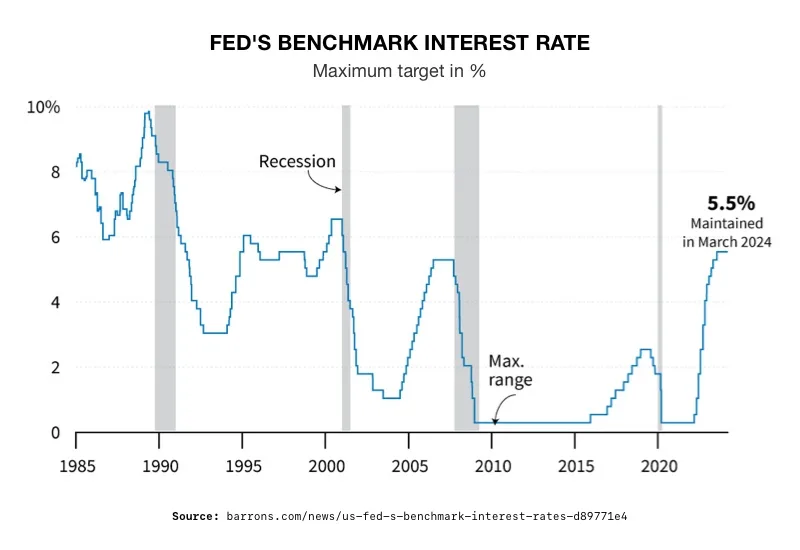

- The Federal Reserve held rates at their 23-year high for the fifth time in March 2024

- Economists say the Fed’s data dependency, instead of strategic vision, is hurting the economy by keeping rates too high for too long

- The delay in rate cuts may present a buying opportunity for gold

Fed Keeps Interest Rates High

The Federal Reserve held rates at their 23-year high for the fifth time in March 2024. Fed Chair Powell signaled that rate cuts are likely later in the year. But he said the central bank wants to see more evidence of inflation moving towards its 2% goal before easing policy. As the ‘higher-for-longer’ rates stalls the economy, some experts are questioning the process behind the Fed’s decisions. They are now shining a light on the danger posed by those decisions. 1

At the meeting on March 20, 2024, the Federal Reserve kept interest rates steady in a range of 5.25% to 5.5%. The Fed said it “does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.”2

3

Rate Cuts Delayed, Again

Powell emphasized that the Fed is “strongly committed to returning inflation to its 2 percent objective.” And that they will continue monitoring the economic outlook to determine their future decisions. The central bank wants to be “careful” about slicing rates prematurely. The Fed’s dot plot, which shows individual members’ rate expectations, indicated three rate cuts are projected for 2024. Investors had initially anticipated six or seven cuts. Wall Street is betting that the first of those cuts will come in the summer. 4

Questioning the Fed’s Methods

From Wall Street titans to Main Street shop owners, Americans have no choice but to accept the decisions of the unelected Fed. But now the central bank’s policies are being called into question by renowned economist Mohamed A. El-Erian. El-Erian is the Chief Economic Adviser of Allianz and former CEO of Pimco.

He points out the Fed chooses to look backward with data points without looking forward with a strategy. He said, “In today’s economy, an excessive focus on the numbers tips the balance of risks toward keeping interest rates too restrictive for too long, unduly increasing the probability of output loss, higher unemployment and financial instability.” 5

El-Erian pointed out that “undue data dependency” led to calling inflation “transitory” back in 2021. And as a result, the Fed was forced to issue unprecedented rate hikes to make up for lost time. Powell’s commitment to depending on shifting data has contributed to uneven signaling, reactive measures, and sudden pivots. Unnecessary market volatility has resulted. It has been compared to driving a car by looking in the rear-view mirror instead of the windshield.

With inflation rising once again, policymaking will most likely become more overreactive. More uncertainty is likely to result. A few months ago, the market surged after pricing in a potential six rate cuts in 2024. Those six have been shrunk down to three, and even they aren’t guaranteed. Predictions for the first rate cut in two years were first pushed back to May and then to June.

Goldman Sachs analysts said, “Our inflation path for the rest of the year is now in a range where small surprises could have large consequences.” The chief global strategist at JPMorgan Asset Management said even reducing the cuts from three to two would upset the market. 6

A More Dire Prediction

Bernard Connolly is an economic guru who correctly called the Great Recession and the eurozone sovereign debt crisis. He warned the US will plummet into a severe recession unless the Fed acts promptly to loosen monetary policy. Large cuts are required due to a weakening labor market and the depletion of pandemic-era savings. Such a recession would sharply devalue the dollar. The global financial system itself could be put in jeopardy.

Conclusion

The Fed is continuing its ‘higher-for-longer’ policy on interest rates with no apparent strategic vision for the future. Uncertainty is growing along with greater market volatility. No one, perhaps not even Chairman Powell, knows when or how many rate cuts will be occurring. Americans interested in protecting the value of their retirement funds from lingering inflation and increasing market volatility are flocking to precious metals. The delay in rate cuts may present a buying opportunity for gold as the prices recede before continuing their upward trajectory. To learn how a Gold IRA from American Hartford Gold can protect your financial future, contact us today at 800-462-0071.