- The AI fueled stock boom bears an eerie resemblance to the dot-com bubble of the 90s

- Analysts see the highly concentrated, overinflated tech stocks experiencing a similar bust

- Physical precious metals in a Gold IRA can protect the long-term value of your portfolio from an inevitable crash

The AI Stock Bubble is Set to Burst

AI has sparked a stock market boom that may soon go bust. The ‘Magnificent 7’ tech stocks are lifting the market to new heights. But experts are advising caution as conditions take on an eerie resemblance to the dot-com boom of the 1990s. The “irrational exuberance” overinflating today’s stock prices could be squashed by a sudden crash, massive losses, and a lingering recession.

The stock market has been rising since it bottomed out last October. Tech stocks are leading way, specifically, a group known as the Magnificent 7. This group includes Amazon, Apple, Meta, Alphabet, Tesla, Nvidia and Microsoft. Bank of America has called the AI boom a ‘baby bubble’ with returns on trades rising 200%. The 7 almost singlehandedly lifted the S&P 500 to a 24% gain in 2023. This concentration in the market is nearing its highest level since the dot-com days. There is less diversity of companies leading the market in 2024 than at the peak of the dotcom bubble.1

2

2

Parallels to the 1990s

Ed Yardeni is a longtime investment strategist and president of Yardeni Research. He said, “Instead of a repeat of the inflationary 1970s or a replay of the productivity-led boom of the 1920s, the current decade has the potential to play out like the tech-led stock market party of the 1990s.”3

The rapid rise of AI chip maker Nvidia looks like the parabolic ascent of Cisco, the maker of equipment for the internet. Cisco’s share price increased 8-fold from 1997 to March 2000. Meanwhile, Nvidia is up 252% with the AI explosion ignited by ChatGPT.4

The Fed may inadvertently swell the bubble if they begin cutting interest rates this year. Lower rates could fuel the same “irrational exuberance” that powered the doomed internet bubble. Newly accessible cash would overinflate asset prices. And when valuations ultimately crash back to normal, a recession would most likely ensue.

Jon Wolfenberger is the founder of BullAndBearProfits.com and former investment banker at JP Morgan and Merrill Lynch. He also compares today’s market to the dot-com bubble of the 90s.

“For those of you younger than us who did not live through the Tech Bubble of the late 1990s, you are now living through Tech Bubble 2.0. As a reminder, the NASDAQ fell about 80% when that bubble burst in the mild recession of the early 2000s,” Wolfenbarger said. “Given the fact that stock market valuations are even higher now than they were at the Tech Bubble peak of 2000, we would not be surprised by a similar decline in the coming recession.”5

Evidence of a Bubble

There is evidence supporting the idea that there is a bubble. The Shiller price-to-earnings ratio gauges whether the market is overvalued. It is currently at one of its most elevated levels in history. It isn’t as high as it was during the dot-com bubble, but it is higher than it was in 1929.

The concentration of stocks also points to a bubble. The top five stocks make up a higher percentage of the S&P 500 than they did during the dot-com bubble. This concentration drastically increases the vulnerability of the market to a crash if anything happens to those leaders.

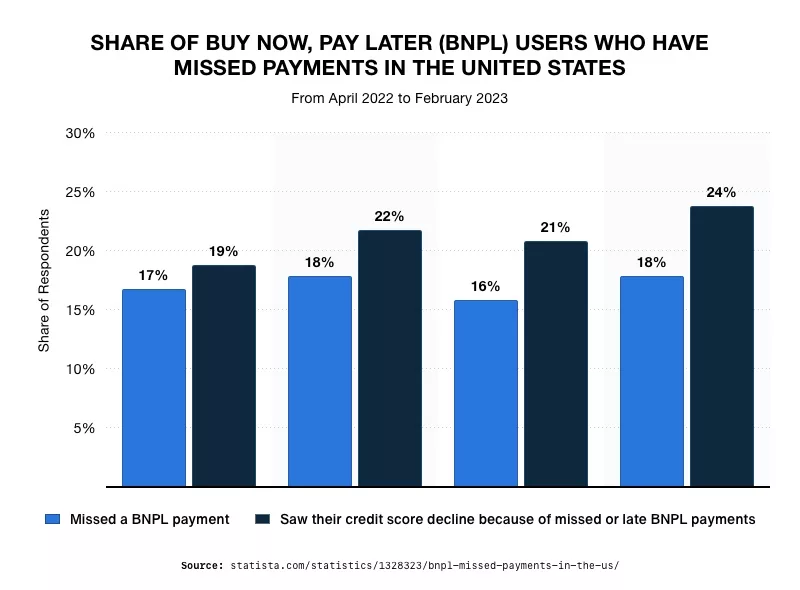

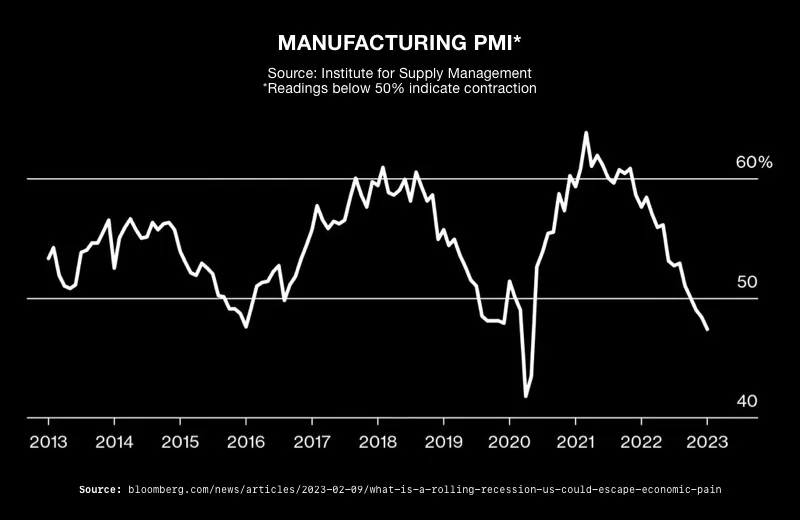

Wolfenberger identified several factors pointing to the impending bubble-bursting recession. He pointed to the continuing sharp decline in the number of full-time employees. The drop is quickly resembling the unemployment rate before the recessions of 2001 and 2008. Wolfenberger also cited declining manufacturing data, which also fuels unemployment, and the inverted Treasury yield curve.

Other expert voices are sounding the alarm. Jeremy Grantham, who called the 2000 and 2008 crashes, has said that stocks are in a ‘super bubble.’ Adam Karr is the President of Orbis Investment Management. He issued this warning, “Historically, similar periods have ended badly. Expensive stocks lost 40% of their value following the Japan bubble in the late 1980s and 50% of their value following the dot-com implosion. Investors can look foolish for not owning the winners in the short term—and ‘FOMO’ can be overwhelming. But paying too much for an asset with high expectations can be a recipe for disaster.”6

JP Morgan is also advising caution. A team of analysts found that the rising concentration in the stock market has become an important risk that investors should be aware of in 2024. The JP Morgan strategists said the Magnificent 7 are overdue for a period where it lags behind the broader market. They warn clients to expect a drop in the market as a result.

Conclusion

The AI boom driving the market higher is taking on an uncanny resemblance to the dot-com bubble of the 1990s. By the time that bubble finished bursting, stocks had lost $5 trillion in market capitalization since the peak. At its trough on October 9, 2002, the NASDAQ-100 had dropped to 1,114, down 78% from its peak.7

It is easy to get caught up in the excitement of quick profits. But the bigger that bubble grows, the harder those stocks will fall. People with a long-term outlook should investigate assets that will weather the inevitable market drop and protect their portfolios from losses. Physical precious metals in a Gold IRA can preserve the value of retirement funds as stocks crash. Contact us today to learn more at 800-462-0071.

2

2

3

3

2

2

2

2 3

3