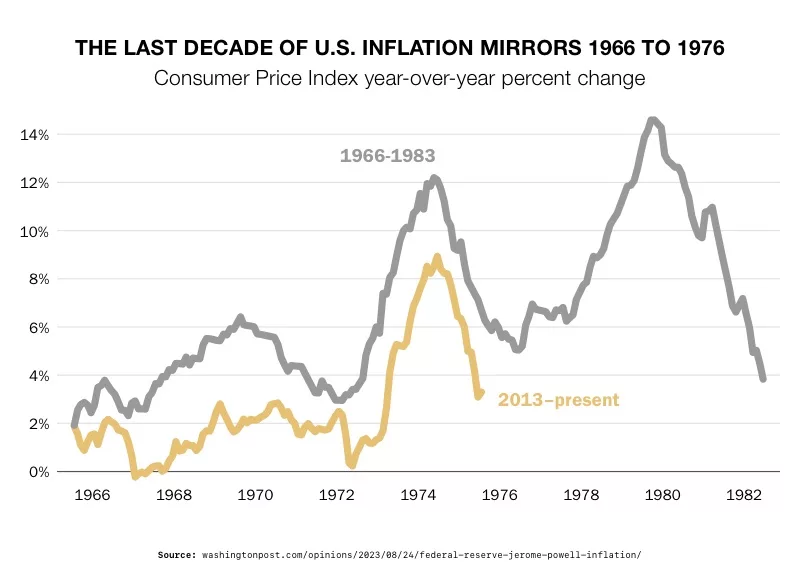

- War, oil shocks, and stubborn inflation has some analysts predicting a return to ’70s-style stagflation

- High interest rates are stagnating the economy along with prolonged inflation expectations

- Market makers advise minimizing market risk and exposure, in the way physical precious metals can

Analysts Warn of Stagflation Threat

With trouble in the Middle East, spiking oil prices, and skyrocketing inflation, it’s like we’re in a 1970’s flashback. But instead of a return to disco, the US is facing a return to stagflation – the dreaded economic condition characterized by stagnant economic growth, high unemployment, and simultaneously high inflation.

Stagflation is when the economy gets caught in a trap. Imagine you have two levers: one for taming inflation, and the other for boosting economic growth. Pulling one lever, say, to control inflation, often ends up pushing the other in the wrong direction, potentially making the recession worse while trying to combat rising prices, and vice versa. It’s like trying to fix one thing and accidentally breaking another. The only solution that seems to work is essentially breaking the whole machine and starting from scratch.

Warning from JPMorgan Chase

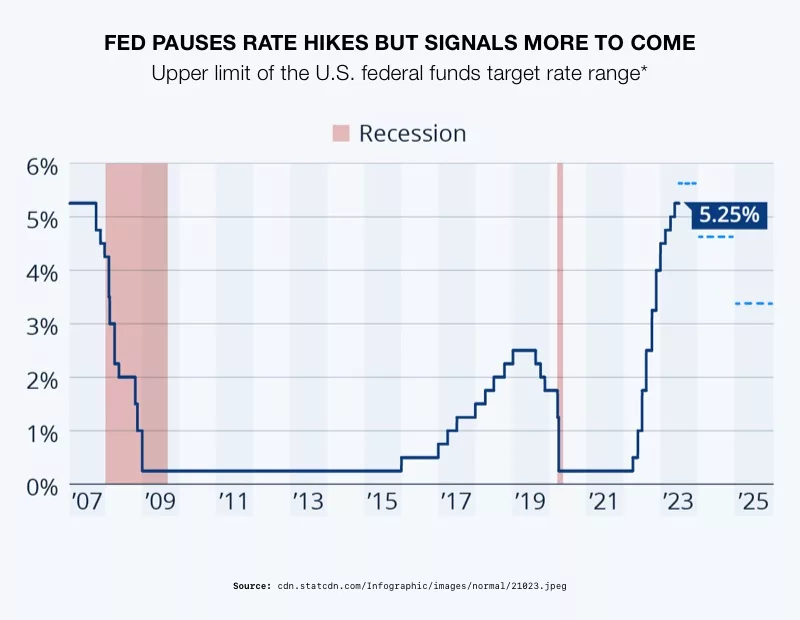

Jamie Dimon is the CEO of JPMorgan Chase. He sees potential stagflation on the horizon. His forecast is tied into his belief that interest rates may break 7%. Dimon’s worries come from the impact that higher interest rates have on debt repayment. Higher interest rates can make repaying debt more expensive. This adds financial stress on individuals and businesses. When interest rates rise significantly, the risk and number of loan defaults also increases. Dimon calculates a 7% interest rate could be devastating to an economy.1

Deutsche Bank Prediction

Deutsche Bank also fears a return to ’70’- style stagflation. Deutsche Bank sees current parallels with that decade – unrest in the Middle East, anemic growth, stubborn inflation, and labor unrest.

2

2

Between 1973 and 1983, GDP rates plummeted. Inflation averaged 11.3% and there was an

oil price shock caused by war. Today, the Russia-Ukraine war lifted oil prices from around $80 per barrel at the start of 2022 to over $139 in just three months. Deutsch Bank analysts said, “These supply shocks caused serious difficulties for the economy, both in the 1970s and today, since they push up inflation and dampen growth at the same time.”3

The number of striking workers is also on the rise in a repeat of the 1970s. Actors, screenwriters, autoworkers, journalists, and more have all taken steps to push for higher wages to compensate for inflation. Fifty years ago, US workers struck to raise their wages by as much as 9% annually to compensate for rising prices. But some economists believe the persistent wage increases helped exacerbate inflation and fear current worker strikes could do the same.

Deutsche Bank analysts are concerned unchecked inflation expectations will lead to recession. Inflation expectations refer to people’s anticipations about the future rate of inflation. These expectations influence economic decisions such as spending, saving, and investing. If expectations aren’t contained, spending and investing could dry up. Recession would result.

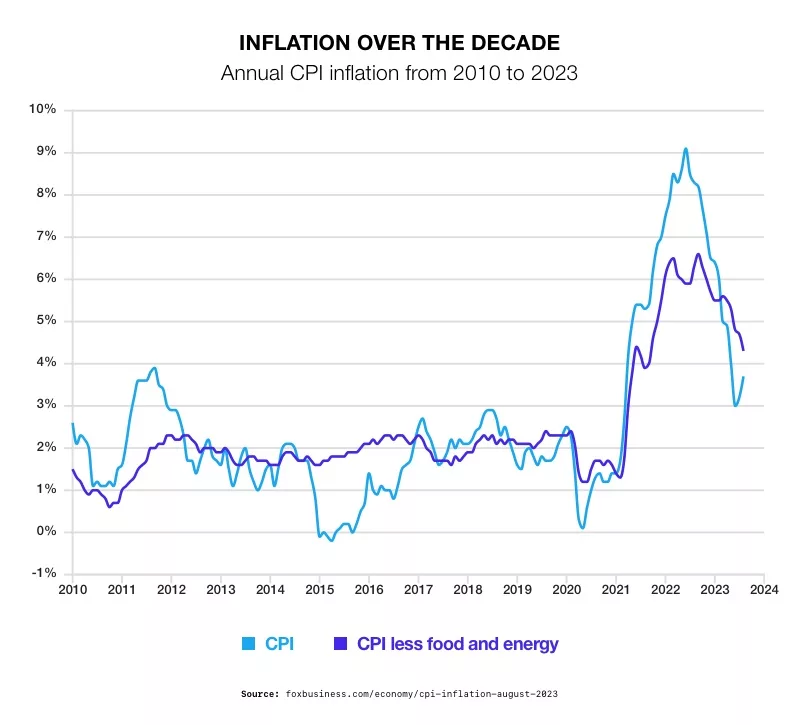

Their stagflation warning was based on several other reasons. One is that is inflation is still above target in every G7 nation. US inflation started rising again in August. It grew at a faster clip than the 3.2% price growth recorded in July.

Second, a new price shock could easily set inflation expectations soaring. An oil crisis, grain failure, or even the predicted El Nino weather event could send the global economy into disarray.

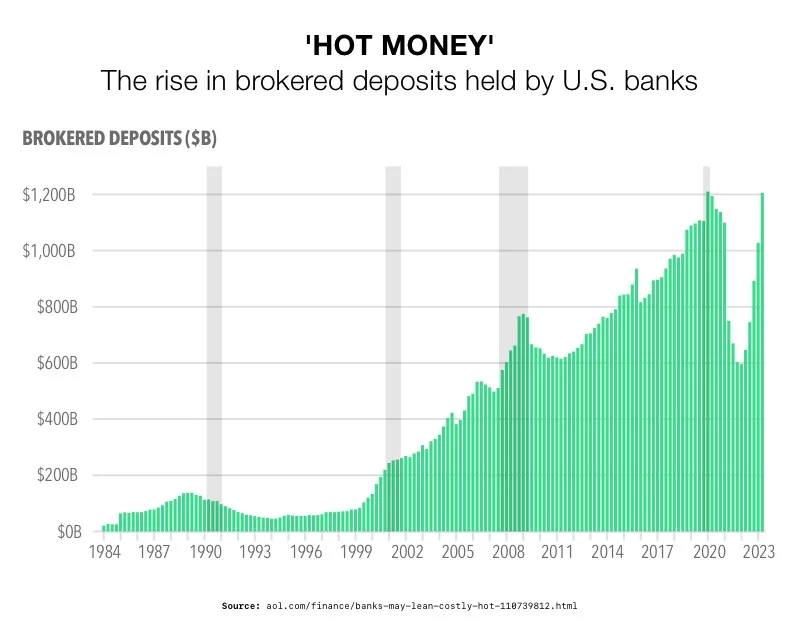

Added to that is the sluggish rate of economic growth. Tighter financial conditions have begun to take a toll on the economy, and there’s little room for that to change. Increasing interest rates and higher borrowing costs are further dragging growth down. However, there is a difference between now and then. The US debt-to-GDP ratio has soared well-above what it was in the 1970s. The amount of fiscal stimulus that can be used to stoke economic growth has been severely limited. And that stimulus is even further restricted by sticky inflation.

Deutsche Bank concludes that the last stretch of the Fed’s inflation war is likely to be the hardest. As inflation inches closer to its target, markets are putting more pressure on the Fed to slash interest rates. Higher borrowing costs weigh heavily on asset prices. Factoring in the lag between hikes and effects, there is a risk the Fed could plunge the economy into recession. But if the Fed stops too soon, inflation will persist. And the country will find itself back in the middle of a stagflation crisis.

Conclusion

Economic indicators are pointing to a repeat of the stagflation that plagued the 1970s. Pointing out the downward trajectory of the economy, Dimon said it would be a “significant misjudgment” to assume prolonged prosperity for the US economy.4 His comments underscore his belief that preparation is key when navigating uncertain economic waters. People should be working to avoid and minimize risk. One of the best ways to mitigate risk is with physical precious metals in a Gold IRA. Learn more about how you can protect the value of your portfolio from the dangers of stagflation by calling us today at 800-462-0071.

5

5

4

4

1

1

2

2