Markets are showing alarming similarities to the early days of the Great Depression.

Investor confidence is shaken as recession risks and policy instability grow.

Americans are protecting their portfolios from uncertainty with the stability of physical gold.

Stocks Continue to Slide

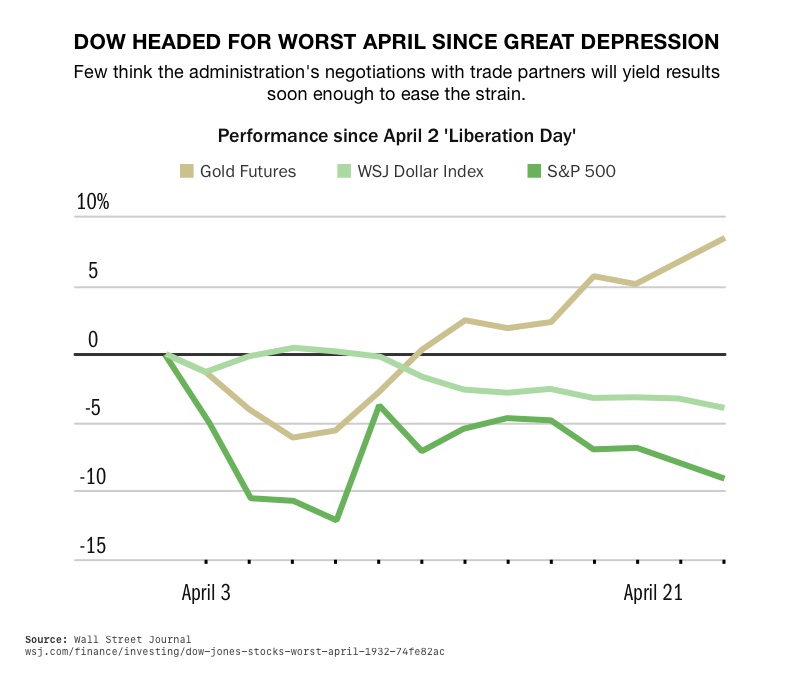

Investors and analysts are drawing eerie parallels between today’s market and the onset of the Great Depression. The Dow Jones Industrial Average recently lost nearly 1,000 points. Prompting the Wall Street Journal to note that the market was “headed for its worst April performance since 1932.” For historical context, that was during the darkest days of the Great Depression, a time few thought they’d see echoed again.1

But now, many fear that history may be repeating itself.

2

S&P 500 Decline Raises Alarm

The S&P 500 has dropped 9% since former President Trump announced his reciprocal tariff policy. It’s logged the worst performance since Inauguration Day for any president since 1928. Meanwhile, the dollar has sunk to its lowest level since March 2022. And the yield on the 10-year Treasury note has risen. Both mark a shift away from traditional safe havens.3

This instability has left investors with few safe spots to turn to. Uncertainty reigns, and, as one analyst put it, “no one wants to invest because of instability and the unknowable future.”

IMF Recession Warning and Fed Drama

That fear is backed by data. According to the International Monetary Fund (IMF), the U.S. economy faces rising headwinds. The IMF warned that tariffs would slow global growth and raised the odds of a U.S. recession from 25% to 40%. Unsettling policy moves haven’t helped. Trump’s threats to fire Fed Chair Jerome Powell sent the markets reeling, weakening the dollar even further. Analysts warn that removing Powell could trigger an even more severe drop.

Executives Lose Confidence

Executives aren’t optimistic either. Many corporate leaders doubt that Trump’s trade negotiations will lead to meaningful outcomes. During this earnings season, usually a time when stocks climb, the tone has shifted sharply. Bank of America reported that the ratio of positive to negative comments on macroeconomic conditions has dropped well below average. It is on track for the worst proportion since 2009.

Some companies are even withdrawing full-year guidance altogether. Kimberly-Clark lowered its profit expectations. Automakers have slashed their earnings outlooks the most. As uncertainty rises, Bank of America warns of “a potential information vacuum” as companies avoid making predictions. Much like they did during the early days of the COVID-19 pandemic.

Volatility and Fear Grip Investors

Volatility remains high. The VIX “fear gauge” is elevated. It is reflecting widespread investor concern about the ongoing trade war and expectations of continued turbulence ahead. Bearish sentiment is rising among individual investors. Expectations that stock prices will fall has hovered above 50% for more than eight consecutive weeks. According to the American Association of Individual Investors, that’s the longest-lasting bear majority on record since tracking began in 1987.

Even though the market managed a wild rebound on Tuesday, climbing nearly 700 points, investors remain cautious. A portfolio manager at Argent Capital Management said, “Lots of uncertainty, not lots of answers, kind of a frustrating environment today for investors. The one feeling that I feel like I can identify is the longer we remain in this limbo, the worse it gets for the economy.”4

Gold Surges as the New Safe Haven

In the face of all this, one asset is bucking the trend: gold.

Gold has soared above $3,500 an ounce for the first time ever in a dramatic “flight to safety.” It continues a powerful rally that began at $2,623 an ounce at the start of the year. In just a matter of weeks, gold has smashed through multiple milestones, including the $3,000 mark. Now, analysts predict it could climb to $4,000 in the coming weeks — a staggering rise that reflects growing investor panic.5

Market Predictions

The reasons are clear. As inflation heats up, and growth slows, Wall Street forecasters like Stifel, UBS, and Bank of America are warning of a rising risk of stagflation. This toxic mix of high inflation and sluggish growth poses a unique challenge for the Federal Reserve. And investors know it.

Goldman Sachs has slashed its forecast for the S&P 500, not once, but twice, this year. The bank now expects the benchmark index to return -5% over the next three months and just 6% over the next 12 months, down from earlier targets of 0% and 16%. They don’t expect the index to return to its all-time high of 6,100 anytime soon.

Goldman’s strategists also downgraded expectations for corporate earnings. They now forecast S&P 500 earnings per share (EPS) growth of just 3% in 2025, down from 7%, and a similar drop in 2026. “Higher tariffs, weaker economic growth, and greater inflation than we previously assumed lead us to cut our S&P 500 EPS growth forecasts,” they said. In a recession, they estimate the S&P 500 could tumble to 4,600 — a 21% drop from current levels.6

Conclusion

This may be the beginning of a long decline in stock value. If the market continues along this trajectory, the economic pain could deepen. Gold has historically performed well in times of uncertainty. The flight to gold may just be getting started.

If you’re looking to protect your retirement savings, now may be the time to consider a Gold IRA. It offers a long-term safeguard against inflation, market volatility, and economic downturns. Call American Hartford Gold at 800-462-0071 to learn how to get started.