- A former CIA advisor predicted that US Dollar hegemony will end on August 22nd

- On that date, the BRICS alliance will announce a rival gold-backed currency

- As the new currency is adopted, analysts predict the value of the dollar will plummet and gold will surge

End Date of US Dollar Supremacy Predicted

Before summer is over, US dollar supremacy will disintegrate. That is, according to James Rickards. He is an investment banker and former CIA and Defense Department advisor.

Rickards predicts that the status of the US dollar as the world’s reserve currency and medium for exchange will formally collapse on August 22nd. On that date, the BRICS alliance will announce the launch of their new currency, signaling the end of the American empire.

Rickards isn’t alone in his assessment. Many analysts have been speculating about a new global currency to challenge the US dollar’s role as the world’s reserve currency. In late March, Former Goldman Sachs chief economist Jim O’Neill said that the US dollar’s dominance is destabilizing global monetary policies. He added that a BRICS currency, challenging the U.S. dollar’s dominance, would bring stability to the global economy.

Reasons for Collapse

Rickards bases this prediction on several factors. One is the weaponization of the dollar against Russia amid the conflict in Ukraine. Other countries saw what happens if they run afoul of US policy. They want to take preemptive measures to avoid the impact of sanctions. By abandoning the dollar, the potency of sanctions is diluted.

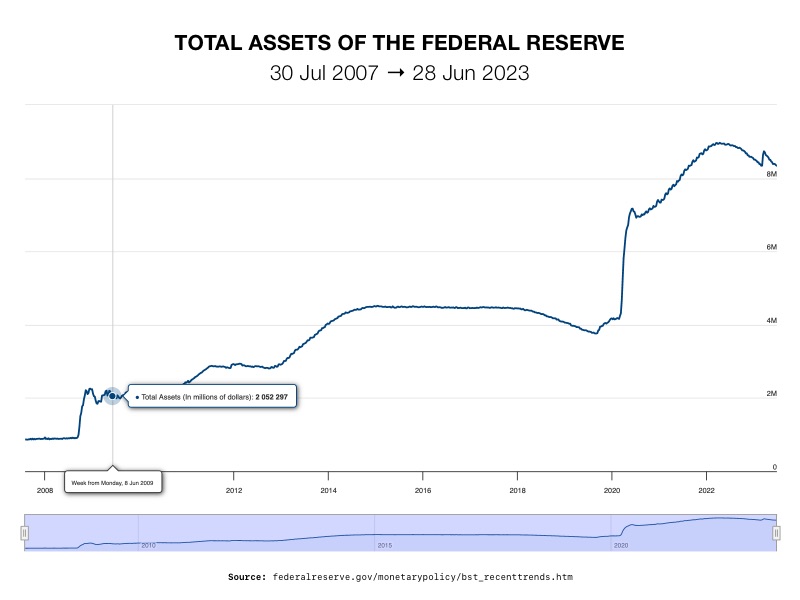

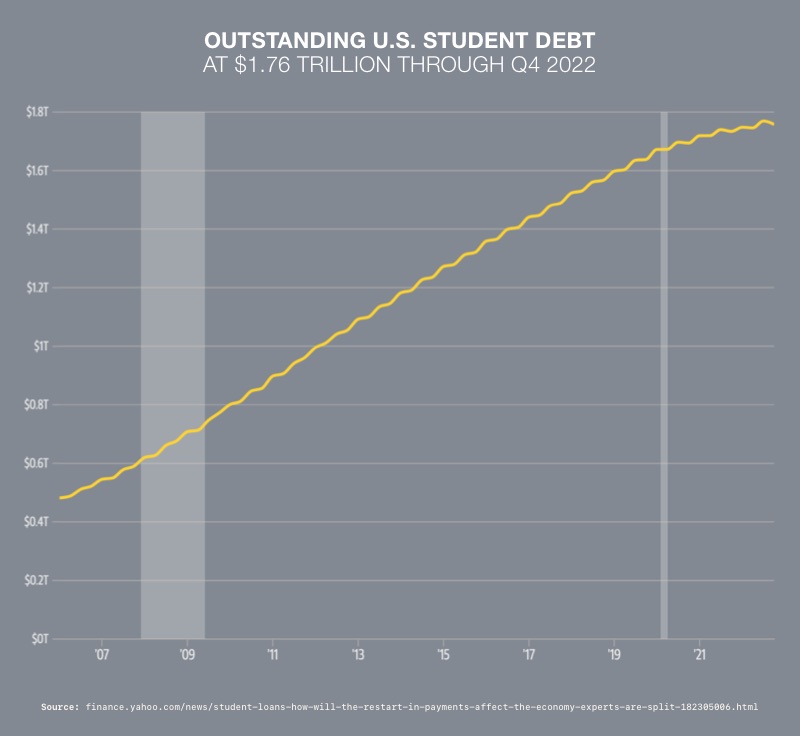

A second factor is the United States’ $31 trillion national debt. Economists foresee a time where interest on the astronomical debt consumes the entire budget. The US would enter a ‘doom loop’ of endless borrowing at higher and higher interest rates. With no money to spend, the economy will collapse, and the dollar will become worthless.

And a third, most notable factor, is the BRICS group plan to enter the next phase of dedollarization – the launch of a rival currency.

“On August 22, about two-and-a-half months from today, the most significant development in international finance since 1971 will be unveiled,” Rickards wrote. He cites that date because it is when the BRICS Leaders Summit will unveil plans for substituting the dollar in global trade. Of note, August 22, 1971, was the day the US dropped the gold standard.1

Rickards believes the rollout of a major new currency could weaken the role of the dollar. The US dollar would be displaced as the dominant trade and reserve currency. This change could occur within just a few years. The currency shift would affect world trade, direct foreign investment and investor portfolios in “dramatic and unforeseen ways.” Rickards warned the currency could set off an “unprecedented geopolitical shockwave.”

Who Are the BRICS?

At its core, the BRICS alliance consists of Brazil, Russia, India, China, and South Africa. Eight other countries have applied for membership. Twelve more have expressed interest in joining the bloc. Of note, Saudi Arabia is one of those countries. Saudi Arabia helped make the US dollar the supreme currency through the petrodollar system. Requiring oil to be traded exclusively in dollars cemented US dominance. With Russia and Saudi Arabia as BRICS members, two of the three largest energy producers with be aligned (the US is the other member of the energy Big Three). The new currency could seize the preeminent role in the energy trade and the benefits that go along with it.

The BRICS countries make up 30 percent of the world’s surface. They produce 50 percent of the globe’s wheat and rice. And they control 15 percent of the planet’s gold reserves. It accounts for 40 percent of the world population. Economically, the BRICS control almost a third of the world’s GDP.

In other words, the BRICS are a substantial and credible threat to Western hegemony. Their new currency has the resources and infrastructure to succeed. And as it is embraced by the globe, it will be able to eventually overthrow the dollar’s preeminence.

Rickards explains that the new currency must offer a safe store of value to be successful. For people to adopt it, the currency should rival the security found in the US bond market. To achieve this credibility, the BRICS are proposing to tie their currency to gold.

He sees “this entire turn of events—introduction of a new gold-backed currency, rapid adoption as a payment currency, and gradual use as a reserve asset currency—will begin on August 22, 2023, after years of development.” The dollar will be effectively removed from a large portion of global trade. Its value will decrease. The effects of which could result in collapsing stock prices, hyperinflation, and a shrinking economy. 2

Gold

The BRICS currency plan could spark a new bull market for gold. The Russian government confirmed the new currency will be backed by gold.

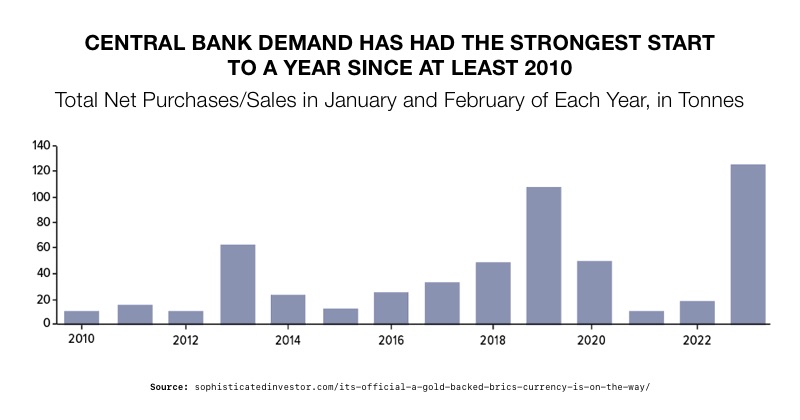

Gold has been playing an outsize role in the dedollarization movement since 2022. Central banks worldwide have been buying gold at a historic pace to diversify their reserves away from the US dollar, as seen below:

3

3

Analysts see a gold-backed currency as the next natural step in the new currency’s evolution. Many see China’s record gold purchases as an attempt to bring credibility to the yuan.

The global fiat money system could be in for a major disruptive shock. A gold-backed currency may lead to a sharp devaluation of many fiat currencies. As a result, it could catapult up goods prices on those fiat currencies.

The launch of a gold-back BRICS currency could fundamentally shift the entire global economic order. Uncertainty will increase as the dollar loses its dominant role. And assets denominated in dollars, like stocks and bonds, face a major devaluation. Retirement funds that aren’t diversified away from such assets are sitting on huge potential losses. For those who want to secure the value of their portfolios, now is the time to investigate gold. A Gold IRA from American Hartford Gold can protect the value of your funds and reap the rewards of a rising gold market. Learn more before August 22nd arrives. Call us today at 800-462-0071.

3

3

1

1

2

2 4

4

1

1 4

4

2

2