- Investment guru Jeremy Grantham warns there is a 70% chance of a stock market crash after the ‘superbubble’ bursts

- Stocks will drop to their true value after too much money in the system overinflated prices across sectors

- Precious metals can safeguard portfolio value and position you for post-crash buying opportunities

Superbubble Warning

Legendary investor Jeremy Grantham warns that the current stock market is on the verge of a major crash. According to Grantham, there is a 70% chance of a crash occurring within the next few years. He believes the market is experiencing a “superbubble” on the brink of implosion.1

But what exactly is a superbubble? A market bubble occurs when prices are too high based on historical metrics. A superbubble takes this concept to an extreme level. It refers to a situation where excessive speculation sends asset prices to multiple times their true value.

Superbubbles have led to catastrophic market crashes in the past. These include the stock market crash of 1929, the 1970s economic downturn, and the dot-com bubble of 2000. The events resulted in drastic drops in stock prices, ranging from 50% to a staggering 90%.2

Reasons for Warning

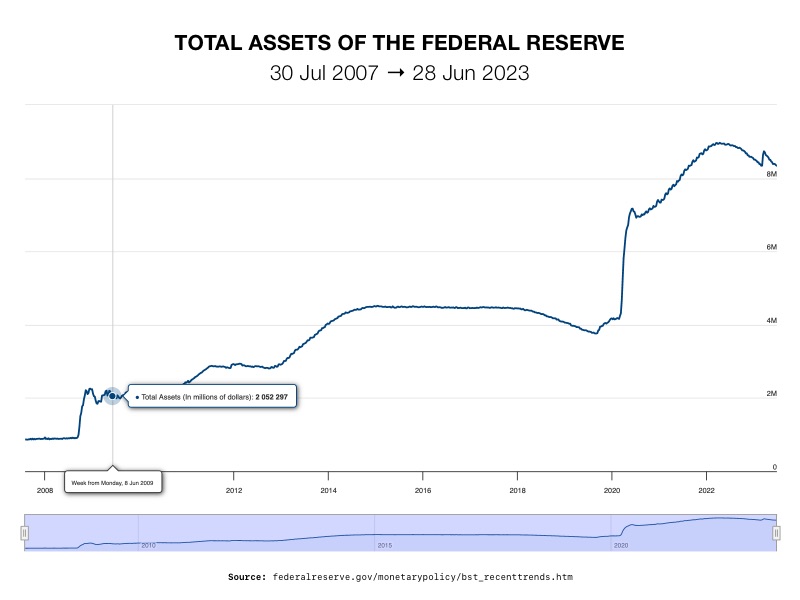

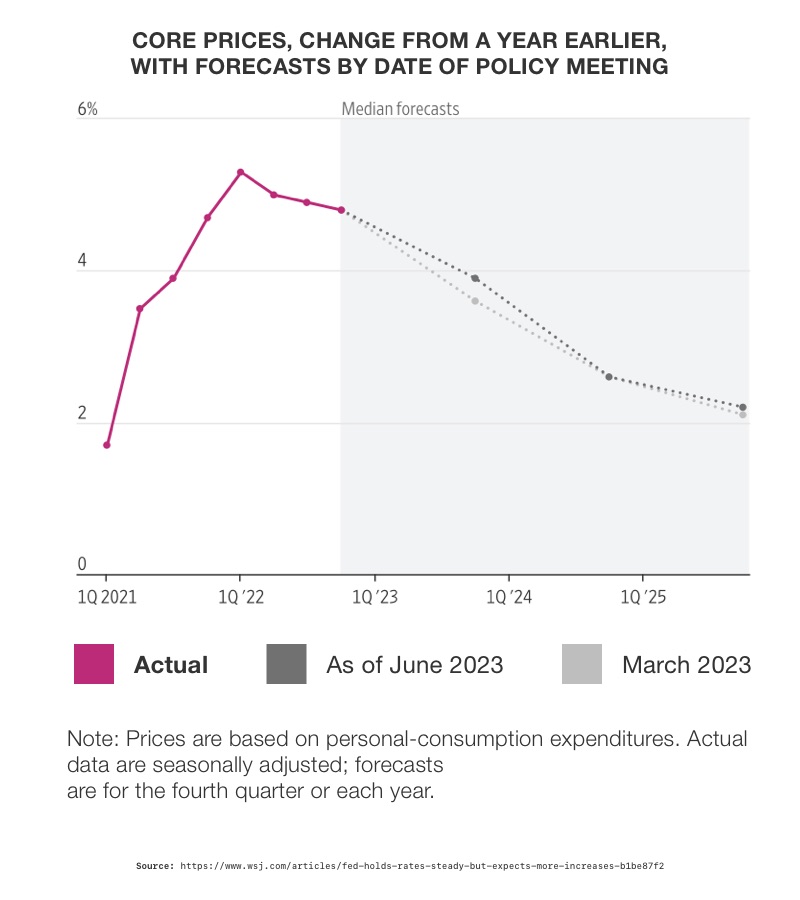

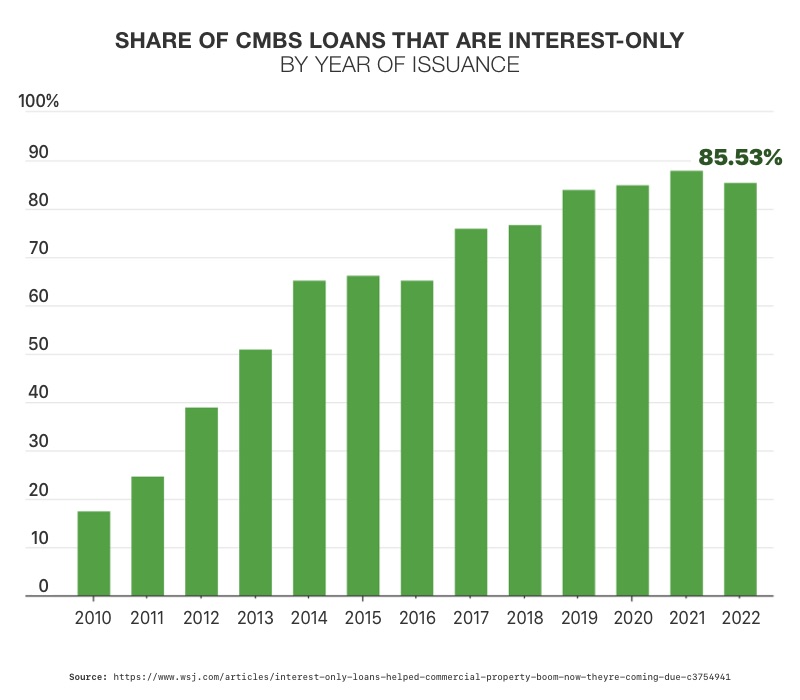

A combination of factors is fueling this current superbubble. The primary cause was too much money being pumped into the financial system. This abundance of dollars flooded into various asset classes, commodities, bonds, and goods and services. Easy access to fiat currency over the past 15 years, especially since the 2008 financial crisis, created this liquidity. The response to the 2020 pandemic further accelerated this trend. Reckless government spending and central bank printing becoming the norm. As seen in the chart below:

3

3

Grantham had previously predicted the dot-com crash and the housing bubble implosion. He diagnosed a “superbubble” spanning stocks, housing, and commodities in January 2022. He declared last September that it was likely in its final stages, and a historic crash seemed imminent. The S&P 500 and Nasdaq ended the year deeply in the red — but have rallied 16% and 32% respectively this year. The recent AI-driven surge in the stock market is providing a boost. But Grantham argues that it won’t prevent the superbubble from bursting. It is only delaying the inevitable. He suggests that the S&P 500 could experience a brutal 44% drop from its current level.4

Grantham points out that there are striking similarities between the current situation and previous crashes. He thinks conditions resemble the ones in 1929 and 2000. He sees a dangerous mix of overvalued stocks, bonds, and housing, combining with a commodity shock and a hawkish Federal Reserve.

The collapse of a superbubble occurs in several stages. First, there is a setback, followed by a slight rally. Finally, the market reaches its low point as fundamentals break down. The S&P 500 exited the longest bear market since 1948 at the beginning of June. Some analysts, such as those from HSBC and UBS, are already predicting a painful second half of 2023. They see an economic downturn deflating the AI boom and exposing the vulnerabilities of the superbubble. UBS analysts noted equity prices can fall as they confront “slowing growth and stickier inflation.”5

Even though the stock market has experienced a rally in recent months, it doesn’t necessarily mean that the bear market is over. History has shown that bear markets can have temporary rallies before experiencing further downside.

How to Prepare

Considering these warnings, it’s crucial to be cautious and prepared for a potential market crash. Grantham himself has bet on bargain assets and positioned against expensive growth stocks. Some analysts see the upcoming downturn as a generational opportunity to make money. But it is vital to preserve your wealth to take advantage of buying opportunities.

In times of market uncertainty, assets like gold have often been considered safe havens. Looking back at previous crashes, gold prices experienced notable increases. That’s because investors sought safe-haven assets. For example, during the crash of 1929, gold prices rose by about 27.5% within a year. Similarly, during the dot-com bubble burst in 2000, gold prices increased by approximately 11%.

Based on his track record, Jeremy Grantham’s warnings should be heeded. Ultimately, the fate of the current superbubble rests on economic conditions, investor sentiment, and market dynamics. As the saying goes, “history doesn’t repeat itself, but it often rhymes.” By learning from past market crashes, you can navigate the uncertain waters and make informed decisions to safeguard your wealth. Now is the time to carefully evaluate your portfolio. Is it diversified and protected against risk and loss? To learn more how a Gold IRA from American Hartford Gold can secure against a bursting bubble, talk to us today at 800-462-0071.

1

1

2

2 4

4

1

1 4

4

2

2

1

1