The Economy: Where It Stands

If the past 6 months have shown us anything, things need to get worse before they can get better. The first half of 2023 has been less than stellar. On the upside, supply chain issues have mostly normalized. This should aid in bringing prices down. And the global economy is hovering slightly out of the reach of a recession. The US economy is also chugging along. It is buoyed by a strong labor market and savings built up during the pandemic. But the economic outlook for the second half of the year foresees a turn for the worse. The economy will be challenged by persistent inflation, recession, and financial instability. The only bright spot seems to be a continued resurgence in gold.

Here are the issues shaping the economic outlook for the rest of the year:

Inflation: The battle against inflation is still not won. It remains stubborn and sticky. Core inflation (excluding volatile energy and food prices) has been stuck close to 5% for several quarters. It is way above the Fed’s 2% goal. High inflation is going to continue straining the resources of Americans.

Recession: With tighter financial conditions, easing domestic demand, and a slowdown in manufacturing, the economy appears to be on a path to recession. Leading indicators support this outlook. These indicators include inversion of yield curves and a contraction in the money supply. In another sign, business investment has dropped over the past six months. This is especially true in manufacturing, which has been contracting since January.

Historically, whenever central banks hike rates to tame inflation, the outcome is almost always a recession. An argument exists over what this recession will look like. There is some optimistic consensus that any recession will be soft and shallow. However, that opinion isn’t shared across the board. The breakdown of the real estate market, both residential and commercial, could result in a more severe downturn like the 2008 Great Recession.

Financial instability: Uncertainty and volatility will persist into the second half of the year. High interest rates are taking their toll on the financial sector. The banking crisis may have quieted down, but it is still not over. Highly leveraged financial institutions are failing to adapt to high interest rates. Their instability carries over to non-bank markets like real estate. Housing prices are coming under pressure with mortgage rates surging to 21-year highs. Troubled regional banks are leading to a tightening in credit for homes. The IMF recently warned about a potential mortgage crisis as more default in the face of high rates.

Unemployment: A strong labor market has prevented an official declaration of recession. That is set to change. The current unemployment rate remains close to a five-decade low. But there are signs the momentum is slowing as the rate of new jobs decreases every month. Given the scope of the economic slowdown, job growth looks to weaken and turn negative in the second half of the year. Unemployment is forecasted to climb to 4.2% by year’s end.1

Interest rates: The economic outlook hinges on the actions of the Federal Reserve. There have been recent stock market rallies based on hopes of a pivot away from rate hikes. Analysts, such as those at Allianz, do not share the market’s optimism. Due to the persistence of inflation, they do not think the Fed can afford to cut interest rates in the second half of the year. Instead, they predict even more interest rate hikes. The Federal Open Market Committee meeting in June pointed to at least two more rate rises before the end of the year, pushing them up to 5.75%.

Despite the risks posed by the aggressive tightening, the Fed is committed to the fight against inflation. A weakening economy is unlikely to make them pivot. Federal Reserve Chair Jerome Powell noted that there would need to be a sharp drop in inflation for the Fed to pivot. He said, “We will be restrictive as long as we need to be. But if inflation is coming down sharply, it would be a different situation, and you would think about loosening policy. We are a long way from that.” Like the saying goes, when someone shows you who they are, believe them the first time. Fed Chair Powell has been consistent in saying rates won’t be cut until data shows inflation is hitting their target rate. Plan like you believe him and not your hopes.2

Where to Go from Here

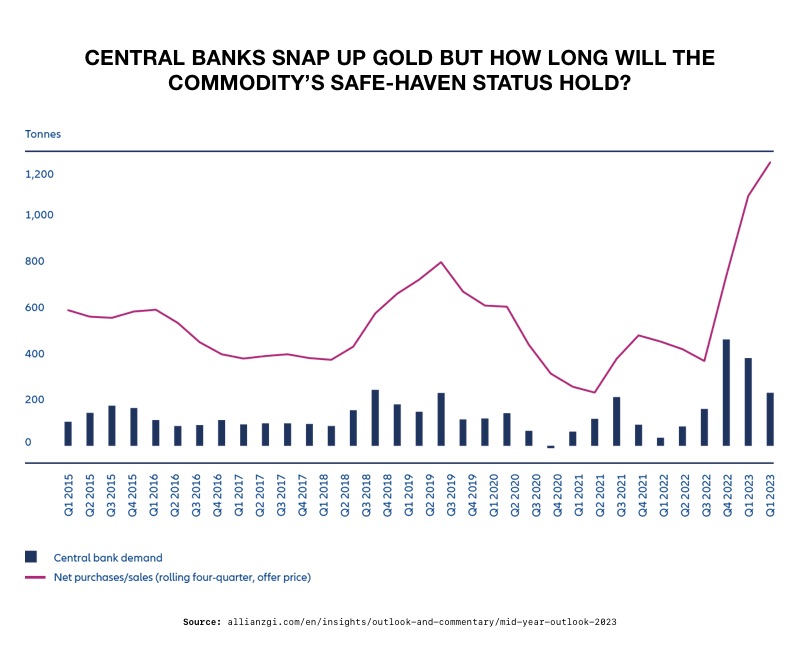

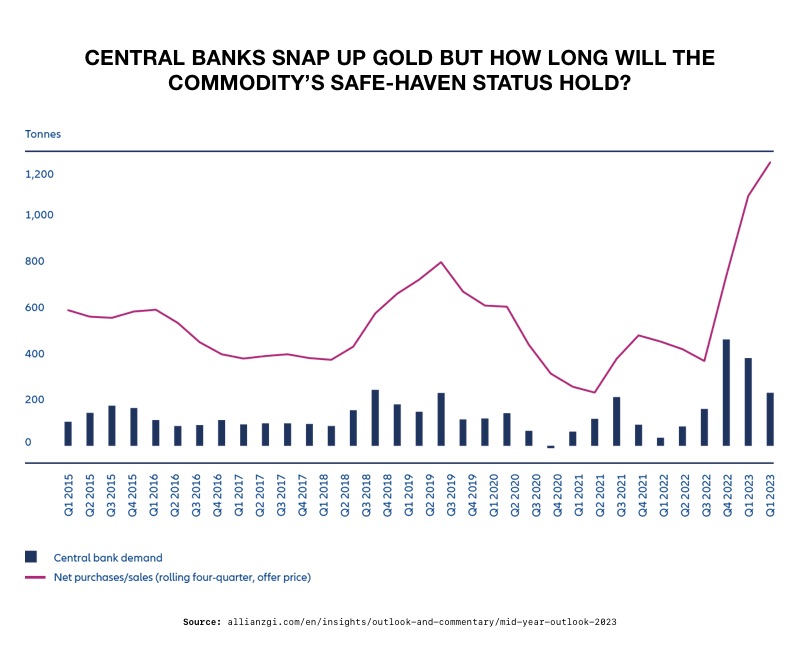

As high rates may trigger further financial instability, resilience is the keyword going into the second half of 2023. Being resilient means keeping a long-term perspective and focusing on diversification. Diversification in precious metals can cut risks by reducing exposure to volatile market risks. Gold remains a bright spot in the second half of the years economic outlook. As seen in the chart below, record central bank gold purchases are boosting prices.

3

Bloomberg Intelligence agrees with the idea of an impending recession. They predict the recession could deflate prices in “industrial metals and broad commodities, with gold the notable exception.”4 Economic conditions are giving gold the tailwinds to hit all-time highs within the next 6 months. Prepare your portfolio for the rest of the year. Learn how a Gold IRA from American Hartford Gold can protect your funds from inflation, recession, and high interest rates. Contact us today at 800-462-0071.

3

Bloomberg Intelligence agrees with the idea of an impending recession. They predict the recession could deflate prices in “industrial metals and broad commodities, with gold the notable exception.”4 Economic conditions are giving gold the tailwinds to hit all-time highs within the next 6 months. Prepare your portfolio for the rest of the year. Learn how a Gold IRA from American Hartford Gold can protect your funds from inflation, recession, and high interest rates. Contact us today at 800-462-0071.

3

Bloomberg Intelligence agrees with the idea of an impending recession. They predict the recession could deflate prices in “industrial metals and broad commodities, with gold the notable exception.”4 Economic conditions are giving gold the tailwinds to hit all-time highs within the next 6 months. Prepare your portfolio for the rest of the year. Learn how a Gold IRA from American Hartford Gold can protect your funds from inflation, recession, and high interest rates. Contact us today at 800-462-0071.

3

Bloomberg Intelligence agrees with the idea of an impending recession. They predict the recession could deflate prices in “industrial metals and broad commodities, with gold the notable exception.”4 Economic conditions are giving gold the tailwinds to hit all-time highs within the next 6 months. Prepare your portfolio for the rest of the year. Learn how a Gold IRA from American Hartford Gold can protect your funds from inflation, recession, and high interest rates. Contact us today at 800-462-0071.