- Inflation continued to rise according to the most recent Labor Department Report

- Inflation is eating away at the value of retirement plans, eroding more tan 10% of value during 2022 and 2023

- Gold is proving itself a hedge against inflation and continues to break all-time highs

Inflation Continues to Rise

The Labor Department’s most recent CPI report painted a grim picture. Higher than expected prices showed that inflation is more stubborn than thought. The stock market immediately dipped upon the news as hopes for interest rates cuts were dashed. Retirement savers are facing a precarious new reality as we seem to be entering a ‘no-landing’ state of permanent inflation.

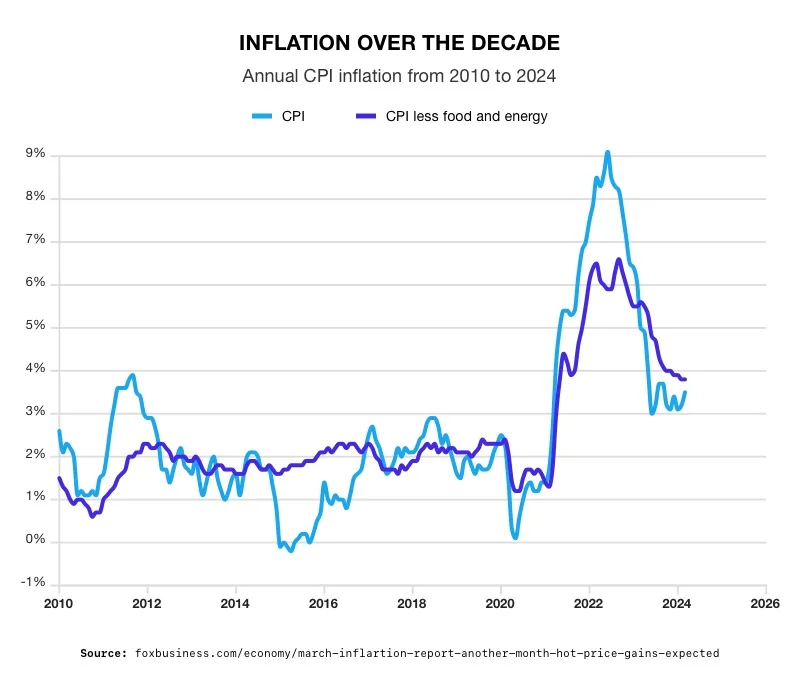

Overall inflation and core inflation, with volatile food and energy costs removed, both remained well above the Fed’s 2% target. Headline CPI rose 3.5% from a year ago. That’s up considerably from February’s 3.2% rate. Core price inflation came in at 3.8%. Service prices were up 5.4% from last year. In effort to get a better picture of the economy, economists started the ‘supercore’ measurement. This new computation takes core services and subtracts housing. That number surged 7.2% at an annualized pace. 1

2

2

Economists suspect the previous easing of inflation was due to falling oil prices. But gasoline prices rose again in March as OPEC+ extended supply cuts and the Middle East conflict grew.

Inflation and the Stock Market

Over the past few months, investors had high hopes for imminent rate cuts. The Fed had signaled the possibility of cutting interest rates three times this year. In January, the CME FedWatch Tool indicated a 73% chance of a 25-basis point rate cut by the Federal Reserve as early as March. This optimism fueled a stock market frenzy. With the release of this latest inflation report, that surge was brought to an abrupt halt.3

The Dow Jones Industrial Average fell more than 500 points. The Nasdaq and the S&P 500 also dropped. Tech stocks, including Microsoft, Amazon and Apple, were lower. The CME FedWatch Tool now show 78% of participants expect the Fed to hold rates steady in June. The markets are now hoping for a rate cut in September. Though there is now a possibility of no interest rate cuts this year – further stagnating the economy.4

Interest rates are also taking on a political overtone. Some economists point out that a well-timed cut could give a crucial boost to the economy when it comes voting time. Seema Shah is the chief global strategist at Principal Asset Management. She said, “Today’s crucial CPI print has likely sealed the fate for the June [Fed] meeting with a cut now very unlikely. Even if inflation were to cool next month to a more comfortable reading, there is likely sufficient caution within the Fed now to mean that a July cut may also be a stretch, by which point the US election will begin to intrude with Fed decision making.”5

Markets historically drop when interest rates are kept longer for higher. This is because it costs more for companies to borrow money and other investments may look better compared to stocks.

Inflation Impact

Continuing inflation is placing severe pressure on most US households. Prices have increased on everyday necessities. In the past few years, the cumulative consumer price index has increased a whopping 18.49%. 6

Lingering inflation is taking a heavy toll on retirement savings. The damage goes beyond falling portfolio value as stocks plummet. Warren Buffets said, “Inflation is a far more devastating tax than anything that has been enacted by our legislature. The inflation tax has a fantastic ability to simply consume capital.”7

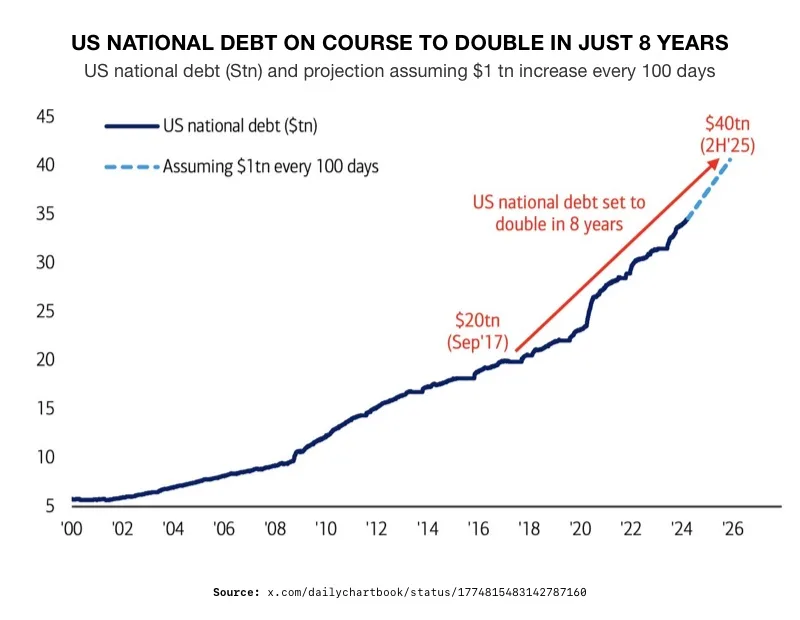

And the math bears it out. Let’s consider an IRA with $100,000 as an example. Just accounting for 8% inflation in 2022, and 4.1% in 2023, the account would have lost $11,772. More than 10% of your retirement savings would have vanished in two years. That money is going to continue disappearing as inflation remains elevated. In addition, higher-for-longer interest rates are likely to keep driving stock values down and increase the chance of recession.

Conclusion

So-called ‘sticky’ inflation presents a real threat to retirement savings. The economy is finding itself in a ‘no-landing’ situation. Continued growth and a tight labor market are working to prevent a decline in inflation. Meanwhile, the most aggressive interest rate hikes in decades haven’t stopped inflation. Instead, they have brought us to the brink of recession.

One stand out in this mess is gold. It is proving itself as a true hedge against inflation. As purchasing power continues its descent, the price of gold keeps breaking record highs. For those people who want to protect the value of their portfolios from the ravages of inflation, now is the time to investigate what gold can do for you. A Gold IRA is designed to maximize your protection from inflationary forces. Contact American Hartford Gold today at 800-462-0071 to learn more.

Notes:

1. https://www.foxbusiness.com/economy/march-inflartion-report-another-month-hot-price-gains-expected

2. https://www.foxbusiness.com/economy/march-inflartion-report-another-month-hot-price-gains-expected

3. https://www.cbsnews.com/news/interest-rates-today-mortgage-goldman-sachs/

4. https://www.foxbusiness.com/markets/stocks-sink-after-hot-march-inflation-data

5. https://www.cnn.com/2024/04/10/markets/markets-fall-cpi-inflation-report/index.html

6. https://www.foxbusiness.com/economy/march-inflartion-report-another-month-hot-price-gains-expected

7.https://www.goodreads.com/author/quotes/756.Warren_Buffett?page=5#:~:text=the%20arithmetic%20makes%20it%20plain,ability%20to%20simply%20consume%20capital.

3

3