby increasing demand and potentially lifting gold prices.

Bear Market and Recession Risks

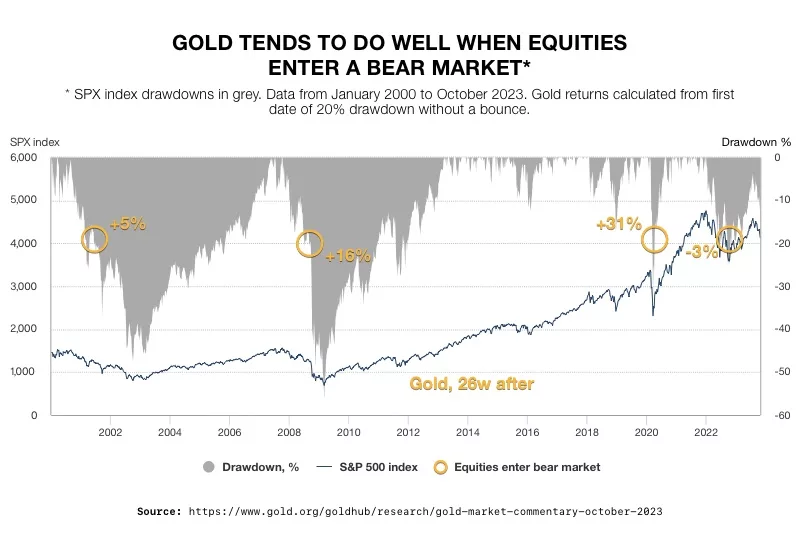

Stocks have been on a continuing downward trend. After a solid start to the year, US stocks suffered declines in August, September, and October. They’ve given back nearly half of their gains. Six of ten industry sectors in the S&P 500 were in negative territory through the first nine months of the year. And the Nasdaq is down more than 10% from its mid-year peak during what is supposedly the seasonally strongest period. A greater than 20% drop would effectively enter a bear market. This could spur additional interest in gold from investors as they realize buying stock dips is no longer paying off. History shows recent bear markets have been good for gold returns. 4

5

5

Looking Forward

The past two years have cemented gold’s ability to remain strong in a turbulent environment as demand for gold comes from various independent sources. This diverse global market helps defy perceived price drivers. Gold is set to break out further in current world conditions. The necessary events to maintain gold’s momentum – sustained geopolitical tensions, potential equity market downturns, and a peak in bond yields- are all taking shape as we speak. Now is an opportune time to secure your retirement funds with physical precious metals. A Gold IRA from American Hartford Gold can help grow your wealth while protecting it. Contact us today at 800-462-0071 to learn more.