- The national deficit is projected to double from $1 trillion to $2 trillion

- Increased deficits can lead to inflation, high interest rates, and recession

- Safe haven assets like physical gold and silver can protect funds from the effects of soaring deficits

Deficit Doubles

The American economic landscape is approaching a steep cliff that is growing drastically higher. The US federal budget deficit is projected to double this year. The non-partisan Committee for a Responsible Federal Budget (CRFB) estimates it will grow from about $1 trillion to a staggering $2 trillion. The chasm between government spending and revenue collection is widening at an alarming rate, unseen since major crises such as World War II and the 2008 financial meltdown. The soaring budget deficit could have catastrophic consequences for retirement funds and the economy as a whole.1

2

2

Deficit Growth Paradox

Traditionally, deficits tend to shrink during periods of economic growth. Increased business activities and higher income levels lead to greater tax revenues. Also, government must spend less on unemployment benefits. However, economists are baffled. The current deficit surge defies conventional economic wisdom. It is occurring during a time of strong economic growth, record-low unemployment rates, and thriving corporate profits.

Deficit Causes:

The deficit explosion follows a record drop in the budget deficit last year. It fell from about $3 trillion to roughly $1 trillion. That drop was due to an uptick in capital gains revenue as Americans sold more stock and recorded large gains. The Treasury department in 2022 also benefitted from a spike in general tax collection. Inflation pushed up the nominal income for millions of households.3

Several factors contribute to the exponential growth of the federal budget deficit in 2023:

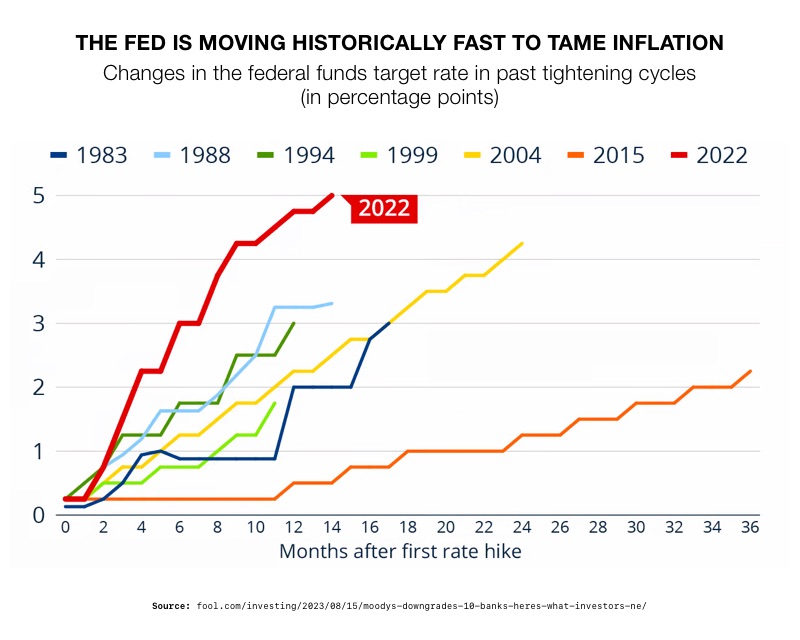

High Inflation: Soaring inflation rates are eroding the purchasing power of the dollar. The government must spend more to provide essential services and pay off debt.

Escalating Interest Payments: As the government accumulates more debt, interest payments rise substantially. Funds need to be diverted away from other critical areas of the budget.

Declining Tax Receipts: Falling markets have led to a sharp decline in capital gains revenue. Higher tax brackets and standard deductions resulted in less tax revenue for the IRS in 2023.

Government Expenditures: Government spending increased in 2023. Social Security and Medicare costs rose since they are indexed to inflation. Also, the 2022 Inflation Reduction Act started disbursing billions of dollars.

The Deficit’s Worrisome Transformation

From August 2022 to July 2023, the federal government spent approximately $6.7 trillion while collecting only $4.5 trillion in revenue. This represents a stark 16% increase in spending compared to the previous year. That is coupled with a 7% decrease in revenue.4

The change has economists worried. Marc Goldwein is the senior policy director at the CRBF. He said, “That’s pretty scary, because normal before the pandemic was $1 trillion. And in 2015, it was $500 billion. So, we went from $500 billion is the normal, to $1 trillion is the normal, to $2 trillion is the normal in less than a decade.”5

Deficit Impact

The deficit surge comes as lawmakers rush to avert a government shutdown. They are looking to pass a short-term deal to keep the government running. Expect deadlock as the sides spar over spending cuts and expiring tax cuts. If talks stall, a government shutdown would be catastrophic for the country.

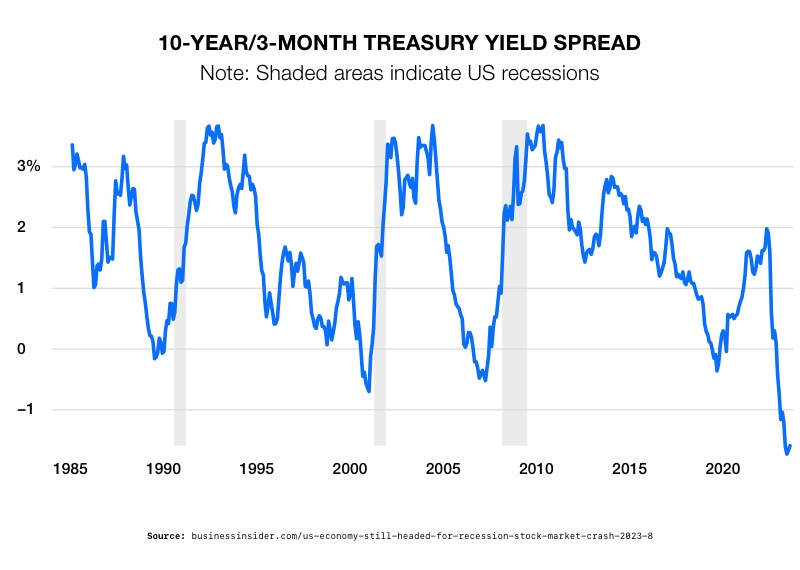

Economists anticipate annual deficits approaching $3 trillion within a decade. Such high deficits can lead to inflation, higher interest rates, and ultimately, a debt crisis. Soaring interest rates could stifle private investment and make loans prohibitively expensive.

Brian Riedle is an economist at the Manhattan Institute. He warns, “A debt growing much faster than the economy will drive up interest rates, reduce economic investment, and over time make interest payments the largest federal expenditure — risking a federal debt crisis.”6

Higher deficits also hamper the government’s ability to respond effectively to economic downturns. This could lead to prolonged recessions and even depressions.

The Mounting Interest Burden

Interest on the national debt is projected to soar to $5.4 trillion by 2053. That surpasses the amount spent on critical programs like Social Security, Medicaid, Medicare, and defense. It could consume up to 35% of all federal revenue in three decades. Interest payments alone are estimated to triple to a staggering $1.4 trillion by 2032. These spiraling interest costs, coupled with surging national debt, could make borrowing money for the country increasingly expensive. The risk of an existential crisis for the country is real.7

“Higher interest costs could crowd out important public investments that can fuel economic growth — priority areas like education, research and development, and infrastructure. A nation saddled with debt will have less to invest in its own future,” the Peter Peterson Foundation said.8

Conclusion

The ballooning US federal budget deficit poses an existential threat to the nation’s economic stability and prosperity. As the deficit spirals out of control and the national debt skyrockets, it becomes increasingly vital to safeguard your financial future, including your retirement funds.

To protect your retirement funds, consider exploring alternatives such as a Gold IRA from American Hartford Gold. In uncertain times, diversifying your investments with assets that historically retain their value, like precious metals, can offer a measure of financial security. Contact us today at 800–462-0071.

6

6

4

4

1

1