- The first half of 2023 was record-setting for gold sales

- Gold demand is predicted to continue rising thru to 2024

- Demand is driven by gold’s safe haven qualities and the de-dollarization trend

Gold Continues Its Upward Trajectory

Gold is having a very good year and the trend is likely to continue to 2024. The global nature of the gold market has allowed different sectors and locations to support an overall rise in gold demand and prices. Central bank, investment, and jewelry demand are creating a supportive environment for gold prices. The London Bullion Market Association (LBMA) gold price averaged $1,976 during the second quarter – a record high. That’s 6% higher than last year and 4% higher than the previous record in 2020.1

Jewelry

Jewelry consumption improved despite high gold prices with a 3% increase over 2022. The overall rise was attributed to rebounding sales in China and Turkey. Analysts foresee holiday related spending supporting a continued rise to the end of the year.2

Investment

Bar and coin investment increased by 6% in H1 (the first half of the year). The increase was largely due to markets in the US and Turkey. In the US, investment demand was fueled by the banking crisis and the volatile debt ceiling negotiations. Momentum carried the market through to the end of the first half of the year.3

Over the counter investment (buying directly from a dealer) jumped in the second quarter. Sales hit 335 tons, with gold coins leading the way in year-over-year retail growth. In China, bar and coin investment grew 32% from last year.4

Meanwhile, US investors continued to show a strong appetite for bars and coins. H1 demand was 65 tons, the strongest half-yearly total since 2008 (the year of Global Financial Crisis). The collapse of Silicon Valley Bank and Signature Bank created shockwaves that sent investors scrambling to buy physical bullion products. US Mint coin sales reflect this upsurge in demand. Sales of American Eagles and Buffaloes reached almost 1 million ounces by the end of June. Compare that with annual sales of 1.4 million ounces over the full year 2022.5

There is a sense that investment interest remains piqued. Demand will likely rise as we approach the 2024 presidential election campaigns and if any signs of banking instability re-emerge.

Central Banks

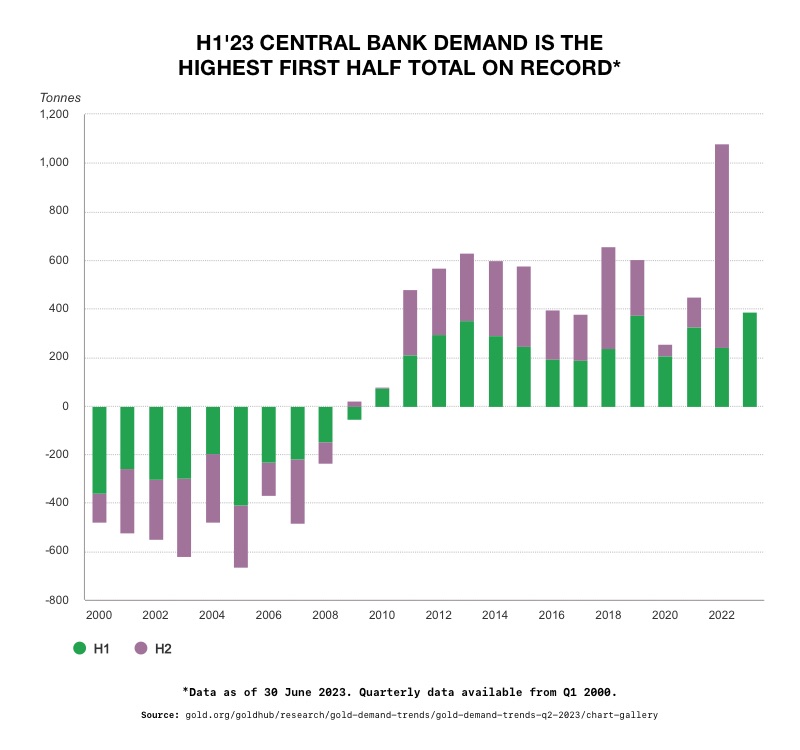

The World Gold Council’s latest Gold Demand Trends report shows that gold benefited from record central bank buying in the first half of the year. Central bank buying in H1 reached 387 tons. Buying slowed down in the second quarter, but a strong first quarter sealed the deal. Gold purchases are widespread among emerging and developed countries.

6

6

Massive central bank purchases are continuing the trend from last year. In 2022, central banks added an eye-catching 1,136 tons of gold, worth about $70 billion, to their stockpiles. According to World Gold Council data, it was the largest amount bought, until this year, since 1950.7

Analysts forecast central bank buying will remain strong thru to the end of the year. The global de-dollarization wave is pushing demand. Sanctions on Russia have other countries reducing their reliance on the dollar. They are turning to gold for reserves instead.

Chinese analysts noted that due to an accelerating global de-dollarization trend, the current “gold rush” shows no signs of stopping. It is expected to continue in the coming months. As of June 2023, gold reserves held by the People’s Bank of China (PBC) reached 1,926 tons. That marked an increase of 680,000 ounces compared to the previous month. This makes the eighth consecutive month of rising gold purchases by the PBC.8

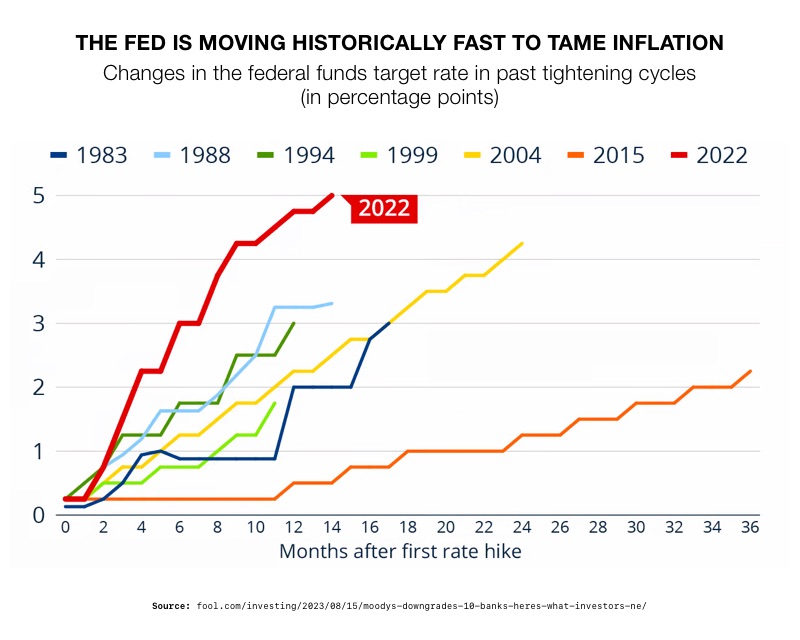

The US Federal Reserve’s aggressive interest rate hikes since early 2022 have exerted significant devaluation pressure on non-dollar currencies. Under this circumstance, only increasing gold reserves can help other countries stabilize the exchange rates of their currencies, said Chinese bank analysts.

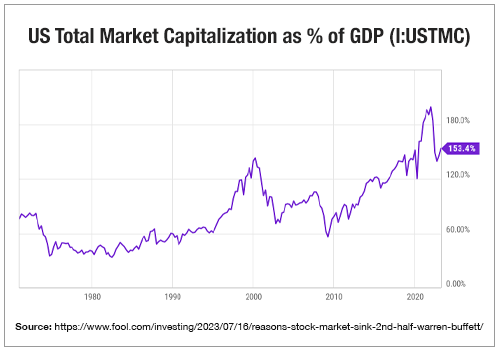

Rating agency Fitch Ratings’ recent downgrade of the US credit rating has also sped up the de-dollarization movement. This surge in investor risk aversion could further drive-up gold prices.

Louise Street, Senior Markets Analyst at the World Gold Council, commented:

“Record central bank demand has dominated the gold market over the last year and, despite a slower pace in Q2, this trend underscores gold’s importance as a safe haven asset amid ongoing geopolitical tensions and challenging economic conditions around the world.”9

China

For China, increasing gold reserves is also a means to help internationalize the yuan. Sufficient gold will give the yuan the backing and credibility it needs to become a dominant international currency. They aim to lure other central banks to start using the yuan for settling international trade instead of the dollar.

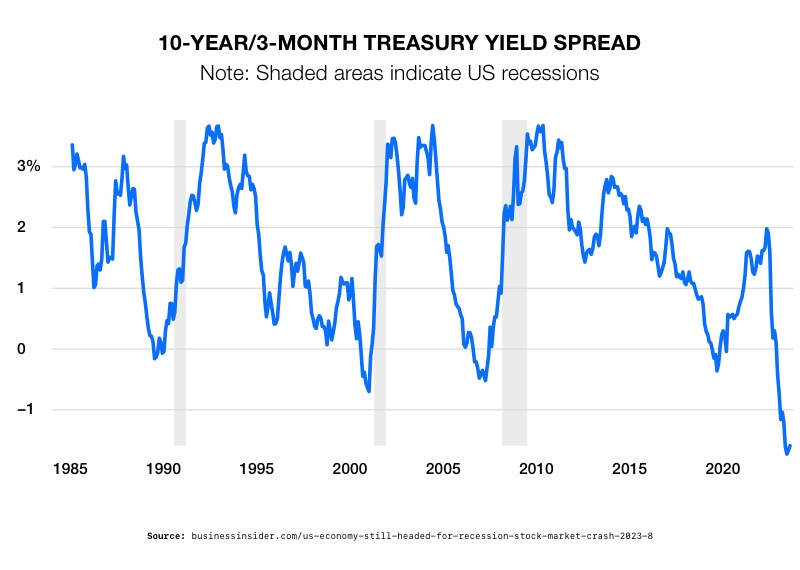

Recession

A looming global recession will also spur greater gold demand. Street said, “Looking ahead to the second half of 2023, an economic contraction could bring additional upside for gold, further reinforcing its safe-haven asset status. In this scenario, gold would be supported by demand from investors and central banks, helping to offset any weakness in jewelry and technology demand triggered by a squeeze on consumer spending.”10

Conclusion

The data clearly points to a potential continued upward trajectory for gold. The precious metal is sought by investors and central banks alike for its inherent safe haven qualities. You can take advantage of those qualities with a Gold IRA from American Hartford Gold. Contact us today at 800-462-0071 to learn more.

4

4

1

1

2

2

2

2