- The Congressional Budget Office determined Social Security will need to cut benefits by 2034 when the trust fund goes broke

- A solution from Congress isn’t anticipated soon because it would require benefits cuts or higher taxes

- Advisors suggest preparing by protecting the value of savings with physical precious metals

Social Security Benefits Threatened

In the wake of demographic shifts and economic uncertainties, the specter of Social Security’s funding gap is casting a longer and longer shadow over the financial security of millions. Right now, one-quarter of US adults aged 50 or over have no retirement income outside of Social Security benefits. And unless there is significant action by Congress, most Americans are facing cuts in those benefits. Economists are emphasizing that people prepare now so they aren’t counting on benefits that might not exist when they need them.1

Americans are rapidly losing faith in the sustainability of Social Security. According to recent polls, 75% of adults aged 50 and older are worried Social Security will run out of funding in their lifetime. A further 24% of adults of all ages believe they won’t get a dime of benefits they have earned.2

To keep things in perspective, Social Security won’t run out of money entirely. But it is facing a massive financial shortfall. Social Security benefits are funded primarily through payroll taxes paid by current workers. Those taxes go to today’s beneficiaries. Payroll taxes aren’t going anywhere anytime soon. But they won’t be enough to completely cover future benefits.

Taxes haven’t fully funded Social Security in recent years. The SS Administration has been tapping its trust fund to bridge the gap and avoid cutting benefits. The trust fund is currently around $2.85 trillion.

The Congressional Budget Office (CBO) determined the trust fund will be exhausted as of 2034. After that, the program can only pay out as much as it takes in from payroll taxes. That is estimated to be around 80% of future benefits. So, retirees could expect a 20% cut in benefits if lawmakers can’t find a solution before then.3

4

4

The CBO noted the impact on starting benefits would be felt beginning with those born in 1969 (those turning 65 in 2034). For those born in the 1970s, there would be a 25% reduction in initial benefits. For those born in the 1980s, 26%. And 28% for those born in the 1990s (assuming you start taking benefits at 65). 5

Why the Shortfall

Social Security’s ticking time bomb can be traced to a few reasons. Birthrates have collapsed from the days of the baby boom. And people are living longer. So not as many people are paying into the system while more people are collecting benefits for longer.

Another factor contributing to the shortfall is the payroll tax cap. Incomes for the best paid 6% of earners rose by 62% from 1983 to 2000. For the other 94%, incomes rose by just 17%. The net result is that the lion’s share of US income growth was above the Social Security tax cap. All that income wasn’t subject to the program’s payroll taxes. The situation hasn’t changed. Last year, almost 20% of earnings weren’t subject to payroll taxes. An overall increase in wages during that time drove up benefits. But tax receipts didn’t keep pace. Some economists are now proposing to raise the cap or eliminating it altogether to help keep the fund solvent.6

Fixing the Problem

Despite headlines highlighting the program’s issues and its profound impact on all Americans, no action has been taken to address the problem thus far. Any changes to Social Security would require 60 votes in the Senate. Therefore, it would have to have agreement from both parties. But a solution would involve either raising taxes (by a third), cutting benefits (by a fourth), or a combination of both. Solutions that each party would vote against.

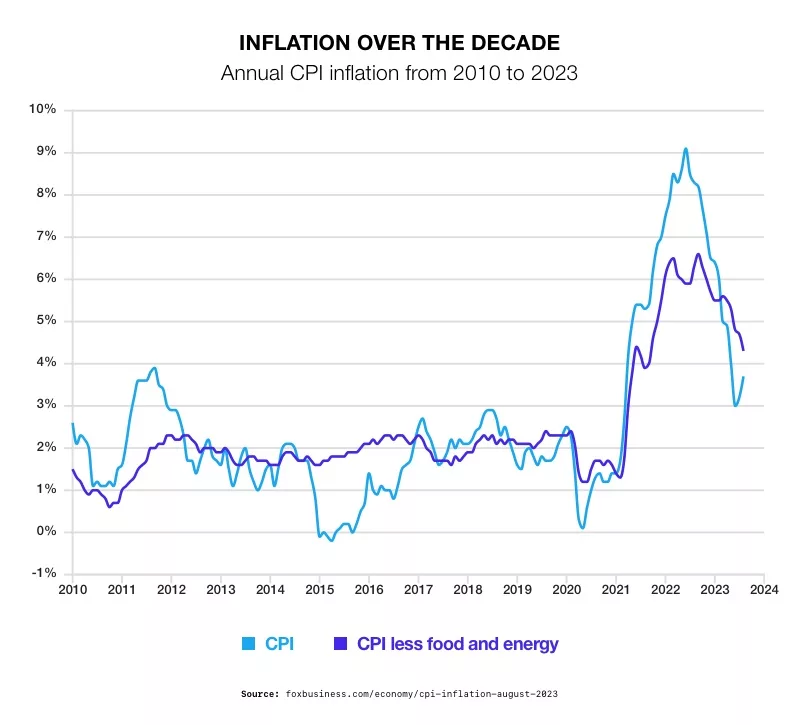

The Inflation Problem

Social Security has another problem besides benefit cuts. The benefits themselves have lost a substantial amount of buying power over the years. Social Security is designed to keep up with inflation. In most years, beneficiaries will receive a cost-of-living adjustment (COLA) to help benefits maintain their buying power.

However, inflation has consistently outpaced these COLAs. In fact, since 2000, Social Security has lost a whopping 40% of its buying power. If this trend continues, Social Security may be even less reliable in the future. If you’re expecting to depend on your monthly checks in retirement, it may be time to come up with a backup plan.7

Solutions

Financial advisors suggest there are ways to prepare for the Social Security shortfall. Off the bat, increasing your savings is a simple method to reduce your dependence on Social Security.

Another option is to consider delaying Social Security. Waiting until age 70 to start taking benefits will earn you at least 24% extra each month on top of your full benefit amount. That could potentially add up to hundreds of dollars per month. Since that adjustment is permanent, you’ll collect larger checks every month for the rest of your life.

An additional option to prepare for sharp cuts in benefits is to safeguard the value of your current retirement funds from inflation. You can investigate how physical precious metals such as gold and silver hedge against inflation. And if they are put in a Gold IRA, they also gain tax-advantages as they preserve your purchasing power. To learn more about how a Gold IRA can help safeguard your retirement from potential Social Security cuts, call us today at 800-462-0071.

1

1

2

2

2

2