- Despite a brief surge after lifting strict Covid restrictions, China’s economy is heading for recession

- Due to highly interconnected economies, a Chinese recession can negatively impact stock prices

- Physical safe haven assets like gold offer wealth protection against a global economic downturn

Slow Chinese Economic Recovery

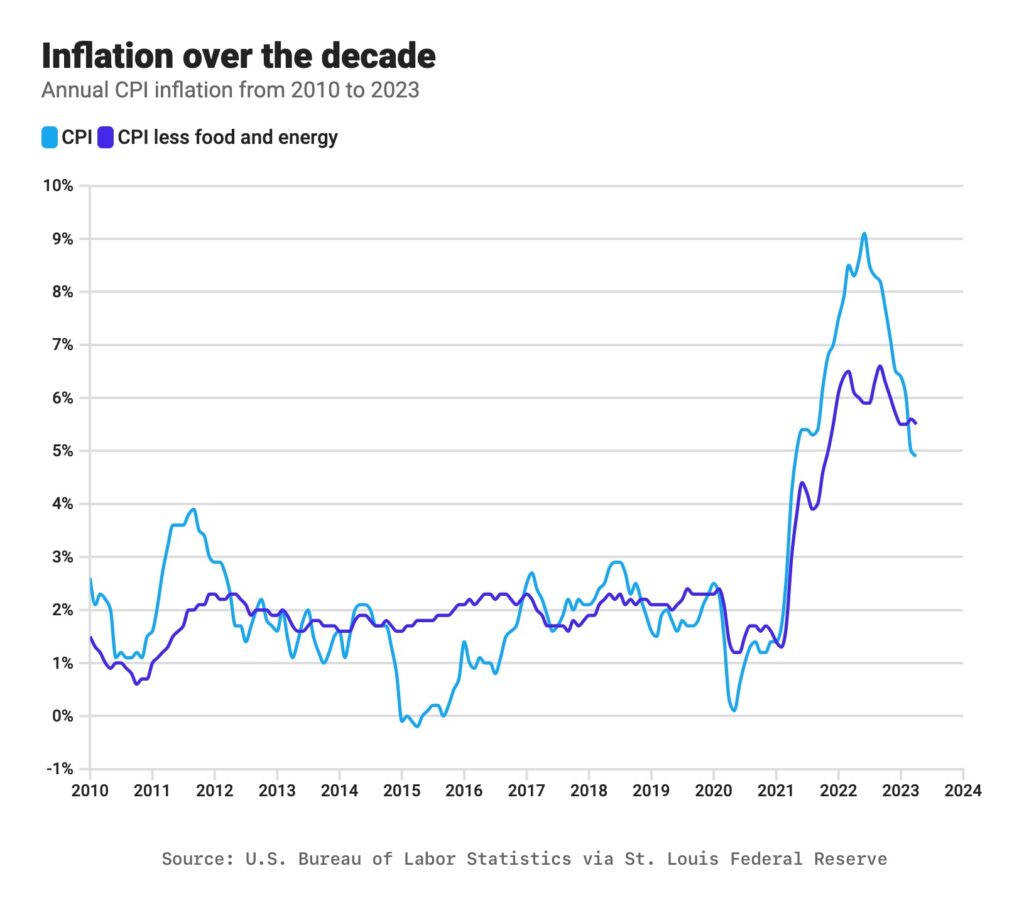

China’s pandemic recovery is not going according to plan and it may end up hurting your retirement funds. Despite a surge after lifting Covid restrictions, the Chinese economy is slowing down. Elon Musk and JP Morgan Chair Jamie Dimon visited China to address concerns about the encroaching recession there. In today’s fragile global financial system, the fate of the second largest economy can have a severe impact on the rest of the world.

China’s stock market experienced a boom earlier this year. Investors bet on the economy bouncing back after China ended their strict zero-Covid policy. They are now losing that bet. The most recent official data points to an economy in decline. Retail sales, factory production and fixed-asset investments all came in weaker than expected. All the main Chinese stock indexes tumbled. The MSCI China index fell into a bear market. It lost more than a fifth of its value. And even shares of China’s state-owned enterprise have fallen 10%.

1

1

Reasons for the slump tie into a lack of investor confidence due to politics. China and US relations soured after the shooting down of a Chinese surveillance balloon. “China’s focus on national security will make the government’s policies less growth-friendly,” Citi analysts wrote in a report on May 30.2

Beijing carried out raids on foreign groups such as Bain & Company, Capvision and due diligence group Mintz. They increased regulation of domestic private businesses as well. Chinese officials appear to be ending their clampdown on the tech sector. Yet, investors still worry that the government could move against other companies.

“They came out with regulation after regulation without warning the market…when you’re a commercial investor, you lose confidence when you see those kinds of things happening,” said a portfolio manager for Janus Henderson Investments.3

JPMorgan has a large investment in China. Chair Jamie Dimon has warned about the effects of the Chinese government’s policies. “If you have more uncertainty, somewhat caused by the Chinese government . . . it’s not just going to change foreign direct investment. It’s going to change the people here, their own confidence….And confidence is very important for growth.”4

The Chinese government says they are prepared to help bolster the economy. Premier Li Qiang said this month more targeted measures were needed to boost demand. And China’s central bank said on May 15 it would provide “strong and stable” support for the real economy.

Why China’s Recession is Our Problem

The slowing of the Chinese economy can impact the United States stock market. Reasons for this include:

Trade Relations: China is one of the largest trading partners of the United States. According to the US Census Bureau, China was the third-largest export market for US goods in 2020, accounting for $103.9 billion in exports. A slowdown in the Chinese economy can impact sectors which rely heavily on exports to China. Such sectors include manufacturing, technology, and agriculture. This can result in lower revenues and earnings, and in turn, lower stock prices.5

China is also the top supplier of goods to the United States. It accounts for 18 percent of total goods imports ($452 billion). A decrease in manufacturing there can result in price increases here.6

Global Supply Chains: Many US companies have complex supply chains that rely on China. If the Chinese economy slows down, it can disrupt these supply chains. This can cause production delays or increased costs for US companies. Such disruptions can affect their profitability and investor confidence. Their stocks could fall as a result. Chinese supply chain snarls during the pandemic are reported to have cost American firms billions.

Investor Sentiment and Confidence: The global financial system is highly interconnected. Events in one country can quickly transmit shocks to other economies. As Dimon pointed out, the stock market is influenced by investor sentiment and confidence. A slowdown in the Chinese economy can be perceived as a sign of broader global economic weakness. This may trigger a sell-off in the US stock market as investors become more risk-averse.

Commodity Prices: China is a major consumer of commodities such as oil, metals, and agricultural products. A slowdown in Chinese economic activity can result in reduced demand for these commodities. Reduced demand can lead to lower global commodity prices. This can impact the profitability of US commodity companies, such as energy or mining. Lower profits often translate into lower stock value. Commodity prices dropped significantly when the 2008 global financial crisis caused a slowdown in the Chinese economy. Oil dropped 80%, copper fell 67%, and corn declined 40%. Interestingly enough, during this time, gold surged from $650 to a peak of around $1,000 per ounce.7,8,9,10

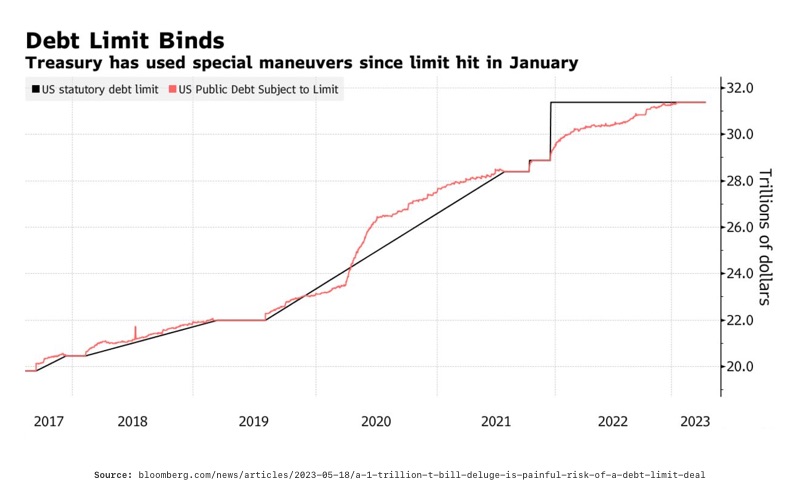

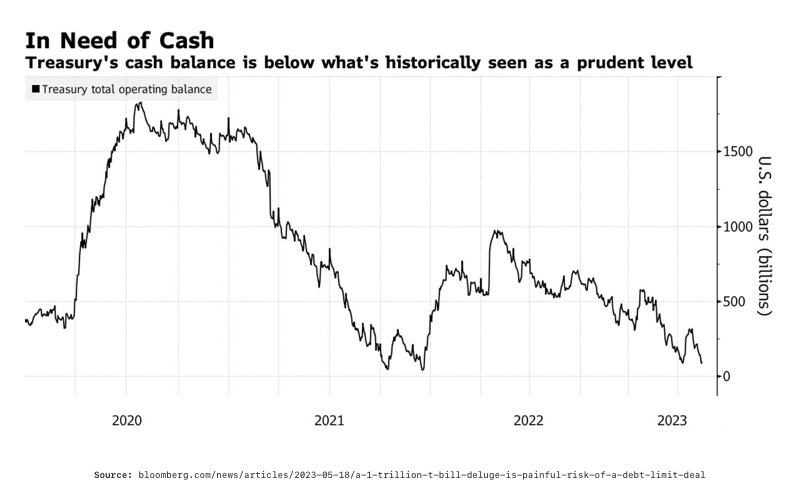

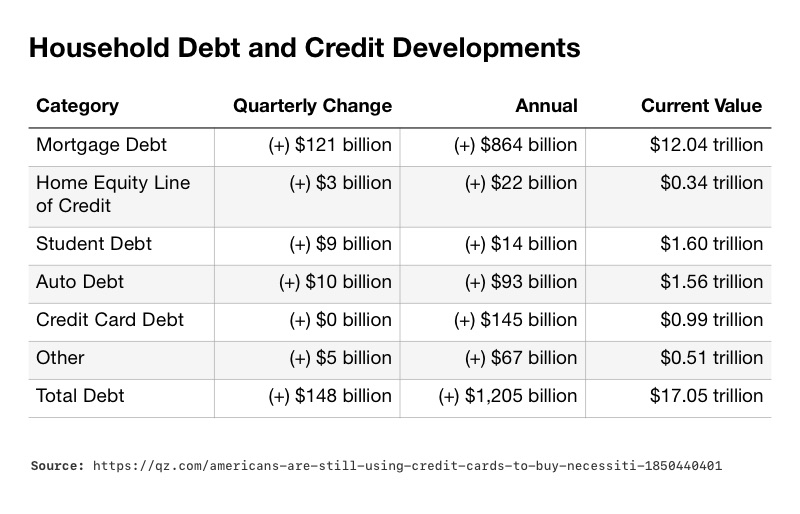

Debt Holdings: A Chinese recession can make our current debt crisis worse. The significant holdings of US government debt by China creates a potential vulnerability that can affect the US stock market. The Chinese economy’s ability to continue purchasing US debt is crucial for maintaining stability in the US stock market. If China faces economic challenges, it may reduce its purchases of US government debt, leading to potential disruptions.

As of July 2021, China was the largest foreign holder of US Treasury securities. Their holdings totaled approximately $1.1 trillion. Fewer Chinese purchases of US government debt can mean less funds available for government spending and programs. This could lead to higher interest rates or reduced government investment.

The potential reduction in Chinese purchases of US debt can also amplify China’s attack on the dollar. Decreased demand for US Treasuries can weaken the dollar’s strength relative to other currencies. This could increase volatility in international trade and the stock market.

Some may cheer the demise of an economic rival like China. But the financial reality is that our economies are intricately linked. A Chinese recession or collapse would most likely lead to a drop in American stock prices. Which of course would depress the value of most retirement funds. One way to protect the value of your funds is to move out of paper assets and into safe haven assets like physical gold. A Gold IRA from American Hartford Gold can shield your wealth from damage caused by a global economic downturn. Contact us today at 800-462-0071 to learn more.

3

3 8

8

3

3

5

5