- The deadline is rapidly approaching to raise the debt ceiling and avoid a government default

- Even if a deal to raise the debt limit is reached, there can still be severe negative consequences

- Any deal is just a short-term fix that kicks the real problem of astronomical debt down the road

Breaking the Debt Ceiling

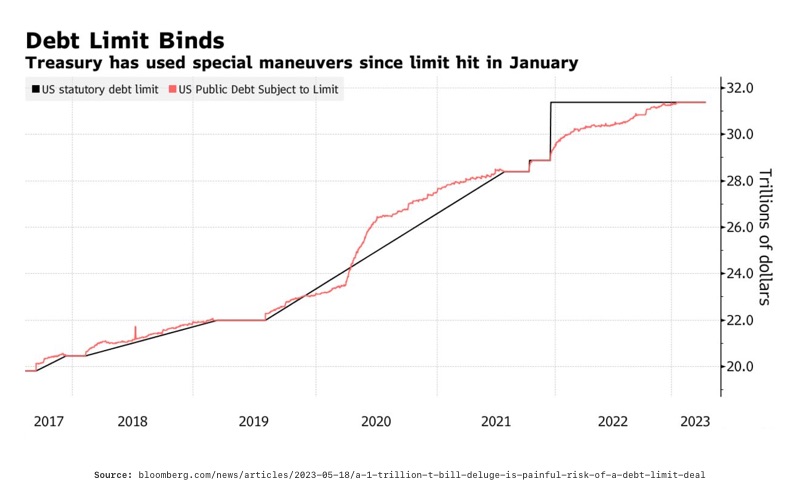

The US economy is staggering on the edge of a financial cliff. It is only a couple of weeks before ‘X-date’ – the day the government runs out of money. If they fail to reach an agreement on raising the US debt ceiling, the nation could default on its record $31.4 trillion debt.1 The results of which would be ‘catastrophic’ according to Treasury Secretary Janet Yellen.2 However, even if a deal is reached, there will be aftershocks to the economy. Indeed, the crisis won’t really be solved. The underlying debt problem will remain lurking beneath the surface. We will have merely kicked the can down the road, only postponing the inevitable serious consequences.

3

3

The Consequences of Defaulting on Debt

If the government defaults, the effects would be devastating to the US and the global economy. Experts largely predict the US credit rating would drop and gross domestic product (GDP) would fall. Social Security and other benefit payments could be delayed, hurting tens of millions of Americans.

Unemployment rates would spike as millions of people potentially lose their jobs. Economists at Moody’s Analytics project that if the government exceeds the debt limit for even a few days, the unemployment rate would jump up to 5%. However, if the breach were to drag on for several weeks, the effects would be much harsher. The unemployment rate could spike to 8% and nearly 8 million people could lose their jobs.4

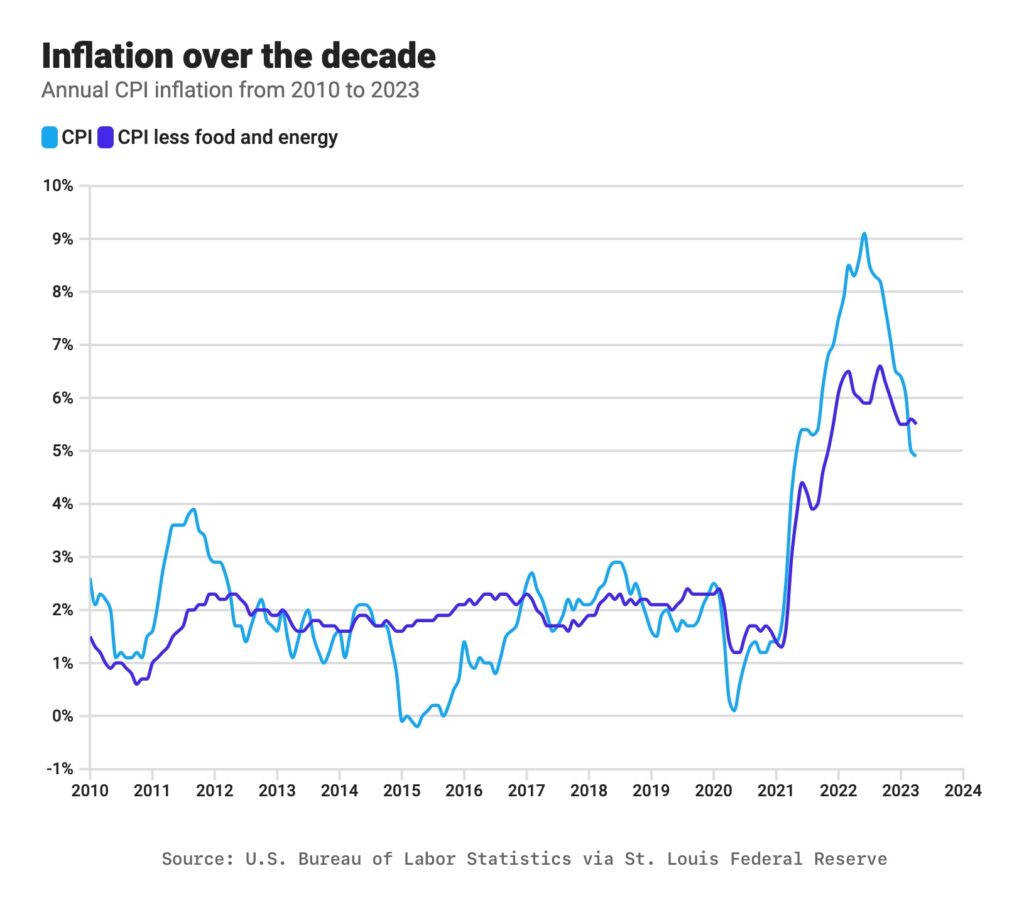

Interest rates have already been steadily rising due to 10 consecutive rate hikes by the Federal Reserve. An unexpected shock like a debt default would spike interest rates further and likely spark a recession. The cost of borrowing money could become prohibitive.

“If policymakers actually do fail to increase or suspend the limit before the Treasury runs out of cash and defaults on its obligations, interest rates will spike and stock prices will crater, with enormous costs to taxpayers and the economy,” Mark Zandi, Moody’s chief economist, said.5

The housing market would also be severely affected. An already tattered housing market would be sent into a “deep freeze,” according to Jeff Tucker, a Zillow senior economist. Tucker projected that home sales would plummet, mortgage rates would climb to as high as 8.4%, and buyers’ mortgage bills would soar by over 20%.6

Stock prices would also likely plummet and wreak havoc on retirement savings. Moody’s predicted that, under a prolonged default scenario, stock prices would plummet by one-fifth, wiping out about $10 trillion in household wealth.7

If A Deal is A Reached

8

8

A debt default is not likely to happen. Even under the current gridlocked circumstances, Moody’s Analytics puts the chances of a default happening at 10%.9

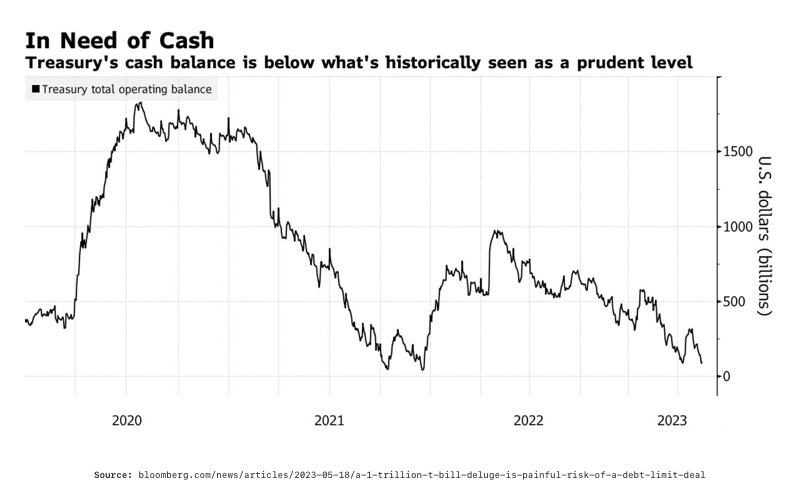

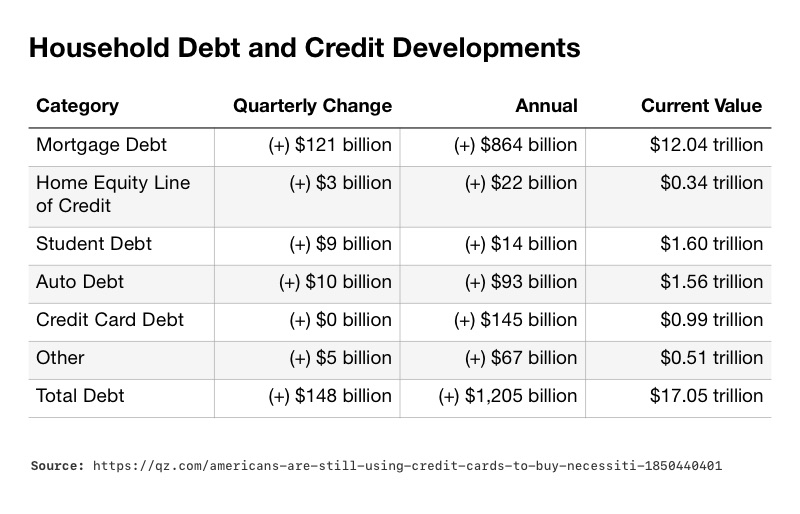

If the US manages to avert default, the consequences would still be significant. To pay its bills, the government would need to sell Treasury bills worth over $1 trillion. When the government sells a significant number of Treasury bills, it increases the Treasury General Account. This is essentially the government’s checking account. It will go from $95 billion to $500 billion in a month. The account will hit $600 billion 3 months.10

However, when there is more money in this account, there is less money available for other purposes. It becomes harder for banks to lend to individuals and businesses. Consequently, borrowing money would become more expensive, leading to higher interest rates. The housing market would suffer, with tumbling sales and soaring mortgage rates. Stock prices would also likely crash, causing a significant loss of wealth.

Money markets, often considered a safer investment, could also become casualty in a debt ceiling deal. A new imbalance between the amount of Treasuries issued and the available cash could cause short-term rates to rise. This means the funding for money markets could be disrupted. Investors could be better served moving to safe assets such as gold and silver.

A Temporary Solution

Raising the debt ceiling without addressing the underlying issues is like applying a band-aid to a deep wound.

Renowned investor Ray Dalio said, “Increasing the debt limit the way Congress and presidents have repeatedly done, and most likely will do this time around, will mean there will be no meaningful limit on the debt. This will eventually lead to a disastrous financial collapse.”11

The underlying problem lies in unsustainable spending and increasing debt. Central banks are left with the unenviable choice of raising interest rates or printing money to buy debt. Both of which have negative ramifications. Our situation is speeding to an unescapable doom loop that ends in total economic ruin.

The government may very well avoid defaulting on the national debt. What they cannot avoid is damaging the economy with their reckless spending. There will severe consequences as the debt crisis is resolved. Yet, these are only temporary fixes. The real dangers of our astronomical debt are being willfully ignored. Ultimately, that debt must be reckoned with. And that reckoning could make the Great Depression look like winning the lottery. If you want to protect your wealth from an impending debt crisis, then you should investigate how a Gold IRA can safeguard your future. Call us today at 800-462-0071 to learn more.

3

3

5

5