- China’s governmental and personal debt is reaching dangerous new heights

- The skyrocketing debt can undermine the Chinese economy and, in turn, the global economy

- A Gold IRA can protect your portfolio from the severe negative impact of China’s collapse

The Danger of China’s Debt

The Chinese economy is like a sinking ship threatening to take down the global economy in its wake. China is the world’s 2nd largest economy. But it is also one of the most indebted large economies in the world. Its state-owned banks are perched on mountains of bad debt. And that’s just on the surface. Underneath are trillions of dollars in murky off-balance sheet lending that threatens to destabilize China’s, and in turn, the world’s economy.

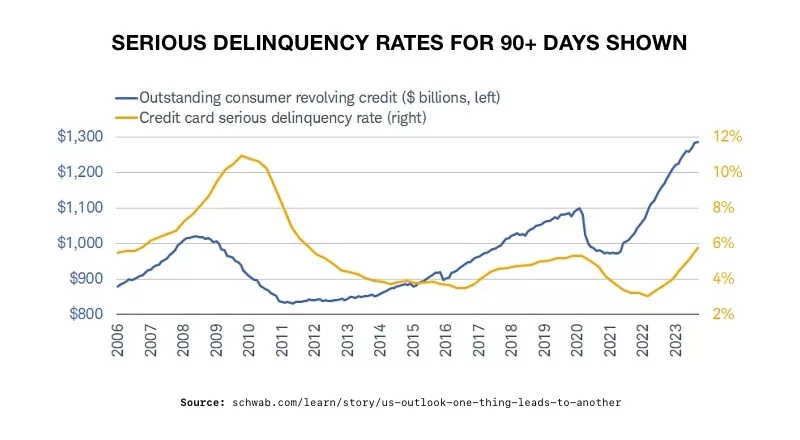

The debt undermining China’s economy extends to the personal and government level. Defaults by Chinese borrowers have surged to record heights, highlighting the depth of the country’s economic downturn. More than 8 million Chinese citizens have been blacklisted by the government for missing payments. That number is up from 5.7 million in 2020. Blacklisted people are blocked from a range of economic activities and become unable to make money in the face of restrictions. Much like a debtor’s prison, they are trapped and unable to ever repay their debts. The situation is worsened by staggering unemployment, especially among younger people, that hit a record 21 %.1

The government’s response to growing personal debt was to simply stop reporting the data. They are slow to pass regulations to help the situation because they fear corruption may be revealed.

A larger issue is that government debt is skyrocketing along with personal debt. China’s economic growth is slowing. Soon local governments will start defaulting on interest and principal payments. Most commercial banks are state owned. They often make decisions based on government decree rather than economic pragmatism. This include making risky loans to state-controlled companies. Official bad loans at Chinese banks hit $540 billion in 2020.2

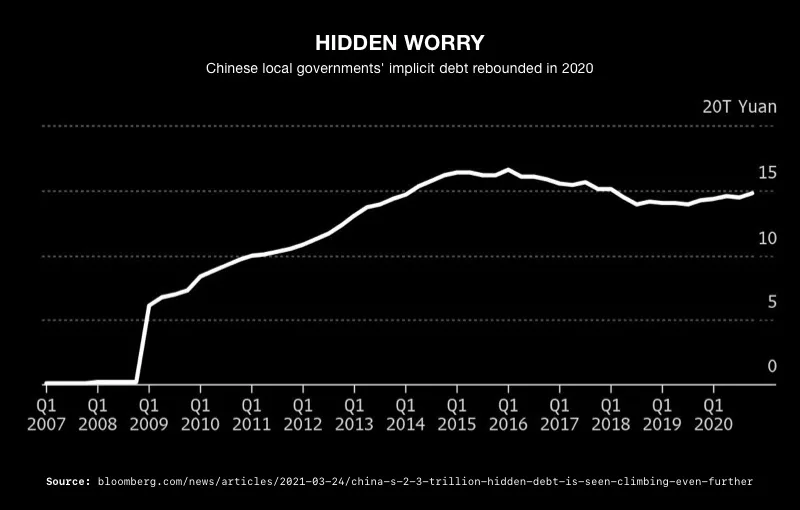

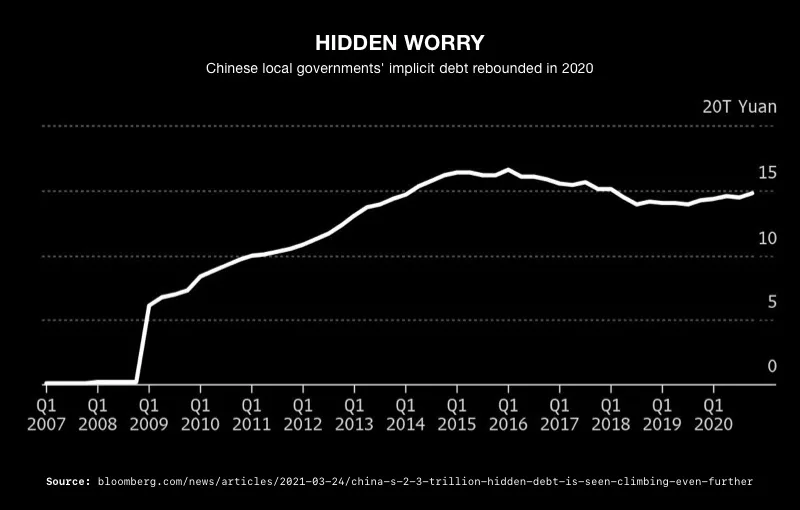

Economists cite a bigger concern that cities and provinces across the country have accumulated a massive amount of ‘hidden debt’ following years of unchecked borrowing and spending. Hidden debt in the Chinese economy refers to undisclosed or off-balance-sheet liabilities, often within local governments or state-owned enterprises, that are not fully transparent or accounted for in official reports or statements. The IMF and Wall Street banks estimate the total outstanding off-balance-sheet government debt is between $7 trillion and $11 trillion. A significant portion of that debt is at high risk of default.

3

3

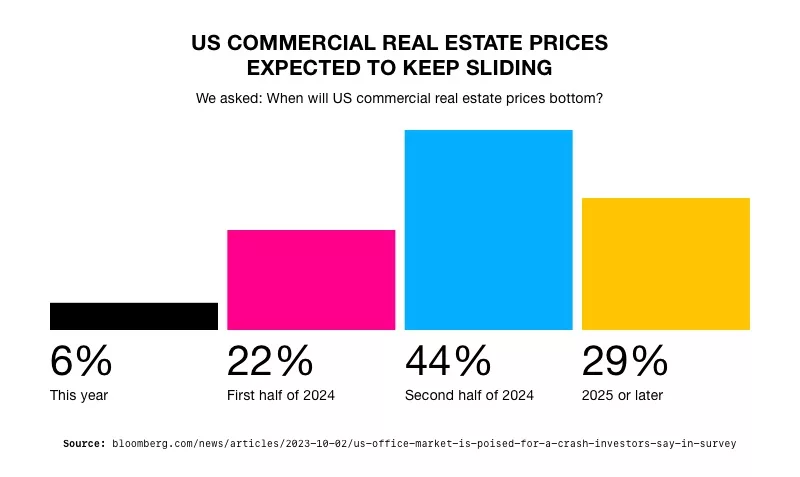

To get non-performing loans off their bank’s balance sheets, they are often bundled and sold to investors. The exact thing that the caused Global Financial Crisis of 2007-2008. That crisis was triggered in part by the bundling of subprime mortgages (high-risk loans given to borrowers with poor credit) into mortgage-backed securities (MBS) and collateralized debt obligations (CDOs), which were then sold to investors.

A wave of local bank defaults could spread losses far and wide. It could quickly snowball into a nationwide financial crisis. Credit markets could seize up and banks could start failing across the country.

Moody’s Investors Service lowered its outlook on China’s credit rating to negative from stable. They pointed to the central government needing to bail out local government debt and the country’s slowing economic growth.

China has also experienced a yearlong property bust and dozens of real estate defaults. Local governments and banks are being put at the greatest risk of collapse since they funded the majority of such projects. Local governments, however, are still under pressure to stimulate growth and are still borrowing heavily. Their outstanding debt has doubled since 2018.

Impact on the US

Much of China’s record growth was fueled by debt. With the bill coming due, China’s economy is rapidly sinking, like a house built on sand. With our highly connected world economy, China’s demise can have severe consequences for the US and significantly impact stock-based retirement funds.

There are various ways China’s decline will impact the West. Firstly, reduced demand for goods and services from China directly affects US companies reliant on exports to the country, impacting their revenue streams. Additionally, intricate supply chains involving Chinese components may face disruptions, hampering production capabilities of US firms. Moreover, a slowdown in China’s economy might decrease the demand for commodities, adversely affecting US energy and commodities sectors.

Investor uncertainty fueled by these events can spike market volatility and incite investors to offload stocks, further impacting market stability. Financial institutions with Chinese investments might undergo stress, potentially affecting US financial sectors. Furthermore, the depreciation of the yuan could instigate currency market instability.

As of now, US pension funds, individuals and institutional investors are on the hook for $2.1 trillion in Chinese companies listed on American exchanges. Holders of China’s foreign currency debt are at risk of losing $2.4 trillion.4

China’s economic chaos will eventually wash up on our shores. Before it does, it could pay to investigate how to protect the value of your retirement funds. One proven method is shifting assets in a Gold IRA. Contact American Hartford Gold today at 800-462-0071 to learn more.

2

2

9

9

3

3

3

3 5

5

5

5

5

5