- Half of Americans believe their finances are worse off since Biden took office

- The negative outlook is primarily due to high inflation, interests rates, and consumer debt

- Surveys show the economy will be the deciding factor in the 2024 election

Financial Situation Worse After Biden Elected

Since the 2020 election, the financial outlook for many Americans has taken a turn for the worse. According to a recent Bankrate survey, a staggering 50% of Americans now believe their financial situations have deteriorated over the past few years. Proving to be a significant blow to President Biden and his “Bidenomics” campaign theme, this downturn in economic confidence is shaping the direction this country takes in 2024.

The survey revealed that approximately 45% of respondents place the blame on President Biden and his economic policies. While 35% attribute their worsening financial situations to Congress. Another 27% hold the Federal Reserve responsible for their economic woes.1

2

2

Surprisingly, only a minority of those who reported an improvement in their financial situations credited President Biden for this positive change. In fact, more than half of those who witnessed improvements believed that neither President Biden, Congress, nor the Federal Reserve had played a significant role in helping them.

Unrelenting Inflation

The White House has been keen to emphasize the steady decline in inflation as one of the successes of the current administration, yet many families have yet to experience any real relief. Economists argue that this decline is primarily the result of Federal Reserve interest rate hikes rather than the President’s economic agenda. Inflation has decreased from its peak of 9.1% to 3.7% but it is still far from the Fed’s 2% target.3

The Consumer Price Index (CPI) remains significantly higher than the pre-pandemic rates. The costs of essentials like food, gasoline, and rent continue to be far more expensive than they were just a year ago. As a result, Americans are now forced to allocate approximately $700 more per month compared to two years ago, according to data from Moody’s Analytics.

Political Impact

These ongoing economic challenges are expected to have a considerable impact on the 2024 election. An astounding 89% of respondents revealed that the state of the economy will be a major factor influencing their vote. A majority of respondents, 69%, stated that their cost of living has worsened since November 2020. Forty two percent reported that their short-term savings have taken a hit. Furthermore, 34% expressed concerns about their long-term investments, including retirement savings.4

Unsurprisingly, the perception of a declining economy varies significantly among political affiliations. Generally, Republicans and independents are more likely to view the economy as having worsened compared to Democrats. Nonetheless, most of all Americans seem to attribute their financial woes to President Biden, Congress, and the Federal Reserve, with President Biden being the most frequently cited reason.

Interestingly, the sentiment that personal financial situations are worsening appears to be more pronounced among older generations, particularly Generation X and Baby Boomers. These groups share concerns about the state of their retirement savings, cost of living, and overall financial well-being as they approach retirement age and grapple with the harsh reality of their financial situations.

Causes of Pessimism

Several economic trends appear to be shaping this negative financial outlook:

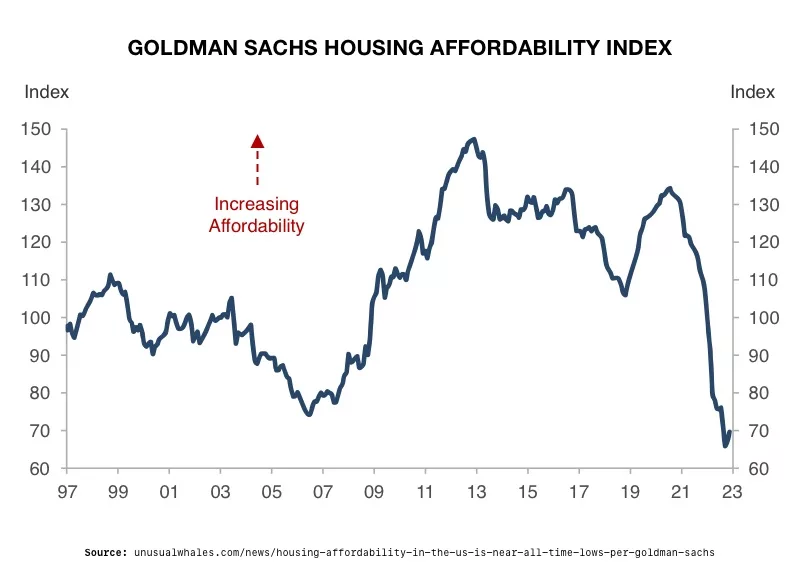

Interest Rates: Experts anticipate that interest rates will remain high throughout 2024, with no indications of cuts on the horizon. While these rates were increased to combat inflation, they have resulted in Americans paying more for car loans, mortgages, and home equity loans.

Inflation: Although inflation has decreased from its peak in 2022, it currently stands at 3.7%. Economists suggest that it may not hit the Fed’s 2% target until 2025 or 2026. High inflation leads to increased expenses across the board. It especially impacts the middle class and lower-income Americans who live paycheck to paycheck.

Consumer Debt: A significant number of Americans are grappling with substantial debt and minimal savings. Pandemic stimulus funds have been exhausted. Many individuals are now faced with repaying student loans and dealing with skyrocketing credit card debt. Studies indicate that 35% of Americans are carrying debt from month to month. The stress of which is taking a toll on their mental health.

Credit card debt has reached record highs, as have delinquencies. This growing reliance on credit cards raises concerns among economists, given astronomically high interest rates. The average annual percentage rate (APR) recently hit a new high of 20.72%, making it more expensive for consumers to repay their debt over time. The previous record was 19% back in 1991. The middle class is carrying a greater debt load at a greater cost as they turn to credit cards to cover everyday expenses.5

The New York Federal Reserve said credit card debt hit a record high at the end of September. It surged to $1.08 trillion from July to September, an increase of $48 billion. That is the highest level of credit card debt since 2003 and the 8th consecutive annual increase.

Furthermore, the amount of credit card debt contributed to a record total household debt of $17.29 billion. That is an increase of $2.9 trillion compared to the end of 2019.6

Delinquencies are also increasing. Borrowers are struggling with credit card, student, and auto loan payments. The number of newly delinquent individuals has surpassed the pre-pandemic level.

Future Outlook

Economic indicators suggest a 46% chance of entering a recession by September 2024, painting a bleak outlook for many. This general pessimism surrounding the economy has led to a collective feeling of hopelessness about the future.7

While economists and policymakers continue to grapple with high interest rates, inflation, and mounting consumer debt, individuals are left navigating an uncertain economic landscape. The importance of securing one’s savings and financial well-being cannot be overstated, especially in these turbulent times. Physical precious metals like gold and silver are seen as hedges against the potential repercussions of government economic policies. Notably, a Gold IRA offers an avenue for individuals to preserve and grow their wealth. To learn more about how a Gold IRA can serve as a shield for your savings, we encourage you to reach out to us at 800-462-0071.

1

1

2

2

4

4