- Studies show Americans are unprepared for retirement due to record inflation and household debt

- The gap in retirement savings could become trillion-dollar liability for the government

- Retirement planners should seek safe haven assets to make sure their funds are there when they need them

Retirement at Risk

The future of retirement for many Americans is becoming increasingly uncertain. Record debt and persistent inflation are hurting Americans’ retirement prospects. These endangered retirements hold potential consequences for the entire economy. People should be taking measures now to safeguard their future.

A survey by the Certified Financial Planner Board identified American’s main financial concerns. Sixty percent of Americans worry about purchasing necessities such as food and clothing. A further 55% worry about paying rent or a mortgage. And 69% worry about preparing for retirement.

The biggest challenge to preparing for retirement was debt. Those under 45 and those over were just as likely to withdraw money from a retirement account. “These past several years have not been easy for Americans,” CFP Board CEO Kevin R. Keller said in a statement. “From the pandemic to the latest banking news, uncertainty has been prevalent.”1

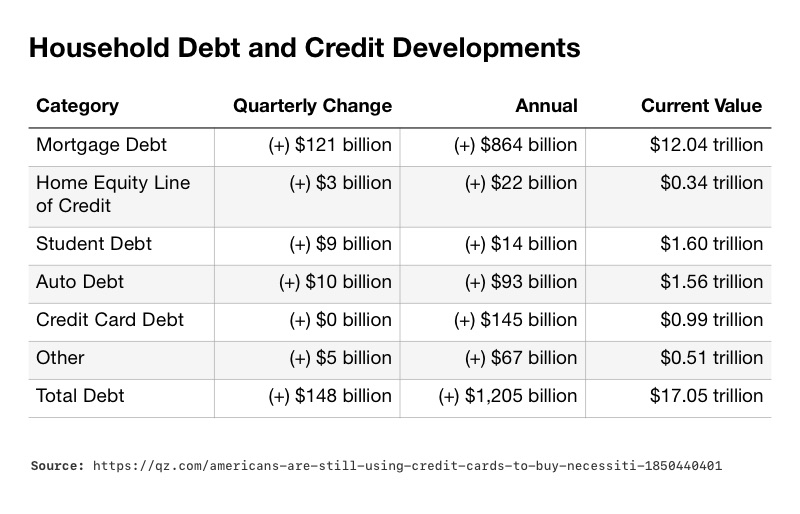

Household debt has reached an unprecedented level of $17 trillion. It increased $2.9 trillion since pre-pandemic 2019. Mortgages typically drive household debt. But new mortgages dropped due to high interest rates. Mortgage debt saw a decline of 62% compared to the previous year. Yet, credit card debt reached a record-breaking $986 billion. A 17% jump from last year, this is the first time in two decades it hasn’t gone down after the holidays. This surge in debt shows the financial strain experienced by many Americans. More and more, people are relying on credit cards to cope with rising costs.2

3

3

Cost to the Economy

The number of financially vulnerable individuals aged 65 and above is expected to increase. From 2020 to 2040, the number is predicted to rise 43%. Alarmingly, approximately 56 million private sector workers lack access to employer-sponsored retirement plans. Many households are left with limited options for building enough retirement funds. Numerous Americans will be facing a lower quality of life during their retirement years.4

The Pew Research Center says the shortage of retirement savings could cost the government $1.3 trillion by 2040. This savings gap could place an immense strain on state and federal budgets. There will be a greater proportion of elderly individuals compared to the working-age population. The expense of Medicare and other programs is expected to be borne by a smaller portion of the workforce. The extra public funding could result in higher taxes. Analysts estimate the projected shortfall would cost $13,600 per household.5

Several states are recognizing the urgent need to address the retirement crisis. They have launched automated savings programs. They allow individuals to set up state-sponsored Individual Retirement Accounts (IRAs). These initiatives are proving successful. Enrollees are saving between $105 and $190 per month. Some analysts believe such initiatives could help reduce the burden on public resources.6

Challenging Economic Landscape

The National Retirement Risk Index highlights the economic challenges faced by working-age households. It shows that about half of the nation’s households may struggle to maintain their standard of living in retirement. One third of households are taking a major hit from the increase in Social Security’s full retirement age. The economy had a period of improvement after the Great Recession. But the uncertainty caused by the pandemic and inflationary pressures undid those gains for many people.

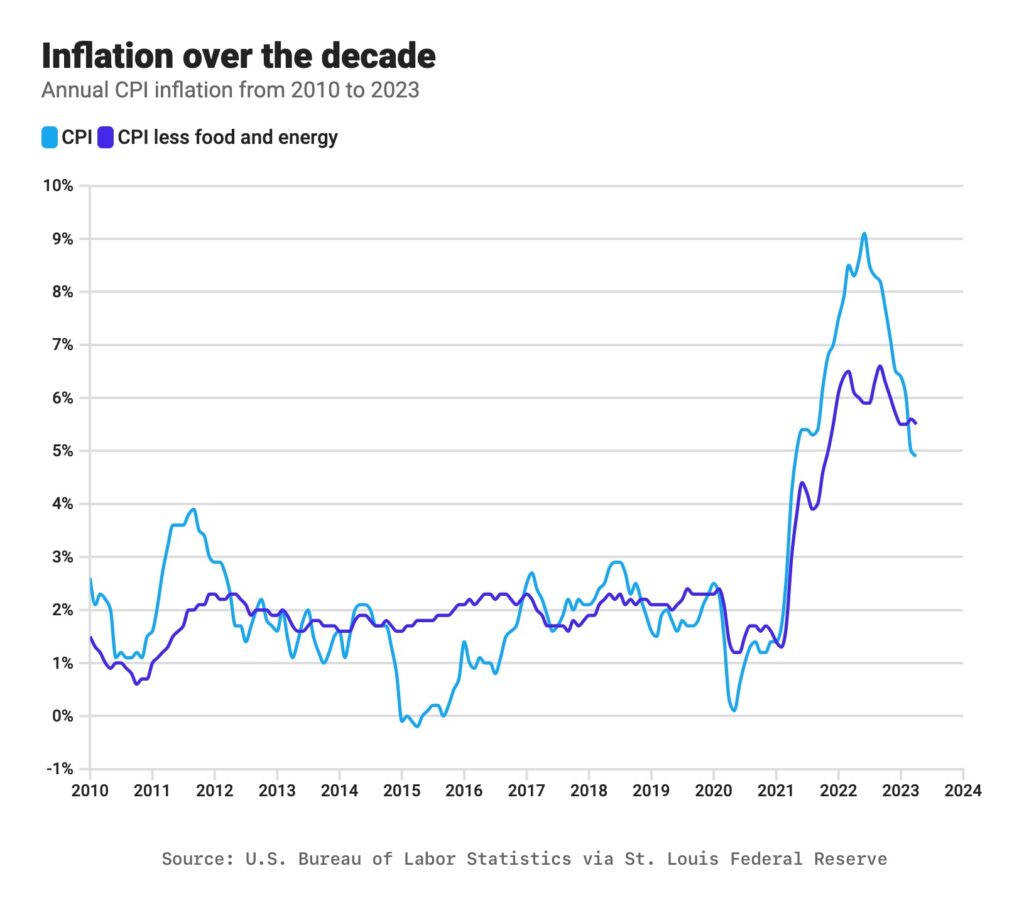

Inflation’s Impact on Retirement Funds

A survey by the Senior Citizens League found inflation is wiping out retirement funds. The percentage of retirees reporting a drain on their savings rose from 20% in the third quarter of 2022 to 26% in the first quarter of 2023. Moreover, a record-high 45% carried credit card debt for more than 90 days.7

“Retirees exhaust retirement savings as they age, but it looks like inflation has sped up the process,” Mary Johnson, a Social Security and Medicare policy analyst at the Senior Citizens League said.8

Record household debt, insufficient retirement savings, and persistent inflation are making retirement planning essential. The strain on retirement funds shows the need for individuals to seek safe-haven assets that can protect their wealth. A Gold IRA can provide a hedge against inflation and safeguard retirement funds in an uncertain economic climate. By taking acting now, individuals can work towards ensuring a more stable and prosperous retirement future. Call American Hartford Gold today at 800-462-0071 to learn more.

5

5