- The housing market is frozen in ‘gridlock’: not getting worse but not getting better

- High interest rates are dampening sales, keeping prices elevated, limiting supply, and increasing foreclosures

- With home equity becoming inaccessible, people are turning to physical precious metals for long-term stores of wealth

The American Dream of Homeownership Put on Hold

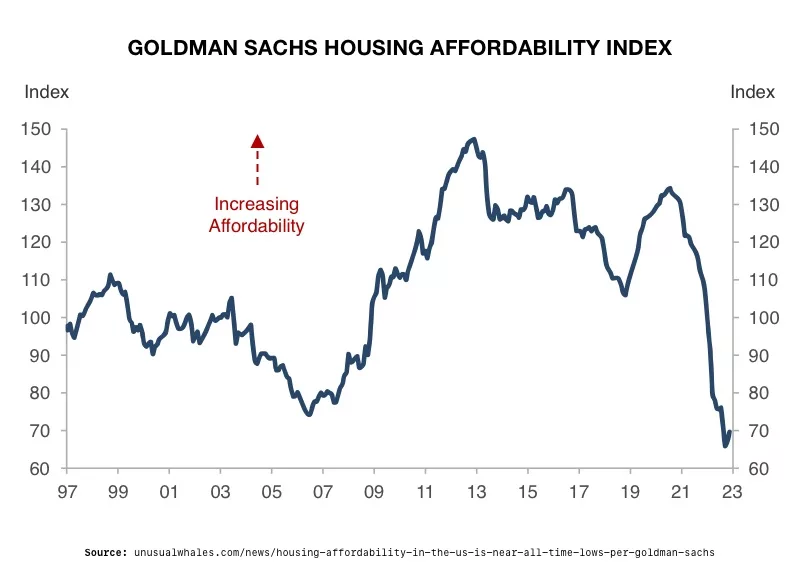

The American Dream of home ownership continues to be deferred. A once reliable long-term store of wealth is escaping the grasp of most Americans. As mortgage rates race to 8%, mortgage demand has plummeted to its lowest point in three decades. Housing affordability is now worse than it was during the peak of the 2008 housing bubble. And real estate experts fear the only thing that can fix the situation stands in direct opposition to the policy that created the problem in the first place.1

Overall Housing Market Decline

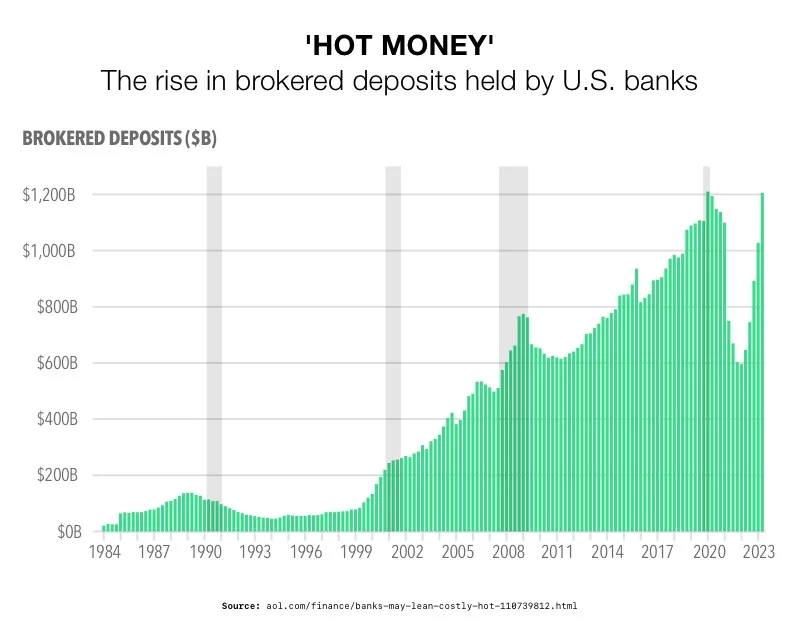

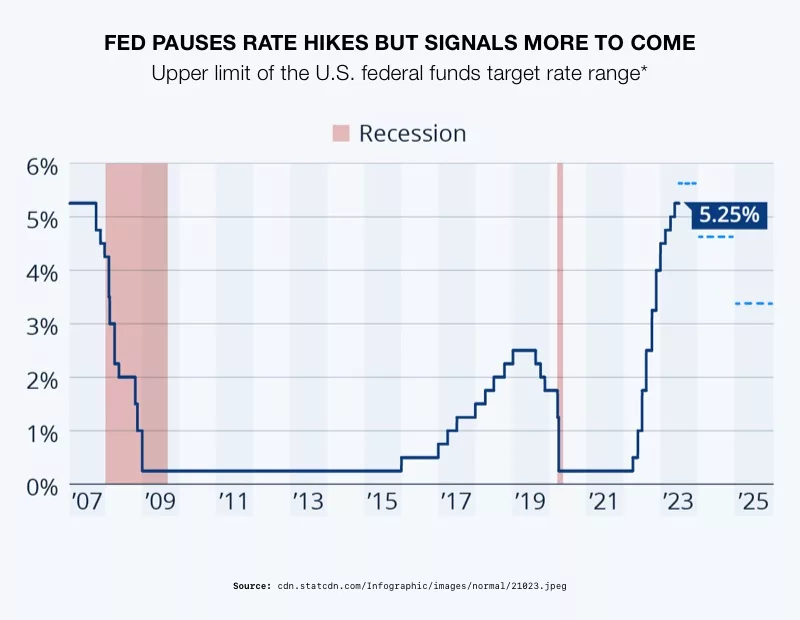

The slide in the housing market is primarily due to the increase in interest rates. The average rate for a 30-year loan has been on the rise six consecutive weeks. It is now reaching 7.7%. This figure is the highest it’s been since November 2000. In comparison, the average rate stood at 3.9% before the pandemic hit. The Fed has hinted at yet another rate hike this year. There is an expectation that rates will remain high for an extended period of time.2

In response to the Fed’s aggressive interest rate hikes, there has been a dramatic shift in application volumes. The Mortgage Bankers Association’s index of mortgage applications fell a staggering 6.9% in the last week. They dropped to levels last seen in 1995. Application volume has shrunk by 21% compared to the same time the previous year. The demand for refinancing is no exception. It has fallen by 10% over the past week, down 12% from the same period last year.3

Affordability and Inventory

4

4

High mortgage rates are having a direct impact on housing affordability and inventory. Homeowners are hesitant to sell their properties. Those who locked in low mortgage rates now find themselves unwilling to sell while rates hover near two-decade highs. Consequently, there is a shortage of available homes for potential buyers, resulting in a surplus of demand.

The shortage of homes on the market has led to a plummet in sales. In 2021, mortgage rates had dropped to the mid-2% range, leading to a surge in home sales. However, after the spike in mortgage rates, sales have significantly decreased. This year is on pace for a 17% decline from 2022.5

Real estate experts suggest that the housing market will not rebound until more homes are available. Available home supply remains down by a staggering 45.1% compared to pre-pandemic levels. This scenario is unlikely to change until mortgage rates fall to at least the mid-5% range, according to experts.6

Homebuilders are unable to construct new homes quickly enough to alleviate the housing shortage, which has led to a gridlock in the housing market. The National Association of Home Builders/Wells Fargo Housing Market Index, which measures the pulse of the single-family housing market, has fallen for the third straight month, dropping by 5 points to 40. This is the lowest reading since January 2023, and any reading below 50 is considered negative.7

Home builders are doing everything in their power to attract buyers, including cutting prices. In October, 32% of builders reported cutting home prices to encourage sales. Typically, a near tripling of mortgage rates over such a short period would result in lower home prices as buyers can only afford so much. However, the scarcity of supply is keeping prices inflated. Homeowners are only selling if there is a life event necessitating a move, such as a death, divorce, or relocation for work.

The Fed’s Housing Market Trap

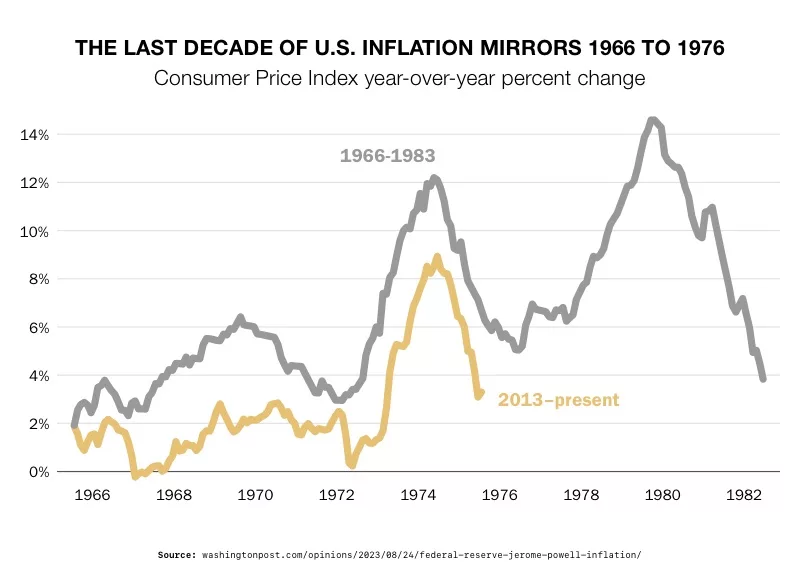

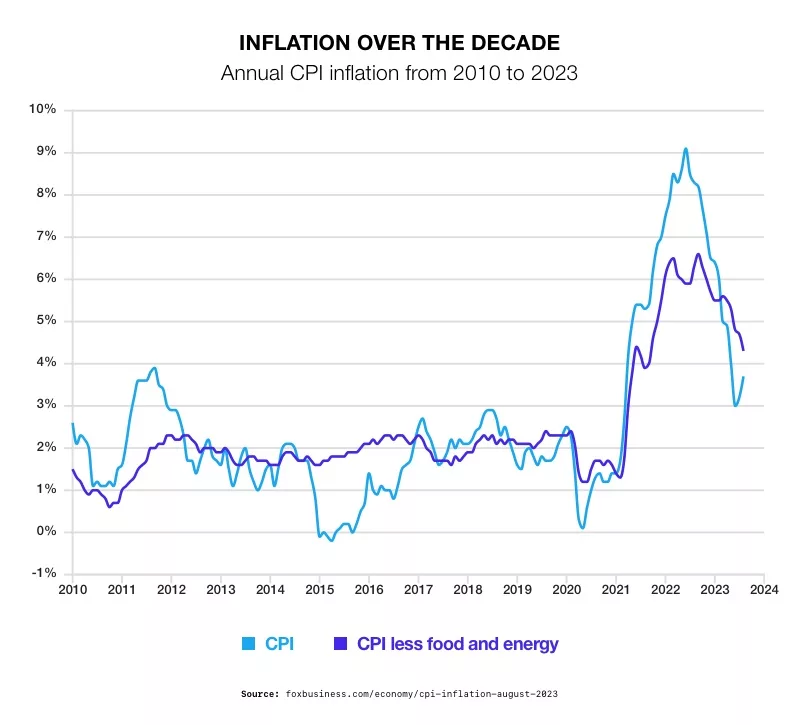

Experts in the real estate market have pointed out the paradox that the Federal Reserve and the housing market find themselves in. Although high interest rates were intended to combat inflation, they are preventing builders from increasing the housing supply. Thereby, reducing demand pressure and lowering prices. In the realm of housing, lowering rates would actually reduce inflation. Robert Dietz, Chief Economist of the National Association of Home Builders, stated, “Boosting housing production would help reduce the shelter inflation component that was responsible for more than half of the overall Consumer Price Index increase in September and aid the Fed’s mission to bring inflation back down to 2%. However, uncertainty regarding monetary policy is contributing to affordability challenges in the market.”8

Devyn Bachman, Senior Vice President of Research at John Burns Research and Consulting, stressed, “In order for the market to recover, we need more inventory. The only way we’re going to receive that inventory is if or when mortgage rates retreat.”9

Other Concerns

Adding to these concerns is the increase in home foreclosures across the nation. They have surged by 34% compared to the same time last year, according to real estate data provider ATTOM. Their data shows that foreclosure filings have spiked by 28% in the third quarter. Analysts fear the problem may worsen with the resumption of student loan payments.10

A poll conducted by Pulsenomics revealed that most economists believe that homeownership rates will be affected for at least a year by the resumption of student loan payments. In total, borrowers will resume paying approximately $10 billion a month, posing a significant challenge to the stability of the housing market.

Conclusion

As the deputy chief economist at First American Financial Corp said, “This market is anything but normal.”11 The housing market is facing a challenging gridlock, with the root of the issue stemming from interest rate hikes aimed at curbing inflation. While homeowners watch their home equity grow, it remains locked in without an opportunity to access it without losses due to high mortgage rates. In such times of uncertainty, people should consider seeking additional pillars of support for their retirement. One solution that can weather the storm of interest rate hikes is a Gold IRA. Offering safety, stability, and long-term preservation of portfolio value, it stands as a reliable alternative to personal real estate in an unpredictable housing market. Contact us today at 800-461-0071 to learn more.

2

2

5

5

4

4

1

1

2

2