- A Central Bank Digital Currency (CBDC), aka the digital dollar, would be a national currency controlled by the Federal Reserve

- Citing threats to personal and economic freedom, Congress is pushing back against the implementation of a CBDC

- Gold is proving itself to be an effective defense against the threats posed by CBDCs

Recognizing the Central Bank Digital Currency Threat

Congress is on the same page as the American people when it comes to the ‘digital dollar.’ Both view the electronic currency as a pitfall rather than a prize. Elected officials are pushing back against plans for a central bank digital currency (CBDC). They are driven by concerns over privacy and economic freedom.

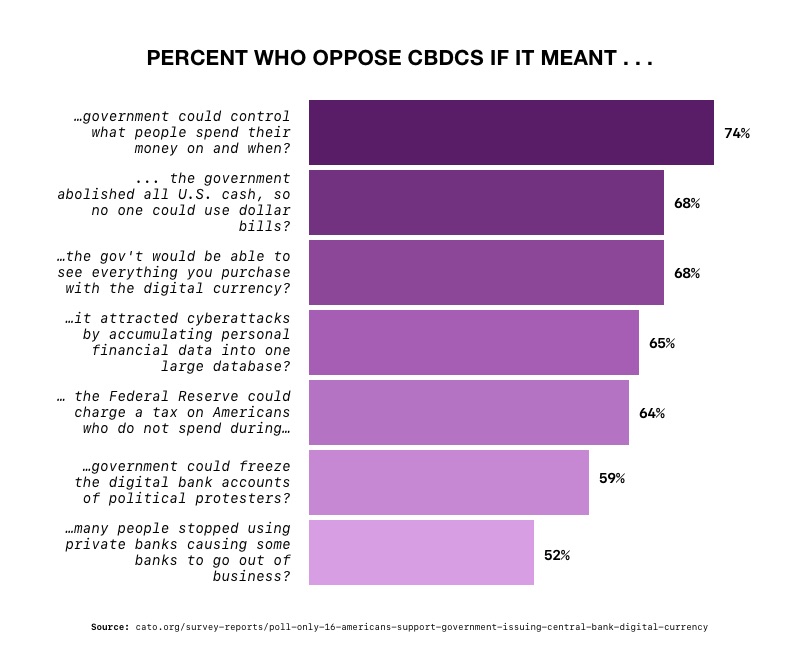

The Cato Institute think tank surveyed Americans on CBDCs. The survey showed only 16% favor adopting a CBDC while 34% oppose. But that opposition increases after learning about the potential risks of a CBDC, as seen in the chart below.

1

1

Contrary to supporting arguments, CBDC is not a just another form of money. A CBDC is a digital national currency. But it is very different from existing digital forms of the US dollar and cryptocurrency. Relying on cryptography to store and exchange value, cryptocurrency is independent from government. The rise of CBDCs could require the end of cash and cryptocurrency.

Unlike cryptocurrency, a CBDC solidifies government control over money and payments. A central bank like the Federal Reserve creates the CBDC. They then handle and control all transactions. By extension, the government can then determine who gets to use money and precisely how they use it. True, paper money is a Federal Reserve liability. But the government can’t control dollar bills once they are in circulation.

A CBDC also unravels the current public-private partnership between regulators and banks. A CBDC can remove banks from the financial system. And when the government is the only bank in the land, getting a loan could become a political as well as an economic decision.

By automatically monitoring transactions, CBDCs are de facto surveillance tools. China is already using their ‘digital yuan’ as a tool to control their population.

Opposition to CBDC

Rep Alex Mooney recently introduced H.R. 3712, the Digital Dollar Pilot Prevention Act. The bill closes the Federal Reserve’s Central Bank Digital Currency pilot program loophole. Rep. Mooney said, “CBDCs would threaten the liberties of law-abiding Americans and are being used by authoritarian countries right now to crack down on dissent.”2

Republicans stated the Federal Reserve needs Congressional approval to issue a CBDC. The pilot program gained attention last year after the Fed partnered with major banks to test potential CBDCs. Now, Republicans want a law to prevent the Fed from issuing a CBDC under the guise of a ‘pilot program.’

The National Association of Federally-Insured Credit Unions (NAFCU) declared support for Rep. Mooney’s bill. NAFCU said the Federal Reserve should halt all studies into CBDCs until there are clear regulatory guidelines. Such guidelines should be written by Congress and stakeholders like banks and credit unions. NAFCU fears a CBDC could upend the payments industry. Critics say a CBDC makes the Federal Reserve both a regulator and a competitor for deposits. Some financial institutions fear a massive bank run as investors convert their deposits to CBDCs.

Governor Ron DeSantis announced legislation in March against CBDCs. The bill prohibits adopting the use of CBDC as money within Florida’s Uniform Commercial Code. DeSantis said, “The Biden administration’s efforts to inject a Centralized Bank Digital Currency is about surveillance and control.”3

Gold to the Rescue

A CBDC amplifies power of the Federal Reserve to an unprecedented level. In the name of stimulating the economy, the Fed could use CBDCs to stop savings and retirement planning. They’d do this with negative interest rates or issuing money that expires if it isn’t spent within a limited amount of time. A CBDC lets the Fed create or remove money from the system. There would be no need for their current ad hoc interest rate hikes to try and tame inflation. With a click, they could simply erase the oversupply of money from your savings.

In contrast, gold stands as a safeguard for personal and financial freedom. Physical gold offers tangible benefits. It is a secure, long-term store of value. Gold provides a hedge against inflation and currency devaluation.

Gold ownership remains confidential, protecting personal privacy. Moreover, gold offers independence from cyber threats and technological failures. Individuals can protect their financial destiny and personal freedom by diversifying with gold. Contact us at 800-462-0071 to learn how a Gold IRA can protect your retirement savings from the dangers of the digital dollar.

2

2 4

4

1

1 4

4

2

2

1

1

3

3 8

8