- Economists say the ‘Everything Bubble’ is going to burst in 2024

- The country will experience one of the biggest stock market crashes in history as a result

- Financial gurus advise protecting portfolio value with precious metals

Bursting ‘Everything Bubble’ Could Devastate Economy

Since 2009, an ‘everything bubble’ – composed of stocks, bonds, real estate, and crypto – has been inflated by unprecedented money printing and deficits. Today’s prices are deemed by some experts as 100% artificial. But now, the tap of free money has been turned off and the bill for the astronomical debt is coming due. Harry Dent, a leading economist said, “I think 2024 is going to be the biggest single crash year we’ll see in our lifetimes.” He continued, “I don’t think we’ll ever see a bubble for any of our lifetimes again”. 1

Market bubbles are characterized by a rapid rise in stock prices before being met by a sharp fall.

Dent stated the ‘everything bubble’ picked up momentum in late 2021. The first signs of it bursting occurred in 2022 when the Nasdaq dropped 38%. In 2024, Dent predicts the ‘B wave’ of the crash will occur.

2

2

According to his analysis, this crash is not going to be a correction. A stock market correction refers to a short-term reverse movement in the stock market. Typically, a decline of around 10% or more from the recent peak in stock prices. Corrections are considered normal and are part of the market cycles. They are distinct from bear markets, which involve more prolonged downturns and larger drops in stock prices. Corrections are seen as healthy adjustments that can bring stock prices back in line with their fundamental values and prevent overvaluation.

Instead, Dent maintains that the drastic drop in market value will recreate conditions like the Great Depression. He predicted an 86% crash in the S&P 500, 92% drop in the Nasdaq, and a 96% dip in crypto. Housing is also projected to lose 50% of its value, declining more than at any time in history. 3

Dent considers this current surge in the market a ‘gift’ of time to get yourself out before the crash happens.

The Fed & Rate Cuts

The current leap in stock prices can be traced to optimism about potential interest rate cuts in 2024. Policymakers, in their annual projections, priced in the potential of three rate cuts, with the federal funds rate falling to a range of 4.4% to 4.9%, down from the current 5.25% to 5.50%.

Examining the Federal Reserve’s anticipated rate adjustments, Dent said that achieving a ‘soft landing’ was virtually impossible. He believes the Fed has overtightened and the full impact of the rate cuts will be felt in 2024. And when they hit, the damage to the economy will be severe. He deduces the economy will move beyond recession and into depression. Dent doesn’t see the economy recovering for at least a decade.

Dent isn’t alone in his forecast. “Rich Dad, Poor Dad” author Robert Kiyosaki is also sounding the alarm. He stated, “This may be the start of the biggest crash in history. Hope I am wrong yet no time to play Russian Roulette with your life.”4

Kiyosaki focused on the impact the crash will have on retirement savings. As millions of Americans are heavily invested in the stock market via their retirement funds, a substantial decline in the S&P 500 could have catastrophic consequences. In the market downturn of 2022, participants in 401(k) and IRA plans collectively suffered an estimated loss of roughly $3 trillion.5

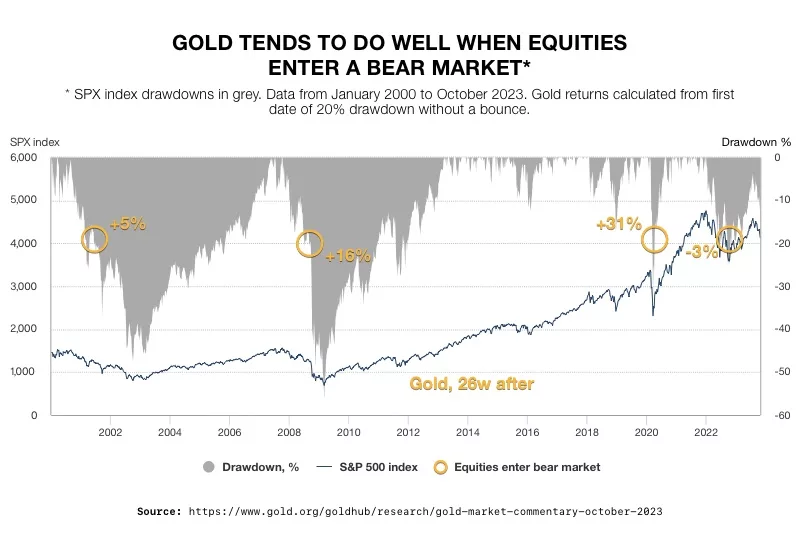

Kiyosaki offered this advice to prepare for the upcoming crisis: Buy gold while you still can. Gold is a time-tested safe haven asset that can safeguard your future from economic collapse. Gold is already at all-time-highs and experts predict that it is only going to go higher.

“You will wish you had bought gold below $2,000. Next stop gold $3,700,” said Robert Kiyosaki.6

There are many ways to gain exposure to gold and silver, but Kiyosaki prefers to just buy the physical metals directly. “I do not touch paper gold or silver ETFs. I only want real gold or silver coins.”7

Reckless government spending and monetary policy have created the ‘everything bubble’ – with drastically overinflated prices for stocks, bonds, real estate, and cryptocurrencies. And signs point to the bubble bursting in 2024. And when it does, economists see the worst stock market crash happening in our lifetimes. Retirement funds could be wiped out. Now is the time to protect your portfolio. A Gold IRA from American Hartford Gold can shield your assets from the severe impact of the bursting ‘everything bubble’. Contact us today at 800-462-0071 to learn more.

9

9

3

3

3

3 5

5

5

5

5

5