- Inflation rose for the second consecutive month in August

- Stubborn inflation may trigger even higher interest rate hikes from the Fed

- JPMorgan Chase CEO Dimon warns of an impending downturn

Inflation Climb Continues

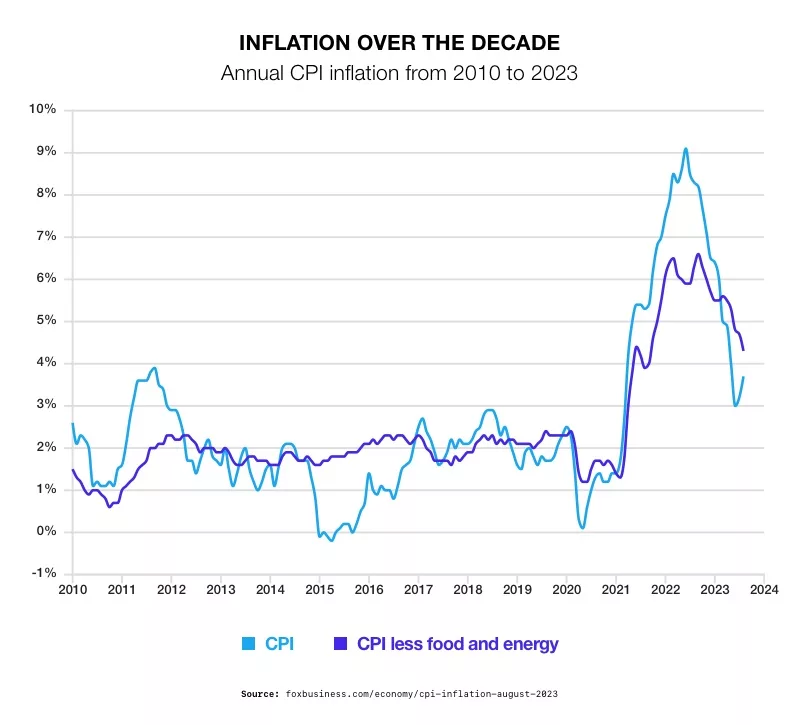

Pushing consumer prices to alarming new heights, unrelenting inflation continues to be a major concern. It accelerated for a second consecutive month in August. The Consumer Price Index (CPI), which measures the price of everyday goods like gasoline, groceries, and rents, surged in August compared to the previous month. This increase marked the steepest monthly rise this year. On a year-over-year basis, prices climbed by a daunting 3.7%, exceeding the reading in July. The seemingly unsolvable problem of inflation has financial experts growing more concerned about recession.1

The problem reaches beyond just headline inflation. That rise is largely attributable to a leap in gas prices. Core prices, which exclude the more volatile measurements of food and energy, also rose in August. It came in much higher than expected. Core prices are showing just how intractable inflation is becoming. They remain more than two times higher than pre-pandemic levels.

2

2

The Fed Response

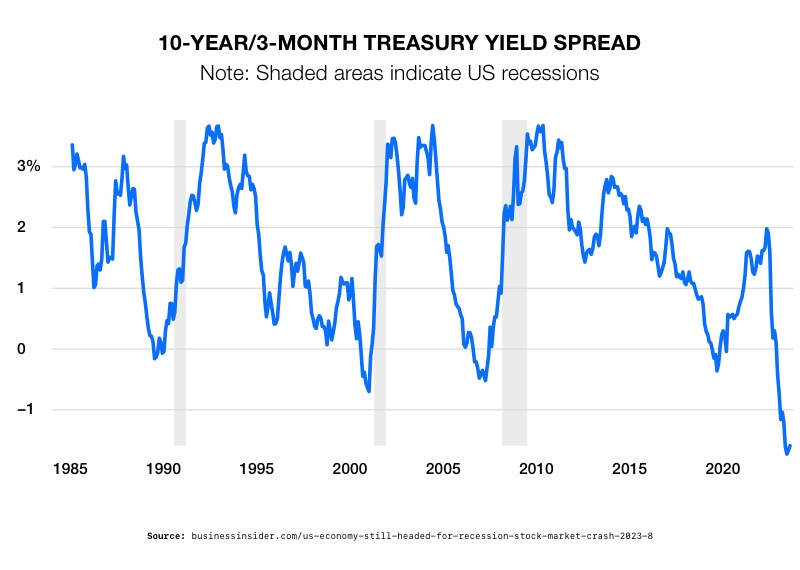

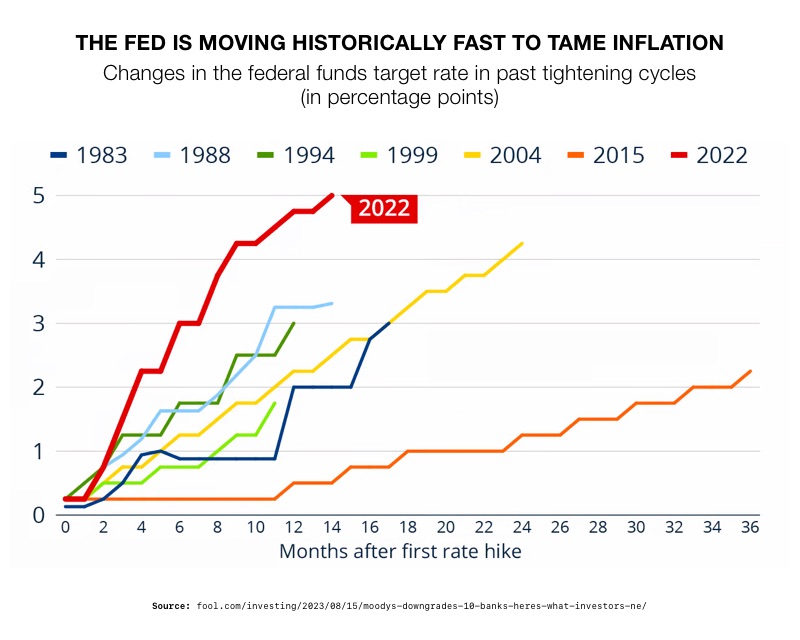

The Fed has been aggressively raising interest rates to combat inflation. They are on one of the fastest tightening paces in decades. Despite efforts to curb inflation, it remains well above the Federal Reserve’s 2% target. As of now, the Fed is expected to maintain rates at their current 22-year high during their upcoming meeting in September. However, August’s hotter-than-expected inflation report could influence further rate hikes in the fourth quarter. That is much to the dismay of Wall Street, which was hoping for a pause, or even a cut, in rates that could spur the growth of stock prices.

Inflation’s Personal Impact

Benjamin Franklin said small leaks will sink great ships. Governments and corporations can argue about what effect a small percentage change in data will have on the macrolevel. But inflation’s impact on the individual is what truly moves the economy. And that impact is looking grim.

US household income faced a decline in 2022 for the third consecutive year. This decline was primarily attributed to the soaring 7.8% inflation rate. It marks the largest annual increase in the cost of living since 1981. People are running out of savings to keep up with rising prices. Total household debt reached $17.06 trillion in Q2 2023 and credit card debt exceeded $1 trillion.3

The Supplemental Poverty Measure (SPM) considers participation in government programs. It increased from 5.2% in 2021 to 12.4% in 2022. The data highlights the financial struggle faced by many Americans as the cost of living continues to rise.4

People shouldn’t expect relief anytime soon. Robert Frick is an economist with Navy Federal Credit Union. He said, “This was bad news for Americans who feel inflation most acutely when filling their tanks and writing their rent checks… And given core inflation rose, it’s clear inflation around current levels may be with us for months.”5

A Warning from Wall Street

JPMorgan CEO Jamie Dimon issued a stark warning about the US economy. Dimon said, “We’ve been spending money like drunken sailors around the world…To say the consumer is strong today, meaning you are going to have a booming environment for years, is a huge mistake.” He cited several significant headwinds to the economy. He included stubborn core inflation, continuing war, and high interest rates.6

Dimon has previously warned about an impending “economic hurricane.” He now expresses doubts about the concept of a “soft landing.” While some economists anticipate a gentle economic slowdown, Dimon remains skeptical. He raised concerns about the Federal Reserve’s quantitative tightening campaign, increased reliance on fiscal deficits, and the downstream impact of various economic factors. Dimon emphasized that the impact of these changes might not be evident immediately. Businesses should be prepared for potential disruptions in the coming year.

Protecting Your Portfolio from Inflation

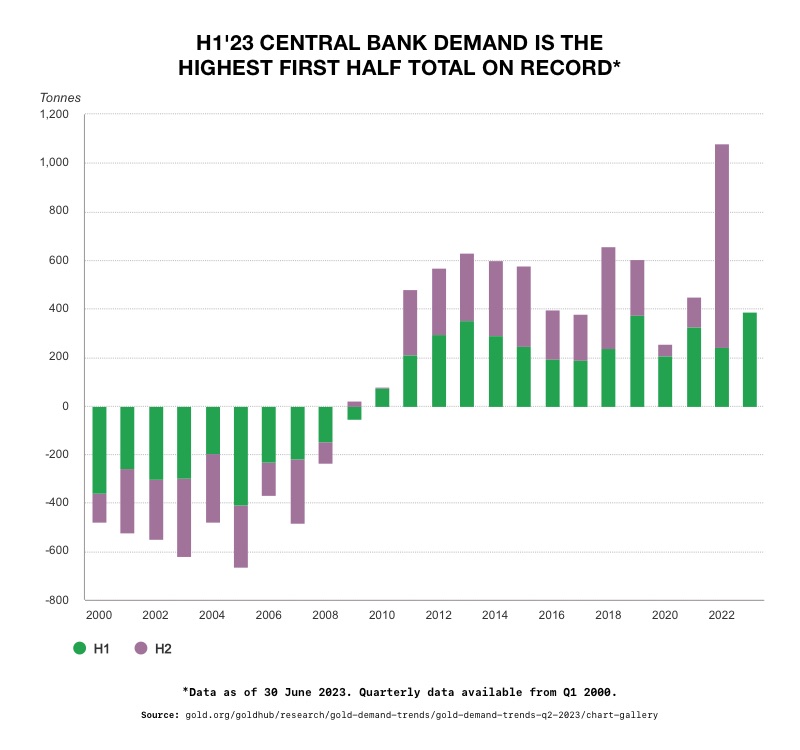

In times of rising inflation and economic uncertainty, it’s essential to consider strategies to safeguard your funds. A Gold IRA from American Hartford Gold can provide a valuable hedge against inflation. Precious metals like gold have historically preserved wealth and retained their value when traditional assets falter. By diversifying your portfolio with a Gold IRA, you can mitigate the impact of inflation and economic turbulence, ensuring a more secure financial future. Learn more today by contacting American Hartford Gold at 800-462-0071.

2

2

6

6

4

4

1

1